Merck (MRK) Q4 Earnings Beat, Sales Miss, Upbeat '24 View

Merck MRK reported adjusted earnings of 3 cents per share in fourth-quarter 2023, wider than the Zacks Consensus Estimate of a loss of 9 cents. In the year-ago period, the company reported adjusted earnings of $1.62. The downside was due to a one-time charge incurred by the company for a collaboration with Daiichi Sankyo, entered in October.

Including acquisition and divestiture-related costs, restructuring costs, income and losses from investments in equity securities and certain other items, loss per share was 48 cents per share. In the year-ago period, Merck reported earnings of $1.18.

Revenues rose 6% year over year (7% excluding foreign exchange (Fx) impact) to $14.63 billion. Sales missed the Zacks Consensus Estimate of $14.7 billion.

Excluding sales from Merck’s COVID-19 drug, Lagevrio, total revenues rose 9% (12% excluding Fx impact).

Quarter in Detail

The Pharmaceutical segment generated revenues of $13.14 billion, up 8% (including and excluding Fx impact) year over year. Higher sales of oncology drugs, vaccines and hospital acute care more than offset the lower sales of Merck’s COVID-19 drug, Lagevrio (molnupiravir) and diabetes medicines. Excluding Lagevrio and Fx impact, Pharmaceutical sales rose 14%.

Pharmaceutical segment revenues missed the Zacks Consensus Estimate of $13.15 billion but beat our model estimate of $13.07 billion.

Keytruda, the biggest product in Merck’s portfolio, generated sales of $6.61 billion in the quarter, up 21% year over year (22% excluding Fx impact). Keytruda sales gained from rapid uptake across earlier-stage indications like triple-negative breast cancer and renal cell carcinoma and continued strong momentum in metastatic indications. Keytruda sales marginally beat the Zacks Consensus Estimate of $6.50 billion and our estimate of $6.42 billion.

Alliance revenues from Lynparza and Lenvima also boosted oncology sales in the quarter. Merck has a deal with British pharma giant AstraZeneca AZN to co-develop and commercialize PARP inhibitor Lynparza and a similar one with Japan’s Eisai for its tyrosine kinase inhibitor, Lenvima.

Alliance revenues from AstraZeneca-partnered Lynparza increased 8% year over year (both including and excluding Fx impact) to $315 million in the quarter, driven by higher pricing in the United States. Lenvima alliance revenues were $260 million, up 5% from the year-ago period’s levels. Welireg recorded sales of $72 million, up 80% year over year.

In vaccines, sales of HPV vaccines — Gardasil and Gardasil 9 — rose 27% year over year (both including and excluding Fx) to $1.87 billion, driven by strong global demand, particularly in China and favorable government buying patterns in the United States. Gardasil sales missed the Zacks Consensus Estimate of $2.06 billion and our estimate of $2.14 billion.

Proquad, M-M-R II and Varivax vaccines recorded combined sales of $713 million, up 3% year over year. Sales of the rotavirus vaccine, Rotateq, were up 33% to $185 million, while Pneumovax 23 (pneumococcal vaccine polyvalent) vaccine sales declined 43% to $85 million. Sales of Vaxneuvance, Merck’s new pneumococcal 15-valent conjugate vaccine, were $176 million, up 26% year over year, driven by continued uptake in the pediatric patient population following its launch in the United States in 2022 and launches in Europe.

In the hospital specialty portfolio, neuromuscular blockade medicine, Bridion injection generated sales of $429 million in the quarter, down 3% year over year, due to generic competition in ex-U.S. markets. Bridion sales missed the Zacks Consensus Estimate of $446 million and our model estimate of $448 million.

In Diabetes, Januvia/Janumet (diabetes) franchise sales were down 13% year over year to $787 million. The drug’s sales were hurt by lower demand in the United States and generic competition in certain international markets.

Lagevrio (molnupiravir) generated sales of $193 million during the fourth quarter, down 76% year over year. Lower sales in Japan and Australia and no sales in the U.K. hurt Lagevrio sales.

Merck’s Animal Health segment generated revenues of $1.28 billion, up 4% year over year (both including and excluding Fx impact). The Animal Health segment sales were in line with the Zacks Consensus Estimate and our model estimate.

Margin Discussion

Adjusted gross margin was 77.2%, up 150 basis points year over year, driven by the favorable impact of product mix and lower sales of Lagevrio, a low-margin product.

Adjusted selling, general, and administrative expenses were $2.8 billion in the reported quarter, up 4.7% year over year due to higher administrative costs. This was partially offset by lower promotional spending.

Adjusted research and development (R&D) spending was $8.8 billion compared with $3.0 billion in the year-ago period due to a one-time charge of $5.5 billion incurred by Merck in relation to thecollaboration with Daiichi Sankyo.

