Merck's (MRK) Keytruda Early-Stage NSCLC Study Shows OS Benefit

Merck MRK announced that a pivotal phase III study evaluating its blockbuster PD-L1 inhibitor, Keytruda, for an earlier stage of lung cancer, met the second of the dual primary endpoints of overall survival (“OS”).

The pivotal phase III KEYNOTE-671 study evaluated Keytruda as a perioperative treatment regimen for patients with resectable stage II, IIIA or IIIB non-small cell lung cancer ("NSCLC"). In a pivotal study, Keytruda was given in combination with chemotherapy before surgery (neoadjuvant), followed by resection and Keytruda as monotherapy after surgery (adjuvant). Data from this new interim analysis of the study demonstrated that the Keytruda-based regimen led to a statistically significant improvement in OS versus pre-operative chemotherapy.

In March, KEYNOTE-671 met the first of its dual primary endpoints of event-free survival. The regimen also showed a statistically significant improvement in key secondary endpoints of pathological complete response and major pathological response at the first interim analysis.

The FDA has already accepted Merck’s supplemental biologics license application, seeking expanded use for the above indication based on data from the first interim analysis. The FDA’s decision is expected on Oct 16, 2023.

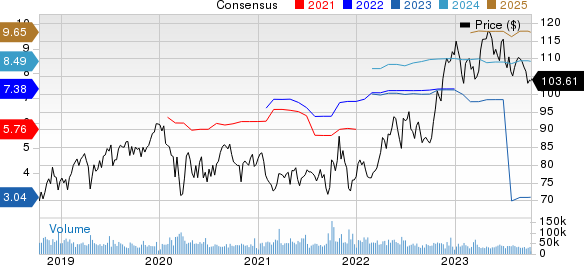

Merck’s stock has declined 6.6% so far this year against an increase of 5.7% for the industry.

Image Source: Zacks Investment Research

Keytruda is presently approved to treat seven indications in earlier-stage cancers in the United States. Sales of Keytruda rose 23%, excluding Fx impact, in the first half of 2023 to $12.06 billion. Numerous recent approvals and the expected launch of many additional indications, including in earlier lines of therapy, can further boost sales. In the United States, Merck expects over half of Keytruda’s growth to come from indications in early-stage treatment settings through 2025 and to represent roughly 25% of total global Keytruda sales by that time.

Keytruda is being studied for more than 30 types of cancer, including both monotherapy and combination studies. Merck is also working on different strategies to drive Keytruda’s long-term growth. These include innovative immuno-oncology combinations, including Keytruda with TIGIT, LAG3 and CTLA-4 inhibitors. Merck is also leveraging Keytruda benefits across several cancer types to identify and develop promising new oncology candidates.

Zacks Rank and Stocks to Consider

Merck has a Zacks Rank #3 (Hold) currently.

Merck & Co., Inc. Price and Consensus

Merck & Co., Inc. price-consensus-chart | Merck & Co., Inc. Quote

Some better-ranked drug/biotech companies worth considering are Alpine Immune Sciences ALPN, Aurinia Pharmaceuticals AUPH and Corcept Therapeutics CORT, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 90 days, the consensus estimate for Alpine Immune Sciences’ 2023 loss has narrowed from $1.43 per share to $1.18 per share, while the same for 2024 has narrowed from $1.73 per share to $1.47 per share. Year to date, shares of Alpine Immune Sciences have rallied 46.8%.

ALPN’s earnings beat estimates in two of the trailing four quarters and missed the mark in the other two, delivering an average negative earnings surprise of 79.65%.

In the past 90 days, the bottom line estimate for Aurinia Pharmaceuticals for 2023 has narrowed from a loss of 71 cents per share to a loss of 58 cents per share, while the same for 2024 has narrowed from a loss of 43 cents per share to a loss of 27 cents per share. Year to date, shares of Aurinia Pharmaceuticals have gained 72.7%.

Earnings of Aurinia Pharmaceuticals beat estimates in all the last four quarters, delivering an earnings surprise of 45.61% on average.

In the past 90 days, the Zacks Consensus Estimate for Corcept’s earnings per share has increased from 62 cents to 78 cents for 2023. The bottom-line estimate for 2024 has also improved from 61 cents to 83 cents during the same time frame. Shares of the company have rallied 34.8% year to date.

CORT’s earnings beat estimates in two of the trailing four quarters and missed the mark in the other two, delivering an average earnings surprise of 6.99%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Corcept Therapeutics Incorporated (CORT) : Free Stock Analysis Report

Aurinia Pharmaceuticals Inc (AUPH) : Free Stock Analysis Report

Alpine Immune Sciences, Inc. (ALPN) : Free Stock Analysis Report