MetLife Inc (MET) Reports Mixed Full Year and Q4 2023 Results Amid Market Challenges

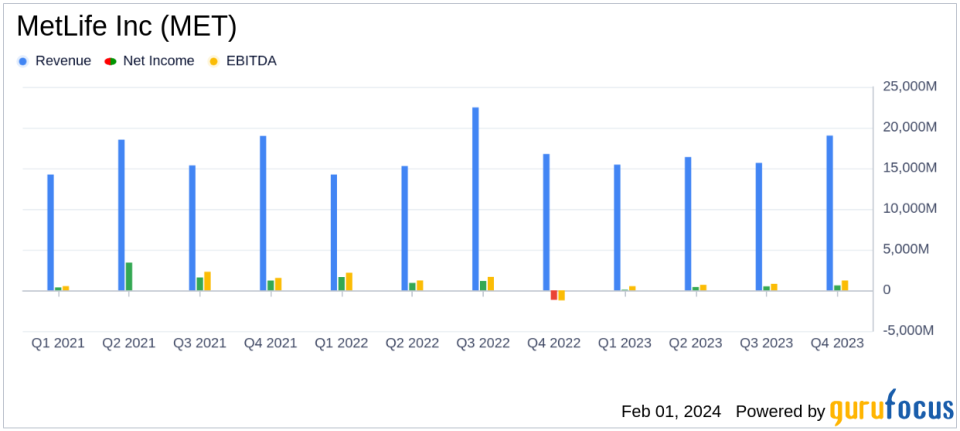

Net Income: Full year net income fell to $1.4 billion, a 73% decrease from the previous year.

Adjusted Earnings: Full year adjusted earnings slightly down at $5.5 billion, with a 1% increase in adjusted EPS to $7.25.

Revenue: Full year premiums, fees, and other revenues decreased by 8% to $51.961 billion.

Book Value: Book value per share increased by 7% to $35.85, while book value excluding AOCI dropped by 1%.

Return on Equity (ROE): Full year ROE declined to 5.4%, with adjusted ROE at 13.6%.

Liquidity: Holding company cash and liquid assets stood at $5.2 billion, above the target buffer.

On January 31, 2024, MetLife Inc (NYSE:MET) released its 8-K filing, disclosing its financial performance for the full year and fourth quarter of 2023. The results highlighted a significant drop in net income for the full year, down to $1.4 billion from $5.1 billion in the previous year, attributed to market risk benefit remeasurement losses and other factors. Despite this, adjusted earnings per share saw a slight increase.

MetLife, a leading global provider of insurance and financial services, operates through segments including U.S., Asia, Latin America, EMEA, and MetLife Holdings. The U.S. segment, which includes group benefits and retirement solutions, contributes the largest portion of earnings at approximately 41%. The Asia segment, with significant contributions from Japan, India, China, and Bangladesh, accounts for roughly 28% of earnings. The company also maintains strong market positions in Mexico and Chile within the Latin America segment, contributing around 6% of earnings, while EMEA and MetLife Holdings segments contribute around 5% and 20%, respectively.

Financial Performance and Challenges

MetLife's full year adjusted earnings were $5.5 billion, a slight decrease from $5.8 billion in the previous year. However, when excluding total notable items, adjusted earnings were $5.6 billion, a modest increase from $5.7 billion in 2022. The company's book value per share increased by 7% to $35.85, but when excluding AOCI other than FCTA, there was a 1% decrease to $53.75 per share. The full year ROE stood at 5.4%, with an adjusted ROE of 13.6%.

The fourth quarter results showed a net income of $574 million, a 63% decrease from the fourth quarter of 2022. Adjusted earnings for the quarter were $1.4 billion, an 8% increase from the same period in the previous year. The adjusted ROE, excluding AOCI other than FCTA, was 13.8%, with an adjusted ROE, excluding notable items and AOCI other than FCTA, of 14.6%.

MetLife President and CEO Michel Khalaf commented on the results, stating,

The positive momentum in our market-leading portfolio of businesses drove MetLife's strong fourth-quarter and full-year 2023 results,"

and highlighted the company's strong capital and liquidity position.

Key Financial Metrics

The company's performance is underscored by several key metrics:

Net investment income increased by 20% to $5.4 billion in Q4 2023, driven by higher interest rates and fair value increases in certain securities.

Premiums, fees, and other revenues for Q4 2023 rose by 26% to $13.7 billion, with a full year decrease of 8% to $51.961 billion.

The expense ratio for the full year was 18.7%, with a direct expense ratio, excluding notable items related to direct expenses and PRT, of 12.2%.

These metrics are crucial for understanding MetLife's financial health and operational efficiency, particularly in the context of the insurance industry where investment income and expense management are key drivers of profitability.

Analysis and Outlook

While MetLife faced challenges in 2023, including market volatility and remeasurement losses, the company's adjusted earnings per share growth and strong liquidity position demonstrate resilience. The increase in book value per share indicates a solid balance sheet, although the decrease in book value excluding AOCI suggests some underlying pressures.

MetLife's diverse global investment portfolio and strategic positioning in key markets provide a foundation for future growth. The company's focus on maintaining strong capital and liquidity will be essential in navigating the uncertain economic environment and continuing to deliver value to shareholders.

For more detailed information, investors and stakeholders are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from MetLife Inc for further details.

This article first appeared on GuruFocus.