New Restructuring Program

Management recently approved a new restructuring program aimed at optimizing its manufacturing operations related to human and animal health. The company recorded a $190 million charge related to the program in the fourth quarter results.

Full-Year 2023 Results

Full-year 2023 sales rose 1% (4% ex Fx) to $60.12 billion, in line with the Zacks Consensus Estimate as well as the guided range of $59.7-$60.2 billion. Pharmaceutical sales grew 3% (5% excluding Fx) to $53.58 billion.

Adjusted earnings for 2023 were $1.51 per share, down 80% year over year (down 75% excluding Fx). This downside was related to certain acquisitions and collaboration agreements entered by Merck throughout 2023.Earnings beat the Zacks Consensus Estimate of $1.38 per share as well as the guided range of $1.33 and $1.38.

2024 Guidance

Merck issued a fresh earnings and sales outlook for 2023.

Merck expects revenues to be in the range of $62.7-$64.2 billion in 2023. The Zacks Consensus Estimate was $63.97 billion. The guidance includes a negative impact on sales from foreign exchange of approximately 2%.

Adjusted earnings per share are expected to be between $8.44 and $8.59, higher than the Zacks Consensus Estimate of $8.39 per share. This guidance includes a one-time charge of 26 cents per share, which is expected to be incurred by management in connection with the acquisition of Harpoon Therapeutics HARP.

Earlier this month, Merck entered into a definitive agreement to acquire Harpoon Therapeutics for an approximate total equity value of $680 million. Through the acquisition, Merck expects to strengthen its oncology pipeline by adding Harpoon Therapeutics’ novel class of T cell engagers, which it is developing by leveraging its proprietary Tri-specific T cell Activating Construct platform. The T cell engagers are designed to remain inactive till they reach the tumor. The transaction is expected to be closed in the first half of 2024.

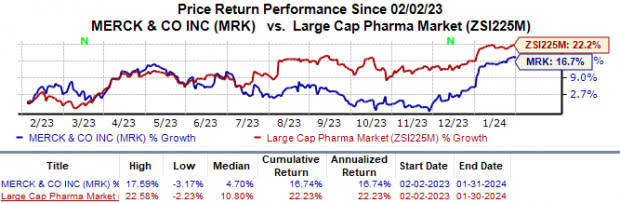

Shares of Merck were up 2.3% in pre-market trading, likely due to the encouraging guidance. In the past year, the stock has gained 16.7% compared to the industry’s 22.2% rise.

Image Source: Zacks Investment Research

The adjusted gross margin is expected to be around 80.5%.

Adjusted operating costs are expected to be in the range of $25.1 to $26.1 billion. The adjusted tax rate is expected to be approximately 14.5% to 15.5%.

Our Take

Merck’s fourth-quarter results were mixed as it beat estimates for earnings but missed the mark for sales. The company also issued encouraging 2024 guidance.

Strong sales of blockbuster cancer drugs drove the top line in the quarter. Though sales of another vital product, Gardasil vaccine, also rose in the quarter, it was less than our expectations.

With regard to pipeline development, Merck made meaningful progress in the past year, achieving multiple regulatory and clinical milestones. It has initiated several phase III studies in 2023, including advancing eight novel candidates into late-stage development across multiple therapeutic areas.

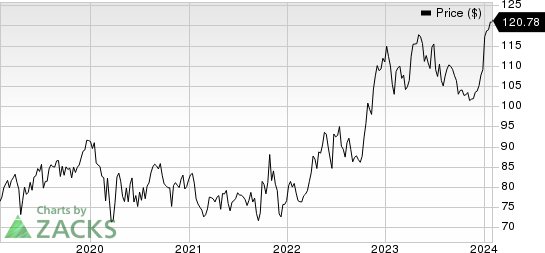

Merck & Co., Inc. Price

Merck & Co., Inc. price | Merck & Co., Inc. Quote

Zacks Rank & Stock to Consider

Merck currently carries a Zacks Rank #3 (Hold). A better-ranked stock in the overall healthcare sector is Novo Nordisk NVO, which has a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, the consensus estimate for Novo Nordisk’s 2024 earnings has risen from $3.22 per share to $3.32 per share, while the same for 2025 has increased from $2.84 per share to $4.09 per share. In the past year, shares of Novo Nordisk have surged 65%.

Novo’s earnings beat estimates in two of the trailing four quarters, missed the mark on one occasion while meeting the mark on another. On average, NVO delivered an earnings surprise of 1.85%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AstraZeneca PLC (AZN) : Free Stock Analysis Report

Novo Nordisk A/S (NVO) : Free Stock Analysis Report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Harpoon Therapeutics, Inc. (HARP) : Free Stock Analysis Report