MetLife (MET) & Nayya Unite to Enhance Insurance Offerings

MetLife, Inc. MET recently collaborated with Nayya to offer its unique benefits engagement and decision support services to employer clients. Employers with more than 1,000 U.S. employees can use Nayya’s services.

This move bodes well for MetLife as Nayya’s solution powered by artificial intelligence will enhance its offerings to employers. Employees will gain from improved benefits experience and be able to choose benefits that suffice their individual needs. Moreover, this strategic partnership will help further solidify MET’s presence in the United States and position the company for long-term growth.

Per the latest U.S. Employee Benefit Trends Study research, 45% of employees do not understand portions of benefits packages. Moreover, 62% of employees agreed that a complete understanding of their benefits will give them a sense of stability. As MET tries to help employees understand their benefits and remain educated about using them, it is expected to increase employee loyalty toward its employees. This would, in turn, help with client retention in the future.

This partnership comes at an opportune time when it is necessary for employees to demolish the barriers to understanding how to use their benefits for their financial goals and personal needs. Nayya will be providing educational guidance that will help increase the use of employer-provided benefits. The company strives to deliver a better experience to employees by offering Nayya through Upwise at no cost to companies. MET aims to combine best-in-class products with the best experience to enhance its insurance offerings.

MetLife has been utilizing its exceptional capabilities and solid financial position to constantly pursue buyouts and partnerships for unveiling revolutionary products and services throughout the globe.

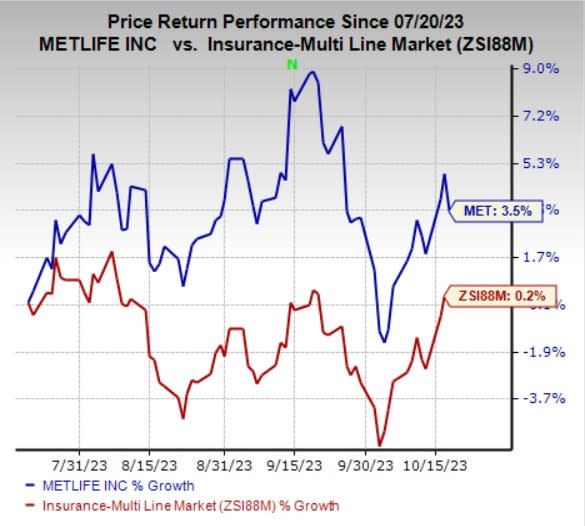

Shares of MetLife have gained 3.5% in the past three months compared with the industry’s 0.2% growth. MET currently carries a Zacks Rank #3 (Hold).

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks in the insurance space are Arch Capital Group Ltd. ACGL, Everest Group, Ltd. EG and Primerica, Inc. PRI. Each stock currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The bottom line of Arch Capital outpaced estimates in each of the last four quarters, the average surprise being 26.8%. The Zacks Consensus Estimate for ACGL’s 2023 earnings suggests an improvement of 42.5%, while the consensus estimate for revenues indicates a 30.7% rise from the respective prior-year reported figures. The consensus mark for ACGL’s 2023 earnings has moved 3.1% north in the past 30 days.

Everest Group’s bottom line outpaced estimates in three of the trailing four quarters and missed the mark once, the average surprise being 17.4%. The Zacks Consensus Estimate for EG’s 2023 earnings indicates an 88.7% surge, while the consensus estimate for revenues indicates an 18.2% rise from the respective prior-year reported figures. The consensus mark for EG’s 2023 earnings has moved 7.1% north in the past 30 days.

The bottom line of Primerica outpaced the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 6.5%. The consensus estimate for PRI’s 2023 earnings suggests a 37.2% improvement, while the consensus estimate for revenues indicates a 2.9% rise from the respective prior-year reported figures. The consensus mark for PRI’s 2023 earnings has moved 0.4% north in the past 30 days.

Shares of Arch Capital, Everest Group and Primerica have gained 18.4%, 8.1% and 15.4%, respectively, in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MetLife, Inc. (MET) : Free Stock Analysis Report

Primerica, Inc. (PRI) : Free Stock Analysis Report

Arch Capital Group Ltd. (ACGL) : Free Stock Analysis Report

Everest Group, Ltd. (EG) : Free Stock Analysis Report