MGIC Investment Corp (MTG) Reports Strong Q4 and Full Year 2023 Results

Net Income: Q4 net income of $184.5 million, full year net income of $712.9 million.

Adjusted Net Operating Income: Q4 adjusted net operating income of $187.6 million, full year adjusted net operating income of $724.4 million.

New Insurance Written (NIW): $10.9 billion in Q4, reflecting market dynamics.

Insurance in Force (IIF): Reached $293.5 billion, showcasing steady demand for private mortgage insurance.

Return on Equity: Annualized return on equity stood at 15.2% for Q4.

Book Value Per Share: Increased to $18.61, indicating a solid balance sheet.

Capital and Liquidity: Holding company liquidity at $918 million, demonstrating financial resilience.

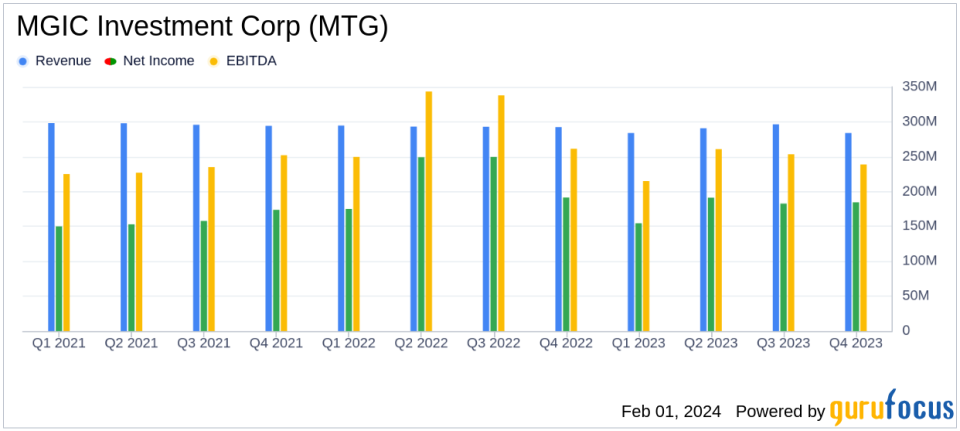

On January 31, 2024, MGIC Investment Corp (NYSE:MTG) released its 8-K filing, announcing its financial results for the fourth quarter and full year of 2023. MGIC, a leading provider of private mortgage insurance and ancillary services, reported a net income of $184.5 million for Q4 and $712.9 million for the full year. The company's adjusted net operating income, a non-GAAP measure, was $187.6 million for Q4 and $724.4 million for the full year, reflecting a disciplined approach to market conditions and a focus on long-term shareholder value.

Performance and Market Position

MGIC's performance in Q4 and throughout 2023 demonstrates the company's ability to navigate a complex market environment. The company's insurance in force (IIF) stood at $293.5 billion, indicating a stable demand for its private mortgage insurance products. The new insurance written (NIW) for Q4 was $10.9 billion, a decrease from Q3, which is reflective of broader market trends and the cyclical nature of the mortgage industry.

Financial Strength and Shareholder Returns

The company's financial achievements, including a strong book value per share of $18.61 and holding company liquidity of $918 million, underscore MGIC's financial strength and capital flexibility. These metrics are particularly important for insurance companies, as they reflect the ability to cover potential claims and return value to shareholders. MGIC's commitment to shareholder returns was evident in its Q4 dividend payment of $0.115 per common share and the repurchase of 7.0 million shares of common stock.

Key Financial Metrics

MGIC's financial statements reveal a solid performance with key metrics such as net premiums earned totaling $226.4 million for Q4 and $952.6 million for the full year. The loss ratio for Q4 was notably favorable at (4.2%), and the underwriting expense ratio stood at 24.6%. The company's annualized return on equity of 15.2% for Q4 highlights its profitability and efficiency in generating shareholder value.

Management Commentary

Tim Mattke, CEO of MTG and Mortgage Guaranty Insurance Corporation (MGIC), commented on the results, stating, "The fourth quarter capped another successful year. In 2023, we again delivered excellent financial results, and returned meaningful capital to our shareholders. During the year, we remained committed to delivering long-term value for our shareholders, disciplined in our approach to the market, and focused on through-the-cycle performance. We enter 2024 with financial strength and capital flexibility, and we are excited for the opportunities that the new year will bring."

Outlook and Strategic Moves

Looking ahead, MGIC is well-positioned for 2024, with strategic reinsurance transactions aligning with its market approach and a focus on reinsuring recent or future NIW. The company's appointment of Michael Thompson to the Board of Directors and the upgrade of MGIC's financial strength and credit rating by S&P to A- reflect confidence in its strategic direction and operational strength.

MGIC's earnings report indicates a company that is not only managing its current challenges effectively but also positioning itself for future opportunities. For value investors and potential members of GuruFocus.com, MGIC's disciplined approach to market conditions and its strong financial metrics make it a company worth considering.

For a detailed analysis of MGIC Investment Corp's financial results and strategic outlook, please visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from MGIC Investment Corp for further details.

This article first appeared on GuruFocus.