Methode Electronics Inc (MEI) Faces Net Loss in Q3 Despite Positive Free Cash Flow

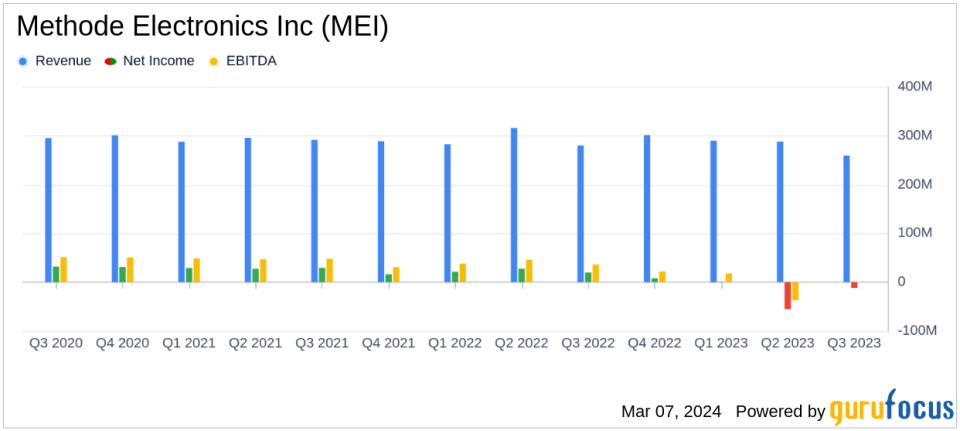

Net Sales: Decreased to $259.5 million from $280.1 million in the same quarter last year.

Net Loss: Reported a net loss of $11.6 million, or $0.33 per diluted share.

Free Cash Flow: Achieved a positive free cash flow of $12.2 million.

Stock Repurchase: Company repurchased 130,592 shares for $3.0 million.

Debt Position: Debt increased to $331.3 million, with net debt rising to $208.4 million.

Guidance: Forward-looking guidance has been suspended due to market and operational challenges.

On March 7, 2024, Methode Electronics Inc (NYSE:MEI), a global supplier of custom-engineered solutions for various applications, released its 8-K filing detailing the financial results for the third quarter of fiscal year 2024, which ended January 27, 2024. The company reported a decrease in net sales to $259.5 million, down from $280.1 million in the same quarter of the previous fiscal year. The net loss stood at $11.6 million, or $0.33 per diluted share, a significant downturn from the net income of $19.9 million, or $0.54 per diluted share, reported in the prior year's comparable quarter.

Company Overview

Methode Electronics Inc specializes in component and subsystem devices using electrical, radio remote control, electronic, wireless, and sensing technologies. The company operates through various segments including Automotive, Industrial, Interface, and Medical. The Automotive segment supplies electronic and electro-mechanical devices to automobile manufacturers, while the Industrial segment offers solutions like external lighting and industrial safety radio remote controls. The Interface segment provides interface solutions, and the Medical segment focuses on pressure injury prevention technologies.

Financial Performance and Challenges

The company's performance was notably impacted by auto program roll-offs and weakened demand in the e-bike and data center markets. Despite electric and hybrid vehicle applications accounting for 19 percent of net sales, the overall sales volume decreased. Operational inefficiencies in the Automotive segment, including costs from program launch delays, contributed to the net loss. However, Methode Electronics managed to return to positive free cash flow during the quarter.

Strategic Actions and Management Commentary

President and CEO Avi Avula highlighted the challenges faced by the company and outlined a strategy to restore profitability. This includes reducing hard costs, disposing of non-critical assets, and improving working capital management. Avula emphasized the company's strong foundation and potential for future success.

"Given ongoing operational inefficiencies, the looming market headwinds in EV, and my recent appointment as CEO, we have suspended guidance. Right now, my primary goal is to restore profitability, starting with an intensive review of and quick actions to reduce hard costs, including items like headcount and various discretionary expenses, and to dispose of non-critical assets. We will also work to reduce working capital, particularly inventory, and increase free cash flow." - Avi Avula, President and CEO

Financial Highlights

The decrease in net sales was mainly attributed to lower Automotive segment sales across all geographic regions, partially offset by the Nordic Lights acquisition and favorable foreign currency translation. Selling and administrative expenses increased slightly due to the acquisition, while loss from operations was $3.0 million, compared to income from operations of $27.3 million in the same quarter of the previous fiscal year.

Debt levels rose to $331.3 million, with net debt at $208.4 million, primarily due to working capital investment and increased property, plant, and equipment purchases. The company also repurchased shares and entered into an amendment to its credit agreement to ensure compliance with debt covenants.

As the company navigates through these challenges, it has suspended forward-looking guidance and plans to provide an update on its business review in the upcoming fiscal fourth quarter results announcement.

For more detailed financial information and the full earnings report, investors and interested parties are encouraged to visit Methode Electronics Inc's website or access the full 8-K filing.

Explore the complete 8-K earnings release (here) from Methode Electronics Inc for further details.

This article first appeared on GuruFocus.