MeridianLink Inc CFO Sean Blitchok Sells 11,789 Shares: An Analysis of Insider Activity and ...

Sean Blitchok, the Chief Financial Officer of MeridianLink Inc (NYSE:MLNK), has recently made a significant change in his holdings of the company's stock. On December 5, 2023, the insider sold 11,789 shares of MeridianLink Inc, a notable transaction that has caught the attention of investors and market analysts alike. This sale is part of a broader pattern of insider activity that can offer insights into the company's financial health and future prospects.

Who is Sean Blitchok of MeridianLink Inc?

Sean Blitchok serves as the Chief Financial Officer of MeridianLink Inc, a position that places him in charge of the company's financial operations, including strategic planning, risk management, and financial reporting. His role is crucial in shaping the company's financial strategy and ensuring its fiscal stability. With a deep understanding of the company's financial landscape, Blitchok's trading activities are often scrutinized for indications of MeridianLink's performance and outlook.

MeridianLink Inc's Business Description

MeridianLink Inc is a leading provider of cloud-based software solutions for financial institutions, including banks, credit unions, mortgage lenders, and specialty lending providers. The company's suite of products is designed to streamline operations, improve efficiency, and enhance the user experience for both clients and their customers. MeridianLink's innovative solutions support loan origination, new account opening, and credit reporting, among other critical financial processes.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

Insider trading activities, such as buys and sells, can provide valuable clues about a company's internal perspective on its stock's value. When insiders sell shares, it can sometimes indicate their belief that the stock may be overvalued or that its growth prospects are limited. Conversely, insider purchases might suggest confidence in the company's future and the potential for stock price appreciation.

In the case of MeridianLink Inc, the insider transaction history over the past year shows a lack of insider purchases, with zero buys recorded. However, there have been 7 insider sells during the same period, which could signal caution from those with intimate knowledge of the company's workings. Sean Blitchok's recent sale of 11,789 shares is part of this trend of insider selling.

On the day of Blitchok's sale, shares of MeridianLink Inc were trading at $21.02, valuing the company at a market cap of $1.724 billion. This price point and valuation can serve as a benchmark for evaluating the significance of the insider's decision to sell at that particular time.

It is important to consider the context of these transactions. Insider sells can occur for various reasons unrelated to the company's performance, such as personal financial planning, diversification of assets, or other personal considerations. Therefore, while insider activity can be a useful indicator, it should not be the sole factor in making investment decisions.

Insider Trends

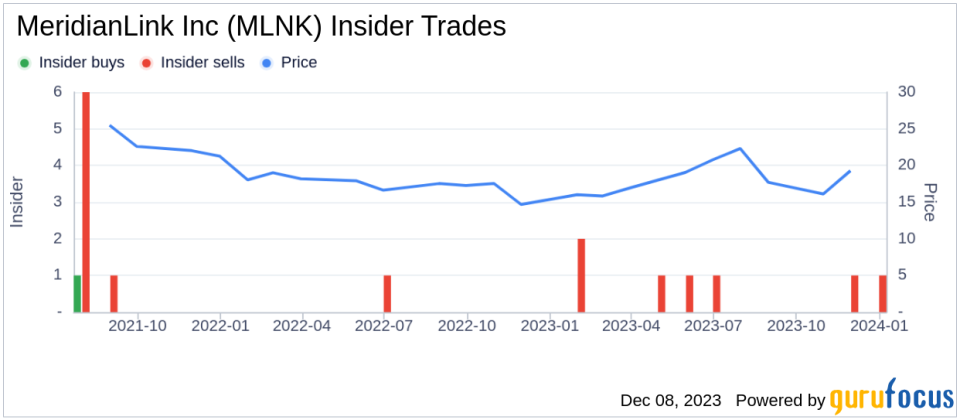

The insider trend for MeridianLink Inc can be visualized through the following image, which captures the pattern of insider transactions over the past year:

This image illustrates the absence of insider buys and the presence of multiple insider sells, including the recent transaction by CFO Sean Blitchok. The trend suggests that insiders have not been inclined to increase their stakes in the company, which could be interpreted as a lack of bullish sentiment among those closest to the company's operations.

Conclusion

The recent sale of 11,789 shares by MeridianLink Inc's CFO Sean Blitchok is a significant event that warrants attention from investors and market analysts. While the absence of insider buys and the presence of several insider sells over the past year may raise questions about the insiders' confidence in the company's stock, it is essential to consider the broader context and not rely solely on these transactions when evaluating the company's potential. Investors should also look at MeridianLink's financial performance, market position, and growth prospects to make informed decisions.

As the market continues to digest this insider activity, it will be important to monitor any further transactions by company insiders and any potential impact on MeridianLink Inc's stock price. Keeping an eye on the company's developments and financial reports will also provide a clearer picture of its trajectory and whether the insider selling trend aligns with the company's overall performance.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.