Meyer Burger Technology (VTX:MBTN shareholders incur further losses as stock declines 22% this week, taking five-year losses to 24%

For many, the main point of investing is to generate higher returns than the overall market. But in any portfolio, there will be mixed results between individual stocks. So we wouldn't blame long term Meyer Burger Technology AG (VTX:MBTN) shareholders for doubting their decision to hold, with the stock down 49% over a half decade. We also note that the stock has performed poorly over the last year, with the share price down 32%. The share price has dropped 52% in three months.

After losing 22% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

View our latest analysis for Meyer Burger Technology

Because Meyer Burger Technology made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last five years Meyer Burger Technology saw its revenue shrink by 35% per year. That's definitely a weaker result than most pre-profit companies report. On the face of it we'd posit the share price fall of 8% compound, over five years is well justified by the fundamental deterioration. We doubt many shareholders are delighted with this share price performance. Risk averse investors probably wouldn't like this one much.

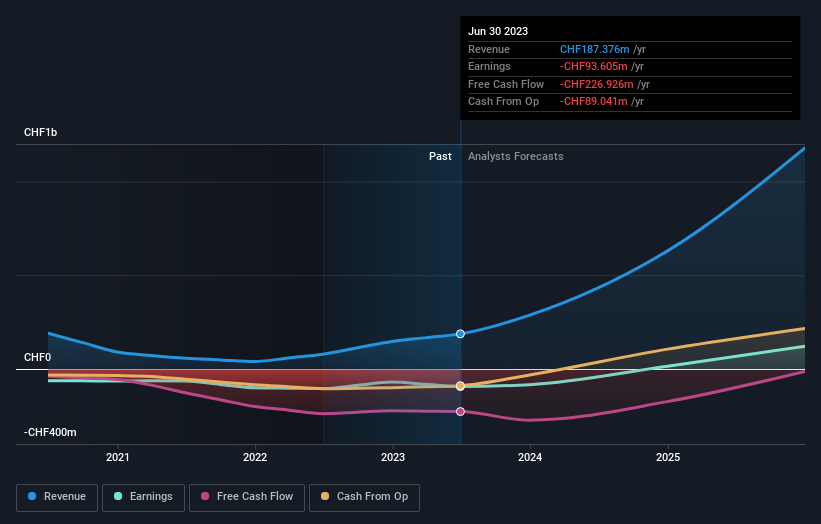

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Meyer Burger Technology is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So it makes a lot of sense to check out what analysts think Meyer Burger Technology will earn in the future (free analyst consensus estimates)

What About The Total Shareholder Return (TSR)?

We've already covered Meyer Burger Technology's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Meyer Burger Technology hasn't been paying dividends, but its TSR of -24% exceeds its share price return of -49%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

While the broader market gained around 5.4% in the last year, Meyer Burger Technology shareholders lost 23%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 4% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Meyer Burger Technology has 2 warning signs (and 1 which shouldn't be ignored) we think you should know about.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swiss exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.