Merck's (MRK) Keytruda-Lynparza Combo Fails 2nd Lung Cancer Study

Merck MRK announced that the phase III KEYLYNK-006 study, evaluating the combination of its blockbuster drugs Keytruda and Lynparza in certain non-small cell lung cancer (NSCLC) patients, failed to meet its primary endpoints.

The KEYLYNK-006 study evaluated Keytruda, combined with Lynparza as maintenance therapy, for the first-line treatment for patients with metastatic non-squamous NSCLC with no EGFR, ALK or ROS1 genomic tumor aberrations. Patients in the control group received pemetrexed chemotherapy instead of Lynparza.

The treatment combination had failed to achieve the study’s pre-specified statistical criteria for the dual primary endpoints of overall survival (OS) and progression-free survival (PFS) compared with those who received the Keytruda- pemetrexed combo.

This is not the first time the Keytruda-Lynparza combination suffered a setback in NSCLC indication. Last December, Merck reported results from the phase III KEYLYNK-008 study, which evaluated the combination as a first-line treatment for patients with metastatic squamous NSCLC. This study failed to show an improvement in OS, one of the study’s dual primary endpoints. The study previously failed to achieve the other dual primary endpoint of PFS during the second interim data analysis.

A complete evaluation of the data from the KEYLYNK-006 study is ongoing. Management intends to work with investigators to share the results with the scientific community.

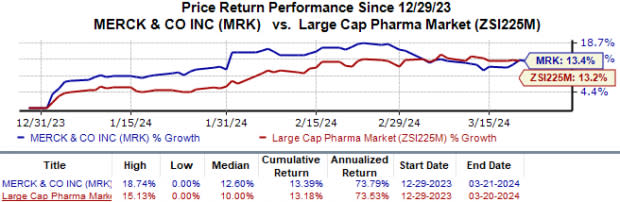

The stock has gained 13.4% year to date compared with the industry’s 13.2% growth.

Image Source: Zacks Investment Research

The Keytruda-Lynparza combo has also suffered a similar setback in prostate cancer indication. In 2022, Merck stopped the phase III KEYLYNK-010 study evaluating the combination in patients with metastatic castration-resistant prostate cancer (mCRPC). The KEYLYNK-010 failed to achieve its primary endpoints of OS and radiographic PFS.

Lynparza, a PARP inhibitor, has been developed by Merck in collaboration with AstraZeneca AZN. Lynparza is approved for four cancer types — ovarian, breast, prostate and pancreatic.

The profit-sharing deal between AstraZeneca and Merck was inked in 2017. Apart from Lynparza, the Merck-AstraZeneca deal also includes Koselugo.

An anti-PD-1 therapy, Keytruda is a revenue driver for Merck. The drug is approved for several types of cancer, contributing around 42% to MRK’s total revenues in 2023. Keytruda is authorized to treat eight indications in earlier-stage cancers in the United States. Merck’s Keytruda continuously grows and expands into new indications and markets globally.

Merck recorded $25.0 billion from Keytruda sales in 2023, up 19% year over year. Drug sales are gaining from continued strong momentum in metastatic indications and rapid uptake across recent earlier-stage launches. Keytruda is consistently growing and expanding into new indications and markets globally.

Merck & Co., Inc. Price

Merck & Co., Inc. price | Merck & Co., Inc. Quote

Zacks Rank & Key Picks

Merck currently carries a Zacks Rank #3 (Hold). A couple of better-ranked stocks in the overall healthcare sector include ADMA Biologics ADMA and ANI Pharmaceuticals ANIP, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for ADMA Biologics’ 2024 earnings per share (EPS) have risen from 22 cents to 30 cents. During the same period, EPS estimates for 2025 have improved from 32 cents to 50 cents. Year to date, shares of ADMA have risen 37.0%.

Earnings of ADMA Biologics beat estimates in three of the last four quarters while meeting the same on one occasion. ADMA delivered a four-quarter average earnings surprise of 85.00%.

In the past 60 days, estimates for ANI Pharmaceuticals’ 2024 EPS have risen from $4.06 to $4.43. Meanwhile, during the same period, EPS estimates for 2025 have improved from $4.80 to $5.04. Year to date, shares of ANIP have risen 25.7%.

Earnings of ANI Pharmaceuticals beat estimates in each of the last four quarters. ANI delivered a four-quarter average earnings surprise of 109.06%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AstraZeneca PLC (AZN) : Free Stock Analysis Report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

ANI Pharmaceuticals, Inc. (ANIP) : Free Stock Analysis Report

ADMA Biologics Inc (ADMA) : Free Stock Analysis Report