Meritage Homes Corp (MTH) Reports Q4 and Full Year 2023 Earnings: A Mixed Bag of Growth and ...

Sales Orders: A significant 60% year-over-year increase in Q4.

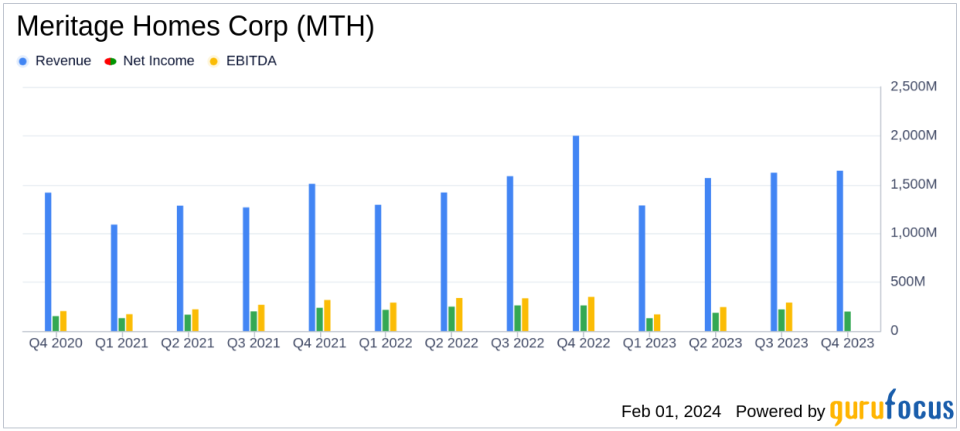

Home Closing Revenue: Decreased by 17% in Q4 and 2% for the full year.

Net Earnings: Dropped by 24% in Q4 and 26% for the full year.

Diluted EPS: Declined to $5.38 in Q4 and $19.93 for the full year, reflecting a 24% and 25% decrease respectively.

Gross Margin: Remained stable at 25.2% in Q4, but full year margin decreased by 380 bps.

Balance Sheet Strength: Cash and cash equivalents increased to $921.2 million.

On January 31, 2024, Meritage Homes Corp (NYSE:MTH) released its 8-K filing, detailing its financial performance for the fourth quarter and full year ended December 31, 2023. The company, a prominent designer and builder of single-family homes, operates across three regions and ten states, with a primary focus on the homebuilding segment complemented by financial services.

Meritage Homes Corp (NYSE:MTH) experienced a robust 60% year-over-year increase in sales orders for Q4 2023, driven by healthy homebuying demand as interest rates dipped below 7%. Despite this, home closing revenue saw a 17% decline in Q4 and a slight 2% dip for the full year. The average sales price on closings also fell by 5% in Q4, attributed to more costly financing incentives and geographic mix.

Net earnings and diluted earnings per share (EPS) both took a hit, with net earnings falling by 24% in Q4 and 26% for the full year, and diluted EPS decreasing to $5.38 in Q4 and $19.93 for the full year. The company's home closing gross margin remained stable at 25.2% in Q4, though the full year margin decreased by 380 basis points due to increased financing incentives and higher lot costs.

Meritage Homes Corp (NYSE:MTH) strengthened its balance sheet, with cash and cash equivalents rising to $921.2 million. The company's land acquisition and development spend increased significantly, and it added over 7,600 new lots in Q4, representing an estimated 43 future communities focused on entry-level products.

Despite the challenges, Meritage Homes Corp (NYSE:MTH) remains optimistic about the future, with the executive chairman Steven J. Hilton and CEO Phillippe Lord highlighting the company's strong order finish and exceptional execution. They believe that the company is well-positioned to take advantage of positive demand, especially from entry-level buyers, as the economy stabilizes.

Financial Highlights and Management Commentary

Meritage Homes Corp (NYSE:MTH) reported a decrease in earnings before income taxes by 24% for Q4 and 26% for the full year. The diluted EPS was impacted by lower home closing revenue and higher selling, general, and administrative expenses. The company's SG&A as a percentage of home closing revenue increased by 230 basis points in Q4 due to increased performance-based compensation costs and higher commission rates.

Despite these pressures, management remains confident. CEO Phillippe Lord expressed gratitude towards the employees for another great year and emphasized the company's readiness to capitalize on the positive demand environment. The company's strategy of growing spec inventory levels and focusing on entry-level homes is expected to continue driving growth.

"Healthy homebuying demand in the fourth quarter of 2023 led to Meritage's strong orders finish to the year, as interest rates retreated below 7% and consumer confidence started to recover," said Steven J. Hilton, executive chairman of Meritage Homes.

"The Meritage team's exceptional execution in the fourth quarter of 2023 and our spec building strategy resulted in 3,951 homes delivered, our second highest quarterly home closings in company history, and a record 110% quarterly backlog conversion," added Phillippe Lord, chief executive officer of Meritage Homes.

Meritage Homes Corp (NYSE:MTH) is navigating a complex market environment with a mix of strategic growth initiatives and operational challenges. The company's latest earnings report reflects this dynamic, with significant growth in sales orders contrasted by pressures on revenue and margins. For value investors and potential GuruFocus.com members, the company's performance and strategic positioning offer a nuanced picture of its resilience and potential in the homebuilding industry.

Explore the complete 8-K earnings release (here) from Meritage Homes Corp for further details.

This article first appeared on GuruFocus.