Merit Medical's (MMSI) SCOUT Guidance System Gets FDA Nod

Merit Medical Systems, Inc. MMSI recently announced the FDA approval for the SCOUT MD Surgical Guidance System.

With the ability to target tumor sites in various dimensions for accurate excision and successful surgeries, the new guiding system represents a substantial development in the treatment of breast cancer. SCOUT MD adds to Merit Medical’s oncology portfolio.

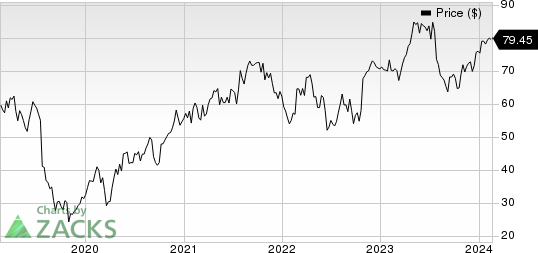

Price Performance

For the past six months, MMSI’s shares have gained 17.2% against the industry’s decline of 0.4%. The S&P 500 increased 13.2% in the same time frame.

Image Source: Zacks Investment Research

More on the News

SCOUT MD supports up to four distinct reflector configurations that can be implanted. The reflectors are intended to locate tumors in various dimensions for more accurate excision when implanted within aberrant breast tissue or other soft tissue. The FDA-cleared surgical system includes products like the SCOUT Radar Localization System with SCOUT Mini Reflector and SCOUT Bx Delivery System, as well as the SAVI Brachy System.

Surgeons will be able to distinguish the line of resection more precisely thanks to Merit Medical's invention of various reflectors with distinct signals. With SCOUT MD, a targeted approach can help reduce the risk of re-excision, lessen harm to nearby healthy tissue, and prevent the psychological and physical stress that comes with a second surgery.

Lumpectomy is often performed as a treatment for breast conserving. Nonetheless, 20% to 30% of women who get a lumpectomy are expected to require a second procedure. By enabling surgeons to target breast cancer more accurately, localization methods may lead to more successful surgeries and better patient outcomes.

Merit Medical supplied more than 500,000 devices as of January 2024 for placement in patient procedures. The launch of SCOUT MD marks an essential milestone for Merit Medical and breast surgery patients globally, which will likely boost the company’s supply of its devices in the future.

The introduction of the new guiding system represents a major improvement in the treatment of breast cancer patients and exemplifies Merit's continued leadership in oncology.

Industry Prospects

Per a report by Predence Research,the global oncology market size was valued at $203.4 billion in 2022 and is expected to reach more than $470.6 billion by 2032 at a growth rate of 8.8%.

The global oncology market is expanding rapidly due to the growing incidence of cancer worldwide because of rising alcohol and tobacco use.

Given the market potential for oncology, the latest FDA clearance for Merit’s SCOUT MD is likely to provide a significant boost to the company’s business.

Merit Medical Systems, Inc. Price

Merit Medical Systems, Inc. price | Merit Medical Systems, Inc. Quote

Zacks Rank & Other Stocks to Consider

MMSI sports a Zacks Rank #1 (Strong Buy) at present.

Some other top-ranked stocks to consider in the broader medical space are Universal Health Services UHS, Integer Holdings Corporation ITGR and Elevance Health, Inc ELV.

Universal Health Services, carrying a Zacks Rank #2 (Buy) at present, has an estimated growth rate of 4.4% for 2024. UHS’s earnings surpassed estimates in all the trailing four quarters, delivering an average surprise of 5.47%. You can see the complete list of today’s Zacks #1 Rank stocks here.

UHS’s shares have gained 1.9% in the past six months against the industry’s 5% decline.

Integer Holdings, presently carrying a Zacks Rank of 2, has an estimated long-term growth rate of 15.8%. ITGR’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 11.9%.

Integer Holdings’ shares have rallied 43.5% in the past year against the industry’s 3.7% decline.

Elevance Health, carrying a Zacks Rank of 2, reported fourth-quarter 2023 adjusted earnings per share of $5.62, beating the Zacks Consensus Estimate by 1.3%. Revenues of $42.45 billion outpaced the consensus mark by 1.5%.

Elevance Health has a long-term estimated growth rate of 12%. ELV’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 3.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Universal Health Services, Inc. (UHS) : Free Stock Analysis Report

Merit Medical Systems, Inc. (MMSI) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report

Elevance Health, Inc. (ELV) : Free Stock Analysis Report