Merit Medical (MMSI) Completes Enrollment in WRAPSODY Study

Merit Medical Systems MMSI announced that it has met the enrollment target in the multicenter, pivotal study, WAVE, which is evaluating its Cell-Impermeable Endoprosthesis device — WRAPSODY.

The pivotal study has enrolled 244 patients with arteriovenous fistula (AVF) and 113 patients with arteriovenous graft (AVG) across sites in Brazil, Canada, the United Kingdom and the United States. The company intends to follow up patients in the study for 24 months following completion of the enrollment. It expects to file primary data from the study to support a Premarket Approval application to the FDA after six months.

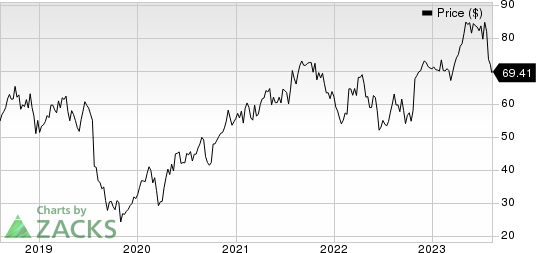

Price Performance

Shares of Merit Medical have lost 1.8% year to date against the industry’s growth of 16.4%. The S&P 500 Index has gained 18.5% in the same time frame.

Image Source: Zacks Investment Research

Significance of the Study

The WAVE study is comparing WRAPSODY to percutaneous transluminal angioplasty as a potential treatment for stenosis (narrowing) and/or occlusion (blockage) of blood vessels in the venous outflow circuit in patients undergoing hemodialysis.

A long-term vascular access in patients undergoing hemodialysis is achieved with the creation and maintenance of AVF/AVG in blood vessels. However, stenosis/occlusion in the blood vessel used for AVF/AVG can prevent delivery of hemodialysis that may lead to life-threatening consequences. The WRAPSODY device is being developed to help physicians treat patients with stenosis/occlusion.

The currently available treatment options to maintain vascular access in hemodialysis patients have inadequate response. WRAPSODY, on the other hand, has the potential to provide better maintenance of AVF/AVG due to its unique cell-impermeable stent covering.

The WRAPSODY device has already achieved CE-mark in Europe and is also available in Brazil. While the device is not available commercially in the United States, it is being used in the country under an Investigational Device Exemption from the FDA.

Industry Prospects

Per a report by Allied Market Research, the global dialysis market was valued at $91,205.0 million in 2020 and is projected to reach $129,756.8 million by 2028 at a CAGR of 4.7%. Factors like an increase in number of diabetic and hypertension patients, a rise in the number of end-stage renal disease patients and a preference over kidney transplantation are likely to drive the market.

Given the market potential, the successful development of WRAPSODY is expected to provide a significant boost to Merit Medical’s business in the niche space.

Notable Developments

In July, Merit Medical announced second-quarter 2023 results, wherein it registered an encouraging year-over-year uptick in the top and bottom lines. The company witnessed revenue growth in both its segments and across all the product categories in its Cardiovascular unit. Robust performances in the United States and outside were also recorded. Expansion of gross margin buoys optimism.

In June, MMSI completed the acquisition of a portfolio of dialysis catheter products and the BioSentry Biopsy Tract Sealant System from AngioDynamics. Management believes that these acquisitions will likely strengthen its position in the dialysis and biopsy markets, besides expanding its specialty dialysis device offering.

In March, the company announced the expansion of its SwiftNINJA Steerable Microcatheter product line, which belongs to its delivery systems portfolio. The new sizes include a low-profile 2.4F distal diameter option in 125-cm and new longer 150-cm length.

Merit Medical Systems, Inc. Price

Merit Medical Systems, Inc. price | Merit Medical Systems, Inc. Quote

Zacks Rank & Stocks to Consider

Merit Medical currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are Patterson Companies PDCO, West Pharmaceutical Services WST and McKesson MCK. While Patterson Companies sports a Zacks Rank #1 (Strong Buy), both West Pharmaceuticals and McKesson carry a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Patterson Companies has an estimated long-term growth rate of 9.2%. PDCO’s earnings surpassed estimates in three of the trailing four quarters and missed once, delivering an average surprise of 4.52%.

Patterson Companies’ shares have risen 19.1% year to date compared with the industry’s 16.4% growth.

West Pharmaceutical Services has an estimated earnings growth rate of 4.6% over the next five year. The company’s earnings surpassed estimates in three of the trailing four quarters and missed the same in one, delivering an average surprise of 12.47%.

WST’s shares haverisen 70% year to date compared with the industry’s 16.4% growth.

McKesson has an estimated long-term growth rate of 10.7%. The company’s earnings surpassed estimates in three of the trailing four quarters and missed the same in one, delivering an average surprise of 8.1%.

MCK’s shares have rallied 14.2% year to date compared with the industry’s 16.48% growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

McKesson Corporation (MCK) : Free Stock Analysis Report

Patterson Companies, Inc. (PDCO) : Free Stock Analysis Report

Merit Medical Systems, Inc. (MMSI) : Free Stock Analysis Report

West Pharmaceutical Services, Inc. (WST) : Free Stock Analysis Report