Mettler-Toledo International Inc (MTD) Faces Sales Decline and EPS Drop in Q4 2023

Reported Sales: Declined by 12% year-over-year in Q4 2023.

Net Earnings Per Share (EPS): Decreased to $8.52 in Q4 2023 from $11.86 in the prior-year period.

Adjusted EPS: Fell by 22% to $9.40 compared to $12.10 in Q4 of the previous year.

Full-Year Sales: Dropped by 3% to $3.788 billion in 2023.

Full-Year Adjusted EPS: Declined by 4% to $38.03 from $39.65 in 2022.

Outlook: Q1 2024 sales expected to decline by 4-6%, with Adjusted EPS forecasted to fall by 11-15%.

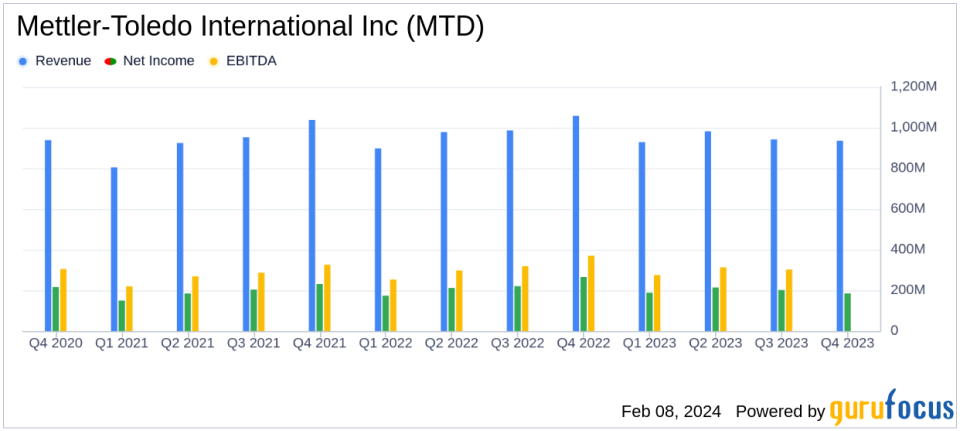

Mettler-Toledo International Inc (NYSE:MTD) released its 8-K filing on February 8, 2024, revealing a challenging fourth quarter in 2023 with a significant decline in sales and earnings per share. The supplier of precision instruments and services, which leads the market in weighing instrumentation and holds a strong global position in laboratory balances, reported a 12% decline in reported sales and a 22% decrease in adjusted EPS compared to the same quarter in the previous year.

President and CEO Patrick Kaltenbach attributed the disappointing results to shipping delays from an external European logistics provider, which are expected to be largely recovered in Q1 2024. Excluding these delays, the company's performance met expectations despite the tough market conditions. Kaltenbach emphasized the company's effective cost control initiatives and strong cash flow generation during the quarter and the full year.

Financial Performance Breakdown

By region, reported sales decreased across the board with the Americas down by 6%, Europe by 11%, and Asia/Rest of World by 19%. Adjusted operating profit also saw a decline, dropping 21% to $281.8 million in Q4 2023. For the full year, total reported sales fell by 3% to $3.788 billion, with local currency sales also decreasing by 3% as currency impact was neutral for the year.

Adjusted operating profit for the full year decreased by 3% to $1.152 billion. The balance sheet reflects a decrease in cash and cash equivalents from $95.966 million at the end of 2022 to $69.807 million at the end of 2023. Total assets also saw a reduction from $3.492 billion to $3.355 billion in the same period.

Despite the downturn, Mettler-Toledo's management is preparing for persistent challenging market conditions in the first half of 2024, while remaining ready to capitalize on growth opportunities. The company continues to invest in next-generation products and solutions, enhancing its competitive position for when market conditions improve.

Forward-Looking Statements and Outlook

The company's outlook for Q1 2024 includes an anticipated decline in local currency sales of approximately 4% to 6%, with adjusted EPS forecasted to decrease by 11% to 15%. For the full year 2024, management expects local currency sales to increase by 1% to 2%, with adjusted EPS projected to grow by 4% to 6%. However, management cautions that market conditions are uncertain and subject to rapid changes.

Mettler-Toledo's commitment to innovation and strategic investments positions the company to navigate through economic headwinds and leverage market recovery when it occurs. Investors and stakeholders are advised to monitor the company's performance closely as it adapts to the evolving business environment.

For more detailed information, investors are encouraged to review the full 8-K filing and listen to the conference call scheduled for the morning of February 9th.

Explore the complete 8-K earnings release (here) from Mettler-Toledo International Inc for further details.

This article first appeared on GuruFocus.