Meritage Homes (MTH): A Comprehensive Examination of Its Market Value

Meritage Homes Corp (NYSE:MTH) has been a topic of interest for investors, with a daily loss of 4.02%, a 3-month loss of 1.94%, and an impressive Earnings Per Share (EPS) (EPS) of 22.75. The question on everyone's mind is, "Is this stock fairly valued?" This article will provide a comprehensive analysis of Meritage Homes Corp's valuation. We invite you to read on and gain a deeper understanding of this company's financial standing.

Company Overview

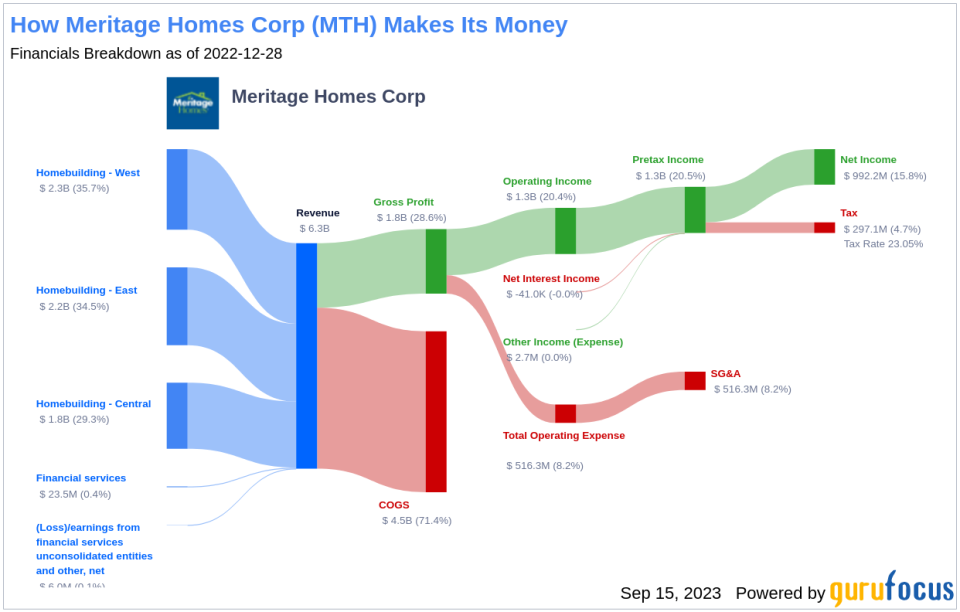

Meritage Homes Corp is a leading designer and builder of single-family homes, with operations spanning across ten states, including Arizona, California, Colorado, Texas, Florida, Georgia, North Carolina, South Carolina, Tennessee, and Utah. The company operates two main segments: homebuilding and financial services. The homebuilding segment focuses on land acquisition, development, construction, marketing, sales, and customer services, while the financial services segment offers title and escrow, mortgage, and insurance services. The homebuilding segment generates the majority of the company's revenue.

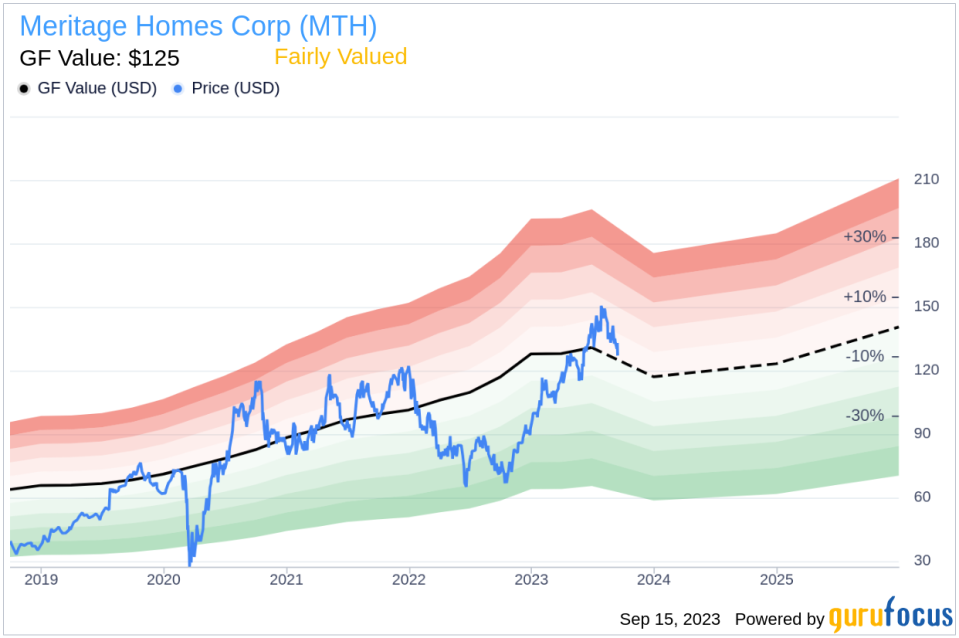

With the stock currently priced at $127.61 per share and a market cap of $4.70 billion, it's crucial to assess whether this aligns with the company's estimated fair value - the GF Value.

