MFP Investors Buys 7 New Holdings

- By David Goodloe

Michael Price (Trades, Portfolio), who runs hedge fund MFP Investors LLC, invested in seven new holdings in the third quarter. Price's estimated net worth is $1.2 billion; MFP Investors has $1.6 billion under management, much of it Price's money.

Warning! GuruFocus has detected 5 Warning Sign with RF. Click here to check it out.

The intrinsic value of RF

His largest purchase was 521,500 shares of Regions Financial Corp. (RF), a financial services company based in Birmingham, Alabama, for an average price of $9.36 per share. The deal had a 0.68% impact on the portfolio.

Richard Pzena (Trades, Portfolio) is Regions Financial's leading shareholder among the gurus with a stake of 27,450,466 shares. The stake is 2.23% of Regions Financial's outstanding shares. Eight other gurus have positions in Regions Financial.

Regions Financial has a price-earnings (P/E) ratio of 16.33, a forward P/E ratio of 14.49, a price-book (P/B) ratio of 1.08 and a price-sales (P/S) ratio of 3.21. GuruFocus gives Regions Financial a Financial Strength rating of 6/10 and a Profitability and Growth rating of 6/10 with return on equity (ROE) of 6.35% that is lower than 65% of the companies in the Global Banks - Regional - US industry and return on assets (ROA) of 0.92% that is higher than 53% of the companies in that industry.

Regions Financial sold for $13.74 per share at market close Friday. The DCF Calculator gives Regions Financial a fair value of $9.1.

The guru bought 85,000 shares of The WhiteWave Foods Co. (WWAV), a packaged food company based in Broomfield, Colorado, for an average price of $55.05 per share. The transaction had a 0.61% impact on the portfolio.

Eric Mindich (Trades, Portfolio) is WhiteWave's leading shareholder among the gurus with a stake of 3,340,905 shares. The stake is 1.89% of WhiteWave's outstanding shares. Four other gurus have positions in WhiteWave.

WhiteWave has a P/E ratio of 49.24, a forward P/E ratio of 34.01, a P/B ratio of 6.90 and a P/S ratio of 2.39. GuruFocus gives WhiteWave a Financial Strength rating of 5/10 and a Profitability and Growth rating of 7/10 with ROE of 15.45% that is higher than 75% of the companies in the Global Packaged Foods industry and ROA of 4.63% that is higher than 57% of the companies in that industry.

WhiteWave sold for $55.19 per share Friday. The DCF Calculator gives WhiteWave a fair value of $11.99.

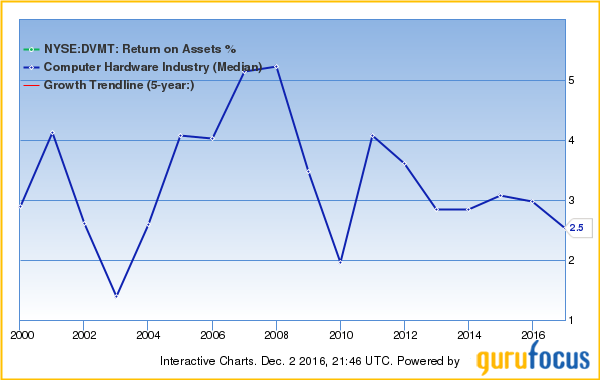

The guru invested in 91,892 shares of Dell Technologies Inc. (DVMT), a Texas-based information technology company, for an average price of $46.83 per share. The deal had a 0.58% impact on the portfolio.

Dodge & Cox is Dell Technologies' leading shareholder among the gurus with a stake of 10,811,775 shares. The stake is 4.85% of Dell Technologies' outstanding shares. Nineteen other gurus have positions in Dell Technologies.

Dell Technologies has a P/B ratio of 5.68. GuruFocus gives Dell Technologies a Financial Strength rating of 3/10 and a Profitability and Growth rating of 3/10 with ROE of -20.10% that is lower than 88% of the companies in the Global Computer Systems industry and ROA of -0.63% that is lower than 70% of the companies in that industry.

Dell Technologies sold for $52.75 per share Friday. The DCF Calculator gives Dell Technologies a fair value of $-38.42.

The guru purchased 715,237 shares of Accuride Corp. (ACW), a vehicle parts manufacturer based in Evansville, Indiana, for an average price of $1.78 per share. The transaction had a 0.24% impact on the portfolio.

Jim Simons (Trades, Portfolio) is Accuride's leading shareholder among the gurus with 724,400 shares. The holding is 1.5% of Accuride's outstanding shares. Mario Gabelli (Trades, Portfolio) and Paul Tudor Jones (Trades, Portfolio) also have positions in Accuride.

Accuride has a P/B ratio of 5.10 and a P/S ratio of 0.21. GuruFocus gives Accuride a Financial Strength rating of 3/10 and a Profitability and Growth rating of 5/10 with ROE of -94.65% that is lower than 98% of the companies in the Global Auto Parts industry and ROA of -7.93% that is lower than 92% of the companies in that industry.

Accuride sold for $2.58 per share Friday. The DCF Calculator gives Accuride a fair value of $-5.99.

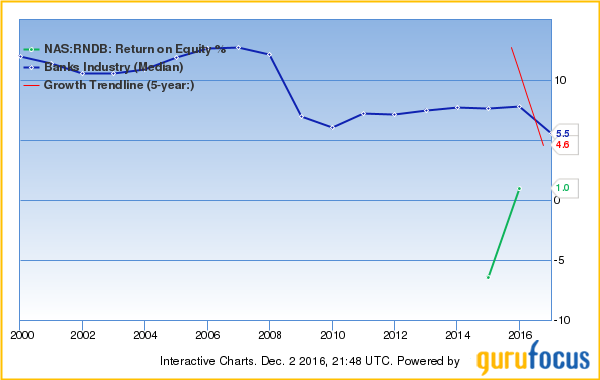

The guru bought 57,200 shares of Randolph Bancorp Inc. (RNDB), the Massachusetts-based holding company for Randolph Savings Bank, for an average price of $12.79 per share. The deal had a 0.1% impact on the portfolio.

Randolph Bancorp has a P/E ratio of 123.49, a P/B ratio of 1.01 and a P/S ratio of 3.28. GuruFocus gives Randolph Bancorp a Financial Strength rating of 5/10 and a Profitability and Growth rating of 3/10 with ROE of 6.30% that is lower than 65% of the companies in the Global Banks - Regional - US industry and ROA of 0.37% that is lower than 78% of the companies in that industry.

Randolph Bancorp sold for $14.62 per share Friday. The DCF Calculator gives Randolph Bancorp a fair value of $1.28.

The guru invested in 53,382 shares of FSB Bancorp Inc. (FSBC), a holding company for First State Bank of Altus, Oklahoma, for an average price of $12.57 per share. The transaction had a 0.09% impact on the portfolio.

FSB Bancorp has a P/E ratio of 59.38, a P/B ratio of 0.88 and a P/S ratio of 3.23. GuruFocus gives FSB Bancorp a Financial Strength rating of 4/10 and a Profitability and Growth rating of 3/10 with ROE of 2.25% and ROA of 0.21% that are lower than 86% of the companies in the Global Banks - Regional - US industry.

FSB Bancorp sold for $14.23 per share Friday. The DCF Calculator gives FSB Bancorp a fair value of $2.46.

The guru also purchased 29,380 shares of Florida-based BKF Capital Group Inc. (BKFG) in the third quarter.

Disclosure: I do not own any stocks mentioned in this article.

Start afree seven-day trialof Premium Membership to GuruFocus.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 5 Warning Sign with RF. Click here to check it out.

The intrinsic value of RF