MeridianLink Inc (MLNK) Reports Growth Amidst Challenges in Q4 and Fiscal Year 2023

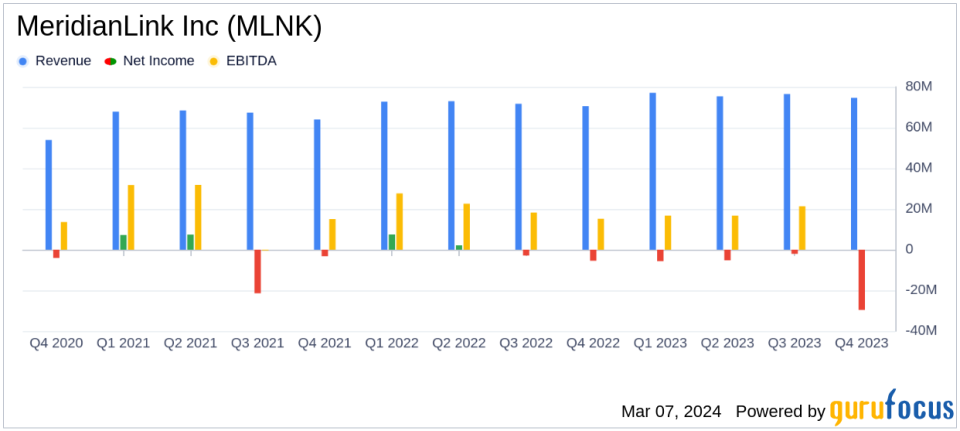

Revenue Growth: Q4 revenue rose to $74.6 million, a 6% year-over-year increase, with lending software solutions up by 8%.

Operating Income: Q4 operating income was $6.8 million, representing 9% of revenue, with non-GAAP operating income at $15.2 million or 20% of revenue.

Net Loss: A net loss of $(29.6) million was reported in Q4, including a one-time non-cash tax expense of $29.4 million.

Adjusted EBITDA: Q4 adjusted EBITDA stood at $31.1 million, or 42% of revenue.

Cash Flow: Cash flows from operations were $12.5 million, or 17% of revenue, with free cash flow at $9.6 million, or 13% of revenue.

Fiscal Year Highlights: Full-year revenue increased by 5% to $303.6 million, with lending software solutions revenue growing 11%.

Guidance: For Q1 fiscal 2024, revenue is expected to be between $75.0 million and $78.0 million, with adjusted EBITDA between $28.0 million and $31.0 million.

On March 5, 2024, MeridianLink Inc (NYSE:MLNK), a leading provider of cloud-based software solutions for financial institutions, released its 8-K filing, detailing the financial results for the fourth quarter and fiscal year ended December 31, 2023. The company, known for its revenue generation primarily from lending software solutions, reported a year-over-year revenue increase for both the quarter and the fiscal year.

Financial Performance and Challenges

MeridianLink Inc (NYSE:MLNK) experienced growth in its fourth quarter, with revenue reaching $74.6 million, a 6% increase compared to the previous year. This growth was primarily driven by an 8% increase in lending software solutions revenue, which amounted to $59.5 million. The company's operating income for the quarter was $6.8 million, or 9% of revenue, with non-GAAP operating income at $15.2 million, or 20% of revenue. Despite these achievements, the company reported a net loss of $(29.6) million, or (40)% of revenue, which includes a significant one-time non-cash tax expense related to a partial valuation allowance on certain deferred tax assets.

For the fiscal year 2023, MeridianLink Inc (NYSE:MLNK) reported a revenue of $303.6 million, marking a 5% increase year-over-year. The lending software solutions segment saw an 11% increase, contributing $232.2 million to the total revenue. The operating income for the year was $15.5 million, or 5% of revenue, with non-GAAP operating income at $51.1 million, or 17% of revenue. The net loss for the fiscal year was $(42.5) million, or (14)% of revenue, which also includes the aforementioned tax expense.

Operational Highlights and Future Outlook

Throughout the year, MeridianLink Inc (NYSE:MLNK) demonstrated strong software bookings, driven by the cross-sell momentum of MeridianLink One. The company also expanded its capabilities through new integrations and partnerships, enhancing its product offerings and increasing cross-sell opportunities for customers.

Looking ahead, MeridianLink Inc (NYSE:MLNK) has provided financial guidance for the first quarter of fiscal 2024, with revenue expected to be in the range of $75.0 million to $78.0 million and adjusted EBITDA anticipated to be between $28.0 million and $31.0 million. For the full year 2024, revenue is projected to be between $313.0 million and $323.0 million, with adjusted EBITDA expected to be between $123.0 million and $130.0 million.

Despite the challenges faced, including a material weakness in internal control over financial reporting related to revenue, MeridianLink Inc (NYSE:MLNK) is undertaking remediation efforts to strengthen its processes and controls. The company's commitment to innovation and customer value, as well as its strategic investments, position it for continued growth and operational success.

Conclusion

MeridianLink Inc (NYSE:MLNK) has shown resilience and strategic progress in the face of macroeconomic challenges, reflected in its revenue growth and operational achievements. The company's focus on expanding its product suite and enhancing customer value through MeridianLink One continues to drive its performance. Investors and stakeholders can look forward to MeridianLink's ongoing efforts to optimize its operations and deliver on its financial guidance for the upcoming fiscal year.

Explore the complete 8-K earnings release (here) from MeridianLink Inc for further details.

This article first appeared on GuruFocus.