Understanding GF Value

The GF Value is a unique measure of a stock's intrinsic value, calculated based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. The GF Value Line provides a visual representation of the stock's ideal fair trading value. If the stock price significantly deviates from the GF Value Line, it indicates that the stock may be overvalued or undervalued, influencing its future return.

Based on our analysis, Meritage Homes Corp appears to be fairly valued. This suggests that the long-term return of its stock is likely to be close to the rate of its business growth.

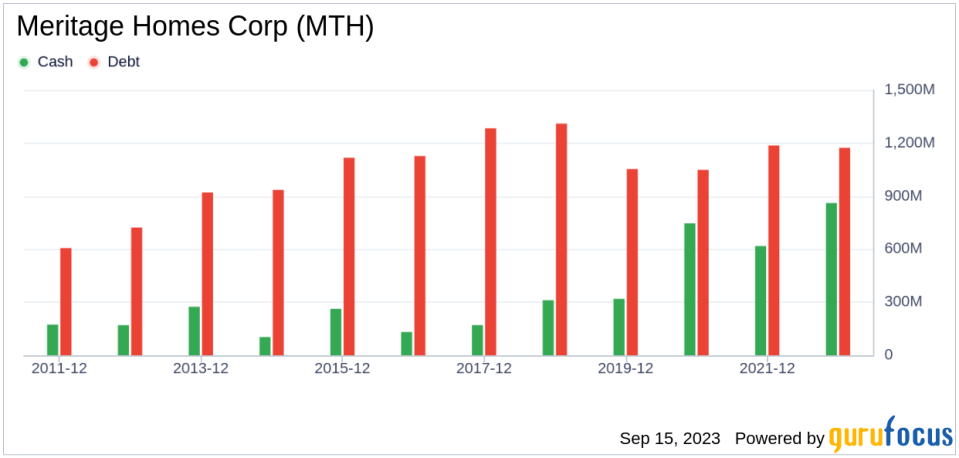

Financial Strength

Investing in companies with robust financial strength reduces the risk of capital loss. A great starting point for understanding a company's financial strength is examining its cash-to-debt ratio and interest coverage. Meritage Homes boasts a cash-to-debt ratio of 0.99, ranking better than 62.26% of companies in the Homebuilding & Construction industry. Overall, GuruFocus ranks Meritage Homes' financial strength at 7 out of 10, indicating fair financial health.

Profitability and Growth

Investing in profitable companies, especially those with consistent long-term profitability and high-profit margins, is generally safer. Meritage Homes has been profitable for ten years, with an operating margin of 16.33%, ranking better than 75.23% of companies in its industry. GuruFocus ranks Meritage Homes' profitability at 9 out of 10, indicating strong profitability.

Growth is a critical factor in a company's valuation. Meritage Homes' growth ranks better than 91.49% of companies in its industry, with a 3-year average revenue growth rate better than 82.35% of its industry peers. Its 3-year average EBITDA growth rate is 59.5%, ranking better than 91.49% of companies in the Homebuilding & Construction industry.

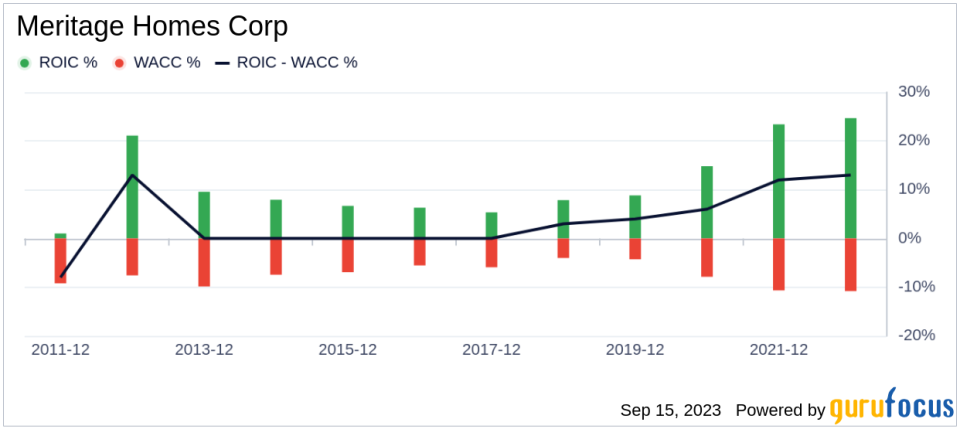

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to its weighted average cost of capital (WACC) can provide insights into its profitability. ROIC measures how well a company generates cash flow relative to the capital it has invested in its business. WACC is the rate a company is expected to pay to finance its assets. If the ROIC exceeds the WACC, the company is likely creating value for its shareholders. Meritage Homes' ROIC is 18.6, while its WACC is 9.53.

Conclusion

In conclusion, Meritage Homes Corp's stock appears to be fairly valued. The company's financial condition is fair, its profitability is strong, and its growth outperforms 91.49% of companies in the Homebuilding & Construction industry. For more information about Meritage Homes' stock, check out its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, visit the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.