Mercury Systems Inc (MRCY) Faces Net Loss in Q2 FY24 Despite Strong Bookings and Positive Cash Flow

Bookings and Book-to-Bill Ratio: Q2 FY24 bookings reached $325.4 million with a high book-to-bill ratio of 1.65.

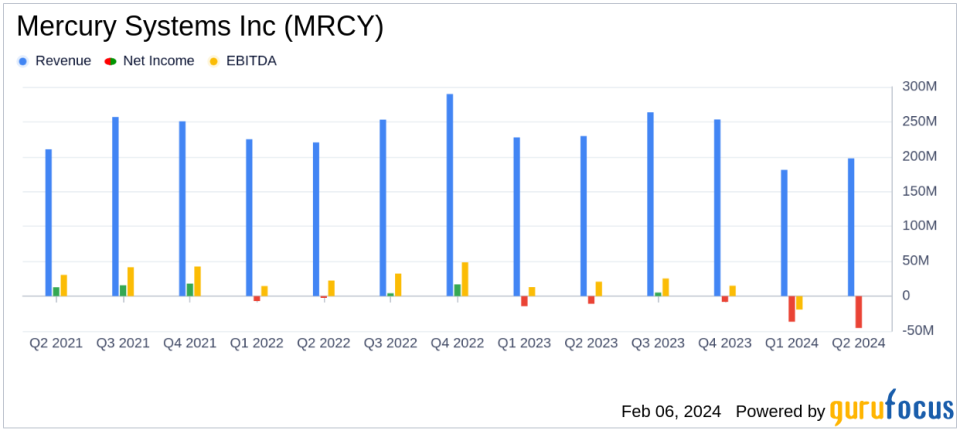

Revenue: Reported revenue was $197.5 million, a decrease from $229.6 million in Q2 FY23.

Net Loss: GAAP net loss was ($45.6) million, compared to a net loss of ($10.9) million in Q2 FY23.

Adjusted EBITDA: Adjusted EBITDA stood at ($21.3) million, down from $35.7 million in the prior year.

Cash Flow: Operating cash flow was positive at $45.5 million, with free cash flow of $37.5 million.

Backlog: Total backlog increased to $1.28 billion, with $786.4 million expected to be recognized as revenue within the next 12 months.

On February 6, 2024, Mercury Systems Inc (NASDAQ:MRCY) released its 8-K filing, detailing the financial results for the second quarter of fiscal year 2024, which ended on December 29, 2023. The company, a prominent player in the aerospace and defense industry, provides secure open architecture solutions for mission-critical applications. Despite facing a net loss and a decrease in revenue compared to the same quarter in the previous fiscal year, Mercury Systems achieved a significant book-to-bill ratio and generated strong cash flow.

Mercury Systems' Chairman and CEO, Bill Ballhaus, acknowledged the financial performance was affected by several factors, including program cost growth and manufacturing adjustments. However, he also highlighted the company's progress in its priority focus areas, such as driving improved free cash flow and consolidating operations to achieve cost savings.

The company's backlog grew substantially, indicating a strong demand for its offerings. However, the reduction in revenue guidance for the full fiscal year 2024 suggests challenges ahead, with the company withdrawing its previous GAAP and Non-GAAP guidance due to uncertainties.

Financial Performance Analysis

Mercury Systems' financial results reflect a transitional period with both achievements and challenges. The high book-to-bill ratio demonstrates the company's ability to secure new orders, which is crucial for future revenue growth. The positive cash flow from operations and free cash flow are indicative of effective working capital management and operational efficiency, which are vital for sustaining operations and investing in growth.

The net loss and negative adjusted EBITDA, however, raise concerns about the company's profitability in the short term. These results are partly due to increased costs and investments in development programs, which are expected to transition to production. The company's focus on resolving challenged programs and streamlining operations may help improve financial performance in the upcoming quarters.

Mercury Systems' strong backlog is a testament to its market position and the ongoing demand for its solutions in the aerospace and defense sector. The ability to convert this backlog into revenue will be key to the company's success moving forward.

Value investors may find Mercury Systems' current position intriguing, as the company is taking strategic steps to address its challenges while capitalizing on its strong market demand. The potential for future revenue growth, coupled with the company's efforts to improve margins and cash flow, could present opportunities for long-term value creation.

For a more detailed analysis of Mercury Systems Inc (NASDAQ:MRCY)'s financials and future outlook, investors are encouraged to review the full earnings report and consider the company's strategies for navigating its current challenges.

Explore the complete 8-K earnings release (here) from Mercury Systems Inc for further details.

This article first appeared on GuruFocus.