MetLife (MET) Expands Partnership With DentalInsurance.com

MetLife Inc MET recently expanded its relationship with DentalInsurance.com to continue marketing its dental insurance plans. DentalInsurance.com is a leading online dental insurance provider offering comparable insurance policies to individuals.

MET, a leading commercial dental insurer, offers quality products with a variety of affordable choices to meet a person’s oral health requirements. This move bodes well for MET as more of its products will be visible on the DentalInsurance.com website, boosting sales.

MET offers dental insurance in the United States through its group benefits segment. This partnership will boost the group benefits segment due to more market penetration. MetLife aims to provide its customers with exceptional service experience with DentalInsurance.com, which is known to provide impeccable customer service.

MET’s potential customers will benefit from the ease of analyzing different plans and making a choice. MetLife offers 521,000 plus access points in its network and 30-40% lower negotiated fees than average, making its products attractive. DentalInsurance.com, on the other hand, would benefit from positive reviews given by repeat customers and improve its business.

DentalInsurance.com and MetLife would continue to work together to further enhance customer experience by developing customer-friendly dental plans in the future. DentalInsurance.com’s platform and MET’s experience should help both companies achieve their objectives in the dental insurance market.

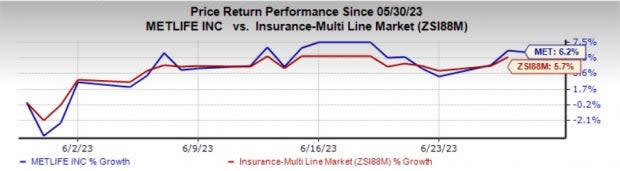

Price Performance

Shares of MetLife have gained 6.2% in the past month compared with the industry’s growth of 5.7%.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

MetLife currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the Multi-line Insurance space are Assurant, Inc. AIZ, Old Republic International Corporation ORI and Enact Holdings, Inc. ACT. Each of these companies currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Assurant’s bottom line outpaced estimates in three of the trailing four quarters and missed once. The average earnings surprise is 18.2%.

The Zacks Consensus Estimate for AIZ’s 2023 earnings indicates a 22.1% rise, while the same for revenues suggests 2.7% growth from the prior-year reported figures.

Old Republic’s bottom line outpaced estimates in each of the trailing four quarters. The average earnings surprise is 29.9%.

The Zacks Consensus Estimate for ORI’s 2024 earnings indicates a 4.2% rise, while the same for revenues suggests 2.4% growth from the prior-year estimated figures.

The bottom line of Enact Holdings outpaced the Zacks Consensus Estimate in three of the last four quarters and missed once, the average surprise being 28.6%.

The consensus mark for ACT’s 2023 earnings has moved 8.9% north in the past 60 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MetLife, Inc. (MET) : Free Stock Analysis Report

Assurant, Inc. (AIZ) : Free Stock Analysis Report

Old Republic International Corporation (ORI) : Free Stock Analysis Report

Enact Holdings, Inc. (ACT) : Free Stock Analysis Report