Merit Medical (MMSI) Q2 Earnings & Revenues Beat Estimates

Merit Medical Systems, Inc. MMSI delivered adjusted earnings per share (EPS) of 81 cents in the second quarter of 2023, up by 10.9% year over year. The figure also surpassed the Zacks Consensus Estimate by 8%.

The adjustments include expenses related to the amortization of intangibles, and corporate transformation and restructuring, among others.

GAAP EPS for the quarter was 35 cents, up by 29.6% year over year.

Revenues in Detail

Merit Medical registered revenues of $320.1 million in the second quarter, up 8.5% year over year. The figure surpassed the Zacks Consensus Estimate by 3.2%.

Per management, the overall top line was driven by 9% growth in U.S. sales and 8% growth in international sales. Strong performance by both segments and the Cardiovascular segment’s product categories also contributed to the top line.

Total revenues at constant exchange rate (CER) inched up 9.4% year over year, whereas CER, organic revenues increased 9.1% year over year.

Segmental Details

Merit Medical operates through two segments — Cardiovascular and Endoscopy.

The Cardiovascular unit reported second-quarter revenues of $311.3 million, up 8.6% on a reported basis and 9.5% at CER year over year.

This figure compares to our segmental projection of $300.9 million for the second quarter.

The Cardiovascular segment includes the following product categories: Peripheral Intervention (PI), Cardiac Intervention (CI), Custom Procedural Solutions (CPS) and original equipment manufacturer (OEM).

PI product line revenues were $125.9 million, up 13.5% on a reported basis and 14.4% at CER year over year. This compares to our projection of $116.9 million.

CI revenues of $93.8 million rose 4.7% on a reported basis and 6% at CER year over year. This compares to our projection of $92.3 million.

CPS revenues improved 0.6% on a reported basis and 1.3% at CER year over year to $49.4 million. This compares to our projection of $53.4 million.

OEM revenues climbed 13.9% on a reported basis and 13.7% at CER year over year to $42.2 million. This compares to our projection of $38.2 million.

Endoscopy devices’ revenues totaled $8.8 million, up 5.7% year over year on a reported basis. At CER, revenues jumped 6% year over year.

This figure compares to our segmental projection of $8.9 million for the second quarter.

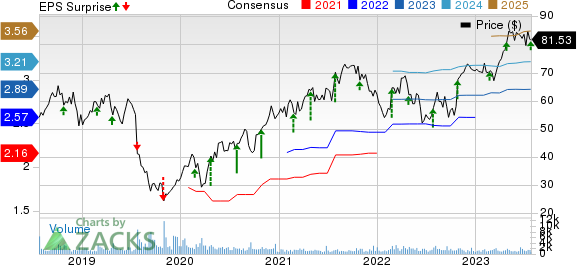

Merit Medical Systems, Inc. Price, Consensus and EPS Surprise

Merit Medical Systems, Inc. price-consensus-eps-surprise-chart | Merit Medical Systems, Inc. Quote

Margins

In the quarter under review, Merit Medical’s gross profit rose 13.1% to $152.8 million. The gross margin expanded 195 basis points (bps) to 47.7%.

We had projected 46.3% of gross margin for the second quarter.

Selling, general & administrative expenses rose 18.1% to $100.9 million. Research and development expenses rose 9% year over year to $20.1 million. Adjusted operating expenses of $121.1 million increased 16.5% year over year.

Adjusted operating profit totaled $31.7 million, reflecting a 1.9% increase from the prior-year quarter. However, the adjusted operating margin in the second quarter contracted by 64 bps to 9.9%.

Financial Position

Merit Medical exited second-quarter 2023 with cash and cash equivalents of $72.1 million compared with $57.9 million at the first-quarter end. Total debt (including the current portion) at the end of second-quarter 2023 was $338.9 million compared with $197.7 million at the end of the first quarter.

Cumulative net cash flow provided by operating activities at the end of second-quarter 2023 was $31.8 million compared with $50.8 million a year ago.

