Meritage Homes (MTH) Stock Down Despite Q4 Earnings Beat

Meritage Homes Corporation MTH reported fourth-quarter 2020 results, with earnings and revenues surpassing the Zacks Consensus Estimate. Also, the top and the bottom line improved significantly on a year-over-year basis.

However, following the earnings release, shares of the company fell 5.4% during after-hours trading session on Jan 27. Negative investors’ sentiments were witnessed as the company projected lower-than-market expected earnings for 2021.

Earnings & Revenue Discussion

Meritage Homes reported earnings of $3.97 per share, which topped the Zacks Consensus Estimate of $3.36 by 18.2% and surged 49.8% year over year. The upside can be primarily attributed to solid home closing revenues and high gross margins.

Total revenues (including Homebuilding and Financial Services revenues) amounted to $1.42 billion, up 24% from the year-ago quarter’s level. The uptick was backed by stronger market demand and lower mortgage interest rates.

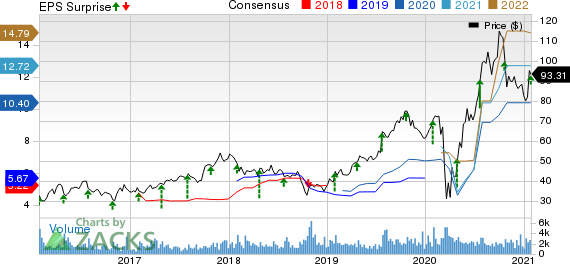

Meritage Homes Corporation Price, Consensus and EPS Surprise

Meritage Homes Corporation price-consensus-eps-surprise-chart | Meritage Homes Corporation Quote

Segment Discussion

Homebuilding: The segment’s revenues in the fourth quarter totaled $1,409.9 million, up 24% from the prior-year quarter’s level of $1,136.8 million. Home closing revenues totaled $1,409.2 million, up 28% year over year. The upside can be attributed to 32% increase in volumes. Average sales price (or ASP) fell 4% year over year due to a strategic shift in the entry-level market.

During the fourth quarter, the company reported homes closed of 3,744 units, up 32% year over year. Total home orders increased 52% from the prior-year levels to 3,174 homes, backed by 87% rise in absorptions. High demand was witnessed for Meritage's entry-level LiVE.NOW product that accounted for almost 72% of fourth-quarter orders compared with 55% in the prior-year quarter. South Carolina generated the highest absorptions in the quarter.

Meanwhile, value of net orders increased 51% year over year to $1.2 billion. Quarter-end backlog totaled 4,672 units, up 68% year over year. Value of the backlog also increased 65% year over year despite 2% fall in ASP.

During the fourth quarter, home closing gross margin increased 420 basis points (bps) to 24% from 19.8% reported in the year-ago quarter. The improvement stemmed from strategic streamlining of operations, higher ASP’s and home closing volume partially offset by high lumber prices. Selling, general and administrative expenses — as a percentage of home closing revenues — declined 80 bps year over year to 9.3%.

Land closing revenues amounted to $7.8 million, down 98% from $33.1 million in the year-ago quarter.

Financial Services: The segment’s revenues increased 21% from the prior-year quarter’s level to $5.8 million.

Balance Sheet

As of Dec 31, 2020, cash and cash equivalents totaled $745.6 million compared with $319.5 million as on Dec 31, 2019.

At quarter-end, the company had nearly 55,500 total lots owned or under control compared with 41,400 at the end of fourth-quarter 2019.

Total debt to capital at the end of the quarter was 30.3% compared with 34% at 2019-end. Net debt to capital declined to 10.5% from 26.2% on Dec 31, 2019.

2020 Highlights

In 2020, home closing gross margin improved 310 bps to 22.0% compared with 18.9% in 2019.

SG&A expenses (as a percentage of home closing revenues) improved 90 bps to 10.0% in 2020 compared with 10.9% in 2019.

Total home closing revenues in 2020 came in at $4,464.4 million compared with $3,604.6 million in 2019.

2021 Guidance

For 2021, Meritage Homes expects 11,500-12,500 home closings with anticipated revenues in the range of $4.2-$4.6 billion. Also, it projects home closing gross margins around 22-23% for 2021.

Meanwhile, 2021 earnings per share are projected in the range of $10.50-$11.50. However, the Zacks Consensus Estimate for earnings in 2021 is pegged at $12.72 per share.

Zacks Rank & Peer Releases

Meritage Homes currently has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

KB Home KBH reported fourth-quarter fiscal 2020 (ended Nov 30, 2020) results, with earnings and revenues topping the Zacks Consensus Estimate on solid housing gross margin.

Lennar Corporation LEN — currently sporting a Zacks Rank #1 — reported better-than-expected results for fourth-quarter fiscal 2020 (ended Nov 30, 2020). The quarterly results benefited from robust housing market fundamentals backed by low interest rates and persistent undersupply of new as well as existing inventory. Also, solid execution of homebuilding and financial services businesses added to its bliss.

D.R. Horton, Inc. DHI reported better-than-expected results for first-quarter fiscal 2021, with earnings and revenues beating the Zacks Consensus Estimate. Notably, the quarterly results reflect solid home closings and net sales orders, thereby improving on a year-over-year basis.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by referendums and legislation, this industry is expected to blast from an already robust $17.7 billion in 2019 to a staggering $73.6 billion by 2027. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot stocks we're targeting >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

KB Home (KBH) : Free Stock Analysis Report

Lennar Corporation (LEN) : Free Stock Analysis Report

D.R. Horton, Inc. (DHI) : Free Stock Analysis Report

Meritage Homes Corporation (MTH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research