Mercury Systems (MRCY) Q3 Earnings & Revenues Beat Estimates

Mercury Systems MRCY reported better-than-expected third-quarter fiscal 2023 results, wherein both the top line and bottom line outpaced the Zacks Consensus Estimate.

The aerospace and defense tech firm reported non-GAAP earnings of 40 cents per share, beating the Zacks Consensus Estimate of 35 cents and came in within the company’s guidance range of 32-42 cents. The bottom line declined 29.8% year over year, mainly due to increased costs and higher interest expenses.

Mercury Systems’ third-quarter non-GAAP revenues increased 4% to $263.5 million compared with $253.1 million reported in the year-ago quarter. The top line surpassed the consensus mark of $252.9 million and was higher than the guided range of $255-$260 million.

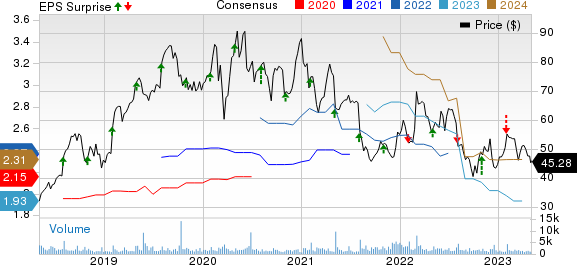

Mercury Systems Inc Price, Consensus and EPS Surprise

Mercury Systems Inc price-consensus-eps-surprise-chart | Mercury Systems Inc Quote

Q3 in Details

Mercury Systems’ total bookings were $245 million, resulting in a 0.93 book-to-bill ratio.

The company ended the quarter with a backlog of $1.10 billion, up $103.2 million on a year-over-year basis. Within the next 12 months, products worth $695 million from this order backlog are expected to be shipped.

Mercury Systems’ gross profit was $90.3 million, down 9.5% year over year. Moreover, its gross margin contracted by 510 basis points (bps) to 34.3%.

Total operating expenses decreased 2% to $88.3 million. As a percentage of revenues, operating expenses declined 200 bps to 33.5% from 35.5% in the year-ago quarter.

Adjusted EBITDA plunged 17.1% year over year to $43.5 million. The margin decreased 420 bps to 16.5% due to a lower gross margin, partially offset by the reduction in operating expenses as a percentage of revenues.

Balance Sheet & Cash Flow

As of Mar 31, 2023, MRCY’s cash and cash equivalents were $64.4 million compared with $76.9 million as of Dec 30, 2022. The long-term debt as of Mar 31, 2023 was $511.5 million.

The company used $3.2 million and $33.9 million in cash for operational activities in the third quarter and first nine months of fiscal 2023, respectively. Mercury generated a negative free cash flow of $12.7 million and $63.8 million in the third quarter and first nine months of fiscal 2023, respectively.

Guidance

For the fourth quarter of fiscal 2023, Mercury Systems projects revenues between $269.3 million and $289.3 million. Adjusted EBITDA is anticipated between $49.6 million and $59.6 million. Adjusted earnings are projected in the range of 47-61 cents per share.

For fiscal 2023, Mercury Systems expects revenues between $990 million and 1.01 billion. It estimates adjusted EBITDA in the range of $160-$170 million.

Mercury forecasts fiscal 2023 adjusted earnings in the $1.36-$1.50 per share band.

Zacks Rank & Key Picks

Mercury currently has a Zacks Rank #3 (Hold). Shares of MRCY have declined 18.9% in the past year.

Some better-ranked stocks from the broader Computer and Technology sector are Meta Platforms META, Momo MOMO and ServiceNow NOW. While Meta Platforms and Momo sport a Zacks Rank #1 (Strong Buy), ServiceNow carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Meta Platforms' second-quarter 2023 earnings has been revised 14% upward to $2.79 per share over the past seven days. For 2023, earnings estimates have moved north by 12.1% to $11.76 in the past seven days.

META’s earnings beat the Zacks Consensus Estimate in two of the trailing four quarters, missing twice, the average surprise being 15.5%. Shares of the company have gained 12.7% in the past year.

The Zacks Consensus Estimate for Momo’s first-quarter 2023 earnings has been revised southward from 36 cents to 32 cents per share over the past 30 days. For 2023, earnings estimates have moved down by 3 cents to $1.55 in the past 30 days.

MOMO's earnings beat the Zacks Consensus Estimate in all the trailing four quarters, the average surprise being 31.9%. Shares of the company have gained 49.9% in the past year.

The Zacks Consensus Estimate for ServiceNow’s second-quarter 2023 earnings has been revised northward by 12 cents to $2.04 per share over the past seven days. For 2023, earnings estimates have moved up by 32 cents to $9.54 in the past seven days.

NOW's earnings beat the Zacks Consensus Estimate in all the trailing four quarters, the average surprise being 10.4%. Shares of the company have inched down 8% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ServiceNow, Inc. (NOW) : Free Stock Analysis Report

Mercury Systems Inc (MRCY) : Free Stock Analysis Report

Hello Group Inc. Sponsored ADR (MOMO) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report