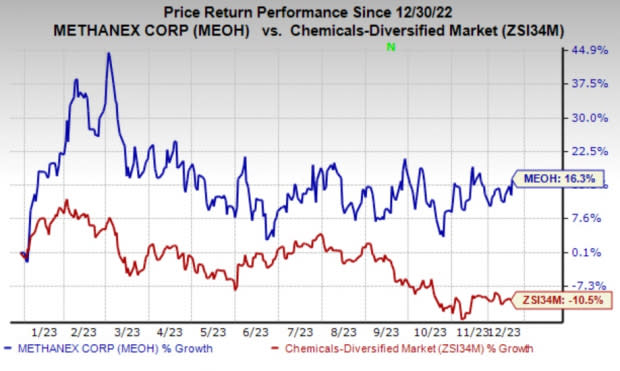

Methanex (MEOH) Shares Up 16% YTD: What's Driving the Stock?

Methanex Corporation’s MEOH shares have rallied 16.3% year to date. The stock outperformed the industry’s fall of 10.5% over the same time frame.

Image Source: Zacks Investment Research

Let’s look at the factors driving this Zacks Rank #2 (Buy) stock.

What’s Going in Methanex’s Favor?

Methanex is benefiting from an increase in methanol demand, which is attributed to the improved market environment and heightened activity in specific sectors, as witnessed during the third quarter. The company recorded a surge in demand in China, fueled by a growing interest in fuel applications. The Methanol-to-Olefins (MTO) sector also experienced improved demand dynamics, with several MTO plants commencing operations in the quarter.

Methanex made significant progress on the Geismar 3 project, aligning seamlessly with the company's outlined plan. This strategic initiative is expected to enhance Methanex's asset portfolio, future cash generation and deliver long-term value to shareholders. The effective management of potential risks is emphasized, with major equipment already on-site, addressing concerns related to supply chain disruptions and inflation.

The projected capital expenditures for the Geismar 3 project are estimated to be between $1.25 billion and $1.3 billion. Additional financial outlays of $140-$190 million have already been secured through available cash reserves. MEOH is optimistic about its robust liquidity position. It anticipates using its strong cash flow generation to fund the Geismar 3 project, with an expectation of timely completion within budget.

The company's proactive approach to capitalizing on rising methanol demand and the strategic advancement of the Geismar 3 project positions it favorably for sustained growth.

With a positive trajectory, the consensus estimate for earnings in the current year has been revised upward by 7% in the past 60 days. The Zacks Consensus Estimate for 2023 earnings is pegged at $2 per share.

Methanex Corporation Price and Consensus

Methanex Corporation price-consensus-chart | Methanex Corporation Quote

Zacks Rank & Other Key Picks

Some other top-ranked stocks in the Basic Materials space are Axalta Coating Systems Ltd. AXTA, sporting a Zacks Rank #1 (Strong Buy), and Hawkins, Inc HWKN and Alamos Gold Inc. AGI, each carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for AXTA’s current-year earnings is pegged at $1.58, indicating year-over-year growth of 6.8%. AXTA beat the Zacks Consensus Estimate in three of the last four quarters and missed one, with the average earnings surprise being 6.7%. The company’s shares have increased 29.9% in the past year.

The Zacks Consensus Estimate for HWKN’s current-year earnings has been revised upward by 1.8% in the past 60 days. HWKN beat the Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 27.5% on average. The stock has rallied around 71.2% in a year.

The consensus estimate for Alamos’ current fiscal year earnings is pegged at 53 cents, indicating a year-over-year surge of 89.3%. AGI beat the Zacks Consensus Estimate in all of the last four quarters, with the average earnings surprise being 25.6%. The company’s shares have surged 47.4% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Methanex Corporation (MEOH) : Free Stock Analysis Report

Alamos Gold Inc. (AGI) : Free Stock Analysis Report

Axalta Coating Systems Ltd. (AXTA) : Free Stock Analysis Report

Hawkins, Inc. (HWKN) : Free Stock Analysis Report