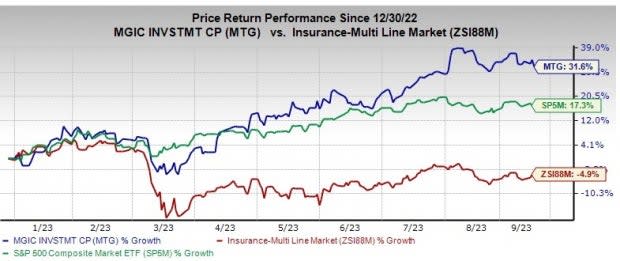

MGIC Investment (MTG) Rises 31.6% YTD: More Room to Run?

Shares of MGIC Investment Corporation MTG have gained 31.6% year to date against the industry's decline of 4.9%. The Zacks S&P 500 composite has surged 17.3% in the said time frame. With a market capitalization of $4.83 billion, the average volume of shares traded in the last three months was 1.9 million.

Image Source: Zacks Investment Research

The rally was largely driven by higher insurance in force, a decline in loss and claims payments, lower delinquency, better housing market fundamentals and prudent capital deployment.

This Zacks Rank #3 (Hold) multi-line insurer has a solid track record of beating earnings estimates in each of the last four quarters, the average being 23.59%.

Will the Bull Run Continue?

The Zacks Consensus Estimate for 2024 earnings per share is pegged at $2.37, indicating a year-over-year increase of 0.1%.

The Zacks Consensus Estimate for 2023 and 2024 revenues is pegged at $1.19 billion and $1.26 billion, indicating a year-over-year increase of 0.5% and 6.4%, respectively.

MGIC Investment has been witnessing an increase in new business written. The insurer expects new business, combined with increasing annual persistency, to result in the continued growth of the insurance-in-force portfolio.

MTG has been witnessing a declining pattern of claim filings. Thus, paid claims are likely to decrease further. A decline in loss and claims will strengthen the balance sheet and hence improve its financial profile.

Banking on capital contribution, reinsurance transaction and cash position, this largest private mortgage insurer in the United States has been improving its capital position. Both leverage and times interest earned ratio have been improving.

Riding on a solid capital position, the company returned approximately $209.5 million of capital to shareholders through a combination of shares repurchases and dividends in the first half of 2023. The board of directors approved an additional share repurchase program, authorizing the repurchase of an additional $500 million worth of shares through Jul 1, 2025.

MGIC Investment’s trailing 12-month return on equity (ROE) reinforces its growth potential. The insurer’s trailing 12-month ROE was 18.8%, which expanded 30 basis points year over year and came ahead of the industry average of 10.5%.

The Zacks Consensus Estimate for 2023 and 2024 earnings has moved 3.5% and 0.4% north, respectively, in the past 30 days, reflecting analysts’ optimism.

Stocks to Consider

Some better-ranked stocks from the multi-line insurance industry are Old Republic International Corporation ORI, Everest Group, Ltd. EG and Radian Group Inc. RDN. While Old Republic International sports a Zacks Rank #1 (Strong Buy), Everest Group and Radian Group carry a Zacks Rank #2 (Buy) each at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Old Republic International’s earnings surpassed estimates in each of the last four quarters, the average earnings surprise being 14.1%.

The Zacks Consensus Estimate for ORI’s 2023 and 2024 earnings has moved 8.3% and 5.2% north, respectively, in the past 60 days. Year to date, the insurer has gained 11.7%.

Everest Group’s earnings surpassed estimates in three of the last four quarters and missed in one, the average earnings surprise being 17.36%.

The Zacks Consensus Estimate for EG’s 2023 and 2024 earnings implies 72.7% and 24% year-over-year growth, respectively. Year to date, the insurer has gained 13.2%.

Radian’s earnings surpassed estimates in each of the last four quarters, the average earnings surprise being 30.88%.

The Zacks Consensus Estimate for RDN’s 2023 and 2024 earnings has moved 5.7% and 4% north, respectively, in the past 60 days. Year to date, the insurer has declined 35.8%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MGIC Investment Corporation (MTG) : Free Stock Analysis Report

Radian Group Inc. (RDN) : Free Stock Analysis Report

Old Republic International Corporation (ORI) : Free Stock Analysis Report

Everest Group, Ltd. (EG) : Free Stock Analysis Report