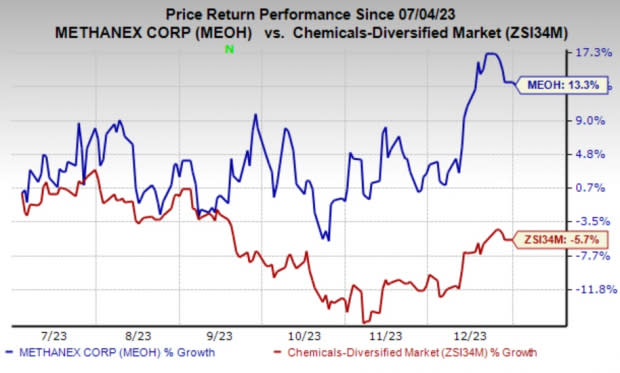

Methanex's (MEOH) Shares Rise 13% in 6 Months: Here's Why

Methanex Corporation’s MEOH shares have gained 13.3% in the last six months. The stock has also outperformed the industry’s fall of 5.7% over the same time frame. The company has topped the S&P 500’s nearly 7% rise over the same period.

Image Source: Zacks Investment Research

Let’s look at the factors driving this Zacks Rank #3 (Hold) stock.

What’s Going in Methanex’s Favor?

During the third quarter, Methanex observed an increase in methanol demand, attributed to an improved market environment and heightened activity in specific sectors. The company specifically noted a substantial surge in demand in China, driven by a growing interest in fuel applications. Methanol-to-Olefins (MTO) also experienced improved demand dynamics as several MTO plants commenced operations during the quarter.

A significant highlight for Methanex was the commendable progress achieved on the Geismar 3 project, which aligned seamlessly with the company's outlined plan. This strategic initiative is expected to enhance Methanex's asset portfolio and future cash generation, delivering long-term value to shareholders. The effective management of potential risks was underscored, with major equipment already on-site, mitigating concerns related to supply chain disruptions and inflation.

The projected capital expenditure for the Geismar 3 project is estimated to be in the range of $1.25-$1.3 billion. Additional financial outlays of $140-$190 million have already been secured through available cash reserves. Methanex expresses confidence in its robust liquidity position and anticipates utilizing its strong cash flow generation to fund the Geismar 3 project, expecting timely completion within budget.

In terms of shareholder value, Methanex returned $12 million during the third quarter through regular dividends, demonstrating the company's commitment to delivering returns to investors. Closing the quarter with $529 million in cash or approximately $510 million excluding non-controlling interests and with an undrawn $300-million revolving credit facility, MEOH maintains financial flexibility to navigate evolving market conditions.

Methanex's proactive approach to capitalizing on rising methanol demand and the strategic advancement of the Geismar 3 project positions it favorably for sustained growth.

In the third quarter, Methanex exceeded expectations by reporting earnings of 2 cents per share against the Zacks Consensus Estimate of a loss of 8 cents. The company exceeded bottom-line forecasts in each of the past four quarters, showcasing an impressive earnings surprise of 53.4% on average.

The Zacks Consensus Estimate for 2023 earnings is currently pegged at $2.05. The consensus estimate for current-year earnings has been revised upward by 6.7% in the past 60 days.

Methanex Corporation Price and Consensus

Methanex Corporation price-consensus-chart | Methanex Corporation Quote

Zacks Rank & Key Picks

Some better-ranked stocks in the Basic Materials space are Centrus Energy Corp. LEU, sporting a Zacks Rank #1 (Strong Buy), and Axalta Coating Systems Ltd. AXTA and Quaker Chemical Corporation KWR, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for LEU’s current-year earnings has been revised upward by 30.5% in the past 60 days. LEU beat the Zacks Consensus Estimate in all of the last four quarters, with the average earnings surprise being 47.7%. The company’s shares have increased 60.2% in the past year.

The consensus estimate for AXTA’s current-year earnings is pegged at $1.58, indicating year-over-year growth of 6.8%. AXTA beat the Zacks Consensus Estimate in three of the last four quarters and missed one, with the average earnings surprise being 6.7%. The company’s shares have increased 26.3% in the past year.

Quaker Chemicalhas a projected earnings growth rate of 28.3% for the current year. KWR has a trailing four-quarter earnings surprise of roughly 16.7%, on average. KWR shares have gained 25.4% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Methanex Corporation (MEOH) : Free Stock Analysis Report

Quaker Houghton (KWR) : Free Stock Analysis Report

Axalta Coating Systems Ltd. (AXTA) : Free Stock Analysis Report

Centrus Energy Corp. (LEU) : Free Stock Analysis Report