Merit Medical Systems Inc (MMSI) Reports Robust Revenue Growth and Strong Free Cash Flow in Q4 ...

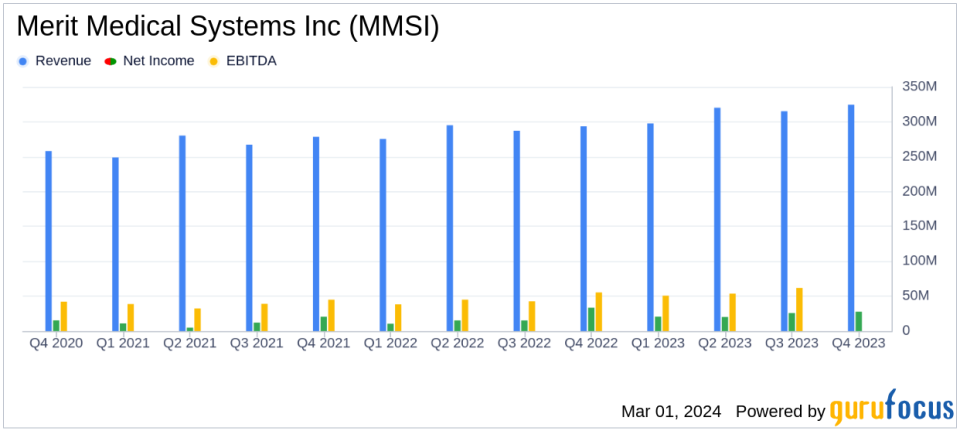

Revenue Growth: Q4 revenue increased by 10.6% year-over-year, reaching $324.5 million.

Non-GAAP Gross Margin Improvement: Non-GAAP gross margin rose to 50.4% in Q4 from 49.5% in the same period last year.

Net Income: GAAP net income for Q4 was $27.6 million, with non-GAAP net income at $47.2 million.

Free Cash Flow: Generated approximately $55 million in Q4, contributing to over $110 million for the full year.

2024 Financial Guidance: Projected revenue growth of 4%-5% and non-GAAP EPS increase of 9%-11%.

Liquidity Position: Cash and cash equivalents stood at $587.0 million as of December 31, 2023.

On February 28, 2024, Merit Medical Systems Inc (NASDAQ:MMSI), a leading manufacturer and marketer of healthcare technology, released its 8-K filing, detailing its financial results for the fourth quarter and full year ended December 31, 2023. The company, known for its medical devices used in various interventional procedures, reported a significant 10.6% increase in revenue for the quarter, amounting to $324.5 million. This growth was underpinned by a solid performance in the Cardiovascular segment, which constitutes the majority of the company's revenue.

Merit Medical Systems Inc's non-GAAP gross margin also saw an improvement, rising to 50.4% in the fourth quarter from 49.5% in the prior year period. This margin expansion reflects the company's ability to manage costs effectively while scaling its operations. The GAAP net income for the quarter was reported at $27.6 million, or $0.47 per share, a decrease from $33.4 million, or $0.58 per share, in the fourth quarter of 2022. However, on a non-GAAP basis, net income increased slightly to $47.2 million, or $0.81 per share, from $46.0 million, or $0.79 per share, in the same quarter of the previous year.

Merit Medical Systems Inc's financial achievements are particularly noteworthy in the context of the Medical Devices & Instruments industry, where innovation, efficient production, and market expansion are key drivers of success. The company's ability to generate strong free cash flow, amounting to approximately $55 million in the fourth quarter and over $110 million for the full year, positions it well for future investments and debt management.

Financial Position and Future Outlook

The company's balance sheet reflects a robust liquidity position, with cash and cash equivalents of $587.0 million as of December 31, 2023, compared to $58.4 million at the end of 2022. Total debt obligations stood at $846.6 million, with available borrowing capacity of approximately $626 million. This financial stability is crucial for Merit Medical Systems Inc as it continues to invest in growth and navigate the competitive landscape of the healthcare technology market.

Looking ahead, Merit Medical Systems Inc has issued guidance for fiscal year 2024, projecting revenue to be between $1.312 billion and $1.325 billion, which would represent a 4% to 5% increase year-over-year. The company also anticipates non-GAAP earnings per share to be in the range of $3.28 to $3.35, marking a 9% to 11% rise from the previous year. This guidance reflects management's confidence in the company's continued strong execution and ability to achieve stable growth and improved profitability.

In summary, Merit Medical Systems Inc's latest earnings report showcases a company that is not only growing its top line but also improving its profitability margins and generating significant free cash flow. These financial metrics are critical for value investors looking for companies with sustainable business models and the potential for long-term growth. The company's forward-looking guidance suggests that this positive trajectory is expected to continue, making Merit Medical Systems Inc a noteworthy company for potential investors to consider.

For a more detailed analysis of Merit Medical Systems Inc's financial performance and future prospects, investors are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Merit Medical Systems Inc for further details.

This article first appeared on GuruFocus.