2023 Guidance

Merit Medical has revised its 2023 outlook from the one it had provided in June after it completed the acquisition of a portfolio of dialysis catheter products and the BioSentry Biopsy Tract Sealant System from AngioDynamics.

Net revenues for 2023 are continued to be projected between $1.230 billion and $1.244 billion, reflecting an increase of approximately 7-8% over the comparable reported figures of 2022. The Zacks Consensus Estimate for the same stands at $1.24 billion.

Net revenues from the cardiovascular segment are now expected to be in the range of $1.193 billion-$1.207 billion, representing an increase of approximately 7-8% over the comparable reported figures of 2022. This is up from the prior outlook of $1.192 billion-$1.206 billion, representing an increase of approximately 7-8% over the comparable reported figures of 2022.

The endoscopy segment’s net revenues are now projected to be between $36.8 million and $37 million, representing an increase of approximately 12-13% over the comparable reported figures of 2022. This is lower than the prior outlook of $37.8 million and $38.1 million, representing an increase of approximately 15-16% over the comparable reported figures of 2022.

Adjusted EPS for 2023 is continued to be projected within $2.81-$2.92. The Zacks Consensus Estimate for the same stands at $2.89.

Our Take

Merit Medical exited the second quarter of 2023 with better-than-expected results. The year-over-year uptick in the top and bottom lines was impressive. The company saw revenue growth in both its segments and across all the product categories within its Cardiovascular unit. Robust performances in the United States and outside were impressive. Strong execution and improving customer demand trends pushed up the overall top line, which was encouraging. The expansion of gross margin bodes well for the stock.

In June, Merit Medical completed the acquisition of a portfolio of dialysis catheter products and the BioSentry Biopsy Tract Sealant System. This followed Merit Medical’s acquisition of the Surfacer Inside-Out Access Catheter System from Bluegrass Vascular Technologies, Inc. These acquisitions will likely strengthen its position in the dialysis and biopsy markets, besides expanding its growing specialty dialysis device offering. These also look promising for the stock.

However, the adjusted operating margin contraction in the quarter does not bode well. The current challenging global macro environment also raises our apprehension.

Zacks Rank and Other Key Picks

Merit Medical currently has a Zacks Rank #2 (Buy).

A few other top-ranked stocks in the broader medical space that have announced quarterly results are Abbott Laboratories ABT, Elevance Health, Inc. ELV and Intuitive Surgical, Inc. ISRG.

Abbott, carrying a Zacks Rank of 2, reported second-quarter 2023 adjusted EPS of $1.08, beating the Zacks Consensus Estimate by 3.8%. Revenues of $9.98 billion outpaced the consensus mark by 2.9%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Abbott has a long-term estimated growth rate of 5.1%. ABT’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 12.4%.

Elevance Health reported second-quarter 2023 adjusted EPS of $9.04, beating the Zacks Consensus Estimate by 2.5%. Revenues of $43.38 billion surpassed the Zacks Consensus Estimate by 4.5%. It currently carries a Zacks Rank #2.

Elevance Health has a long-term estimated growth rate of 12.1%. ELV’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 2.8%.

Intuitive Surgical reported second-quarter 2023 adjusted EPS of $1.42, beating the Zacks Consensus Estimate by 7.6%. Revenues of $1.76 billion surpassed the Zacks Consensus Estimate by 1.4%. It currently carries a Zacks Rank #2.

Intuitive Surgical has a long-term estimated growth rate of 15.7%. ISRG’s earnings surpassed estimates in three of the trailing four quarters and missed once, the average surprise being 4.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abbott Laboratories (ABT) : Free Stock Analysis Report

Intuitive Surgical, Inc. (ISRG) : Free Stock Analysis Report

Merit Medical Systems, Inc. (MMSI) : Free Stock Analysis Report

Elevance Health, Inc. (ELV) : Free Stock Analysis Report