Mesoblast (MESO) to File Pediatric GVHD Drug BLA, Stock Up

Mesoblast Limited’s MESO shares surged 78.6% on Mar 26, after an encouraging regulatory update from the FDA for its lead product candidate, remestemcel-L, which is being developed for the treatment of pediatric patients with steroid-refractory acute graft versus host disease (SR-aGVHD).

Post additional scrutinization, the FDA informed the company that the available clinical data from the phase III MSB-GVHD001 study of remestemcel-L is adequate to support the resubmission of the biologics license application (BLA) for remestemcel-L to treat pediatric patients with SR-aGVHD.

Mesoblast is currently gearing up to file the BLA resubmission during the second quarter of 2024, seeking to address all remaining product characterization issues.

Presently, there are also no approved therapies in the United States for patients under 12 years of age suffering from aGvHD, which provides MESO with a significant market opportunity, subject to the FDA approval of the regulatory filing for remestemcel-L in this indication.

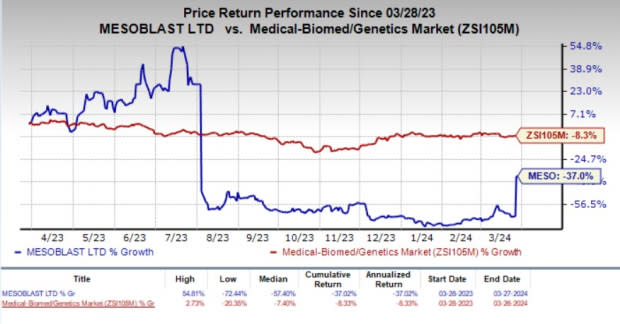

In the past year, shares of MESO have plunged 37% compared with the industry’s 8.5% decline.

Image Source: Zacks Investment Research

We remind the investors that Mesoblast has previously been denied marketing approval by the FDA for remestemcel-L twice in the treatment of pediatric SR-aGvHD. The regulatory body argued that there were deficiencies in clinical and manufacturing data, asking for more data to support marketing approval of remestemcel-L in this indication, including potency assay or clinical data.

The company has also partnered with the Blood and Marrow Transplant Clinical Trials Network (BMT CTN) to develop a pivotal phase III study of remestemcel-L to treat adults with SR-aGVHD.

The BMT CTN is a body formed with a conglomeration of centers that collectively conduct approximately 80% of all U.S. allogeneic blood and marrow transplants. The BMT CTN is funded by the United States National Institutes of Health.

The planned pivotal late-stage study of remestemcel-L will evaluate the candidate in patients aged 12 years and older who are refractory to both corticosteroids and a second-line agent, such as Incyte Corporation’s INCY Jakafi (ruxolitinib). There are currently no approved therapies for such a patient population.

MESO is also currently developing remestemcel-L in mid to late-stage studies in two additional indications, such as inflammatory bowel disease and acute respiratory distress syndrome. Another product candidate, rexlemestrocel-L, is being developed for advanced chronic heart failure and chronic low back pain.

Jakafi, Incyte’s lead drug, is a first-in-class JAK1/JAK2 inhibitor. It is currently the only approved treatment of SR-aGvHD in adult and pediatric patients aged 12 years or older in the United States. INCY has a collaboration agreement with Swiss pharma giant Novartis NVS for Jakafi. Notably, Jakafi is marketed by Incyte in the United States and by Novartis as Jakavi outside the country.

Incyte’s Jakafi was initially approved in the United States for the treatment of patients with polycythemia vera (PV), who have had an inadequate response to or are intolerant to hydroxyurea. It is also approved for the treatment of patients with intermediate or high-risk myelofibrosis (MF), including primary MF, post-PV MF and post-essential thrombocythemia MF.

Mesoblast Limited Price and Consensus

Mesoblast Limited price-consensus-chart | Mesoblast Limited Quote

Zacks Rank and Stock to Consider

Mesoblast currently has a Zacks Rank #4 (Sell).

A better-ranked stock worth mentioning is ADMA Biologics ADMA, sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 30 days, the Zacks Consensus Estimate for ADMA Biologics’ 2024 earnings per share (EPS) has increased from 22 cents to 30 cents. During the same period, the estimate for ADMA’s 2025 EPS has increased from 32 cents to 50 cents. In the past year, shares of ADMA have surged 102.5%.

ADMA beat estimates in three of the trailing four quarters and matched in one, delivering an average earnings surprise of 85%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Novartis AG (NVS) : Free Stock Analysis Report

Incyte Corporation (INCY) : Free Stock Analysis Report

ADMA Biologics Inc (ADMA) : Free Stock Analysis Report

Mesoblast Limited (MESO) : Free Stock Analysis Report