MGIC Investment (MTG) Rises 50% in a Year: More Upside Left?

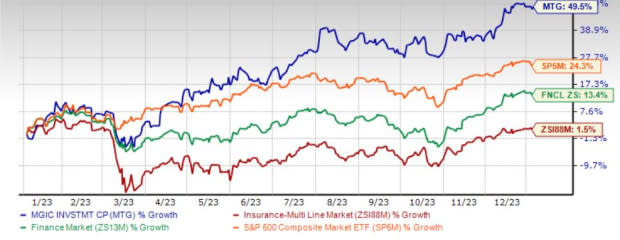

MGIC Investment Corporation’s MTG shares have rallied 49.5% in a year, outperforming the industry’s increase of 1.5%. The Finance sector has risen 13.4% and the Zacks S&P 500 index has gained 24.3% in the said time frame. With a market capitalization of $4.4 billion, the average volume of shares traded in the last three months was 1.3 million.

Solid insurance in force, a decline in loss and claims payments, lower delinquency, better housing market fundamentals and a solid capital position continue to drive the stock.

MGIC Investment has a decent track record of beating earnings estimates in the last five quarters. Earnings of this largest private mortgage insurer in the United States have risen 16% over the last five years, better than the industry average of 4.5%.

Return on invested capital (ROIC) was more than 10% in the last two years. This Zacks Rank #2 (Buy) mortgage insurer has raised its capital investment over some time. A stable ROIC reflects its efficiency in managing its investments to generate income.

Image Source: Zacks Investment Research

Growth Drivers

Favorable credit trends and refinances are driving an increase in new business written for

MGIC Investment. The insurer expects new business, along with increasing annual persistency, to result in the continued growth of the insurance-in-force portfolio.

Given a declining pattern of claim filings, we expect paid claims to decrease further. A decline in loss and claims should continue to strengthen the balance sheet and, hence, improve its financial profile.

MGIC Investment has been witnessing improving housing market fundamentals, such as household formations, home sales and the current capital status. As a result, this mortgage insurer is well-positioned to offer credit enhancement and low-down payment solutions to lenders, borrowers, and government-sponsored enterprises. The company also remains committed to being a major contributor to housing finance policy.

MGIC Investment has been improving its capital position on the strength of capital contribution, reinsurance transaction and cash position. Both leverage and times interest earned ratios have improved.

Riding on a solid capital position, MTG remains focused on enhancing its shareholders’ value. The insurer has $396 million remaining under a $500 million share repurchase program approved by the board in 2023 that expires on Jul 1, 2025.

Attractive Valuation

The stock is trading at a price to book value of 1.1, lower than the industry average of 2.7. It has a Value Score of B. This style score helps find the most attractive value stocks. Back-tested results have shown that stocks with a Value Score of A or B and a Zacks Rank #1 (Strong Buy) or 2 offer better returns.

Other Stocks to Consider

Some other top-ranked stocks from the insurance industry are The Hartford Financial Services Group HIG, Enact Holdings ACT and CNO Financial Group CNO, each carrying Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for HIG’s 2024 earnings indicates an increase of 19.6% from the 2023 estimated figure and has moved 0.6% north in the past 60 days. Hartford Financial delivered a four-quarter average earnings surprise of 10.81%. Shares gained 4.9% in a year.

Enact delivered a four-quarter average earnings surprise of 21.82%. In a year, ACT’s shares have gained 17.7%. The Zacks Consensus Estimate for ACT’s 2024 earnings has moved 1.1% higher in the past 60 days.

The Zacks Consensus Estimate for CNO Financial’s 2024 earnings implies a 10% increase from the 2023 estimated figure. In a year, CNO’s shares have gained 14.5%. The consensus estimate for CNO’s 2024 earnings has moved north by 3 cents in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Hartford Financial Services Group, Inc. (HIG) : Free Stock Analysis Report

MGIC Investment Corporation (MTG) : Free Stock Analysis Report

CNO Financial Group, Inc. (CNO) : Free Stock Analysis Report

Enact Holdings, Inc. (ACT) : Free Stock Analysis Report