Mettler-Toledo (MTD) Beats on Q2 Earnings, Issues Weak Outlook

Mettler-Toledo International, Inc. MTD reported second-quarter 2023 adjusted earnings of $10.19 per share, which beat the Zacks Consensus Estimate by 2%. The bottom line also improved by 9% on a year-over-year basis.

Net sales of $982.12 million were up 0.4% on a reported basis and 2% on a currency-neutral basis from the year-ago quarter’s respective readings. The figure lagged the Zacks Consensus Estimate of $1 billion.

Top-line growth was driven by solid momentum across Industrial and Food Retail segments.

However, the company witnessed sluggishness in its Laboratory segment due to weak market conditions.

Shares of Mettler-Toledo plunged 6.3% in the after-hours trading session, primarily due to lower-than-expected guidance for the third-quarter 2023 as well as the full year.

The company remains apprehensive due to uncertainties in the global economy, dynamic market conditions, rising inflationary pressure and fears of recession in many countries.

MTD has lost 6.7% on a year-to-date basis compared with the industry’s decline of 9%.

We believe portfolio strength, cost-cutting efforts, margin and productivity initiatives, as well as robust sales and marketing strategies, are expected to remain tailwinds for the company.

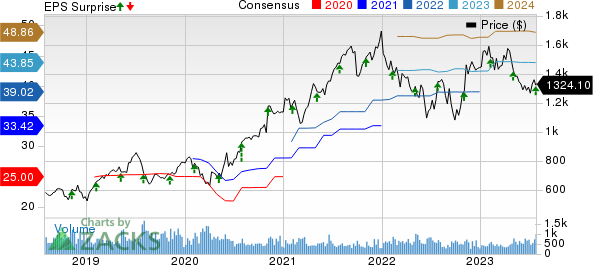

Mettler-Toledo International, Inc. Price, Consensus and EPS Surprise

Mettler-Toledo International, Inc. price-consensus-eps-surprise-chart | Mettler-Toledo International, Inc. Quote

Top Line in Detail

By Segments: MTD reports revenues under three segments, namely Laboratory Instruments, Industrial Instruments and Food Retail, which accounted for 54%, 40% and 6%, respectively, of net sales in the second quarter. The Industrial and Food Retail segments witnessed year-over-year improvements of 6% and 17%, respectively, in the quarter under review.

However, the Laboratory segment witnessed a decline of 3% year over year.

By Geography: Total sales from the Americas, Europe and Asia/Rest of the World contributed 40%, 25% and 35%, respectively, to net sales in the second quarter. Sales in the Americas and Asia/Rest of the World went up 1% and 4%, respectively, on a year-over-year basis. Sales in Europe remained flat year over year.

Operating Results

The gross margin was 59.4%, expanding 100 basis points (bps) year over year.

Research & development (R&D) expenses were $47.2 million, up 7.3% from the year-ago quarter’s figure. Selling, general & administrative (SG&A) expenses decreased 5.6% year over year to $228.6 million.

As a percentage of sales, R&D expenses expanded by 30 bps year over year to 4.9%. SG&A expenses contracted by 150 bps year over year to 23.3%.

The adjusted operating margin was 31.3%, which expanded 210 bps from the prior-year quarter’s level.

Balance Sheet & Cash Flow

As of Jun 30, 2023, Mettler-Toledo’s cash and cash equivalent balance was $83.6 million, down from $89.1 million as of Mar 31, 2023.

Long-term debt was $2.045 billion at the end of second-quarter compared with $2.015 billion at the end of the first quarter.

Mettler-Toledo generated $266.8 million in cash from operating activities in the reported quarter, up from $153.3 million in the previous quarter. Free cash flow was $260.5 million in the reported quarter.

Guidance

For third-quarter 2023, Mettler-Toledo anticipates sales to decline by 3%-4% in local currency from the year-ago quarter’s reported figure. The Zacks Consensus Estimate for third-quarter sales is pegged at $1.05 billion.

Adjusted third-quarter earnings are anticipated to be $9.55-$9.85 per share, implying a 3-6% fall from the year-ago quarter’s reported number, which includes a foreign-currency headwind of 3%. The Zacks Consensus Estimate for earnings is pegged at $11.51 per share.

For 2023, Mettler-Toledo revised its sales growth expectations downward. It now anticipates sales growth in local currency in the band of 0%-1% from the year-earlier tally. Previously, it was projected at 5%. The Zacks Consensus Estimate for 2023 sales is pegged at $4.14 billion.

The company also lowered its guidance for adjusted EPS from $43.65-$43.95 to $40.30-$41.20. The new guided range suggests growth of 2-4% from the year-ago reported number. The Zacks Consensus Estimate for the same is pegged at $43.85.

Zacks Rank & Stocks to Consider

Currently, Mettler-Toledo has a Zacks Rank #4 (Hold).

Some better-ranked stocks in the broader technology sector are Salesforce CRM, AvidXchange AVDX and Akamai Technologies AKAM. Salesforce and AvidXchange sport a Zacks Rank #1 (Strong Buy), and Akamai Technologies carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Salesforce shares have gained 70.7% in the year-to-date period. The long-term earnings growth rate for CRM is projected at 19.25%.

AvidXchange shares have increased 21.1% in the year-to-date period. The long-term earnings growth rate for AVDX is projected at 22.90%.

Akamai shares have gained 9.5% in the year-to-date period. The long-term earnings growth rate for AKAM is projected at 10%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Salesforce Inc. (CRM) : Free Stock Analysis Report

Akamai Technologies, Inc. (AKAM) : Free Stock Analysis Report

Mettler-Toledo International, Inc. (MTD) : Free Stock Analysis Report

AvidXchange Holdings, Inc. (AVDX) : Free Stock Analysis Report