MGM Resorts International Reports Record Q4 and Full Year 2023 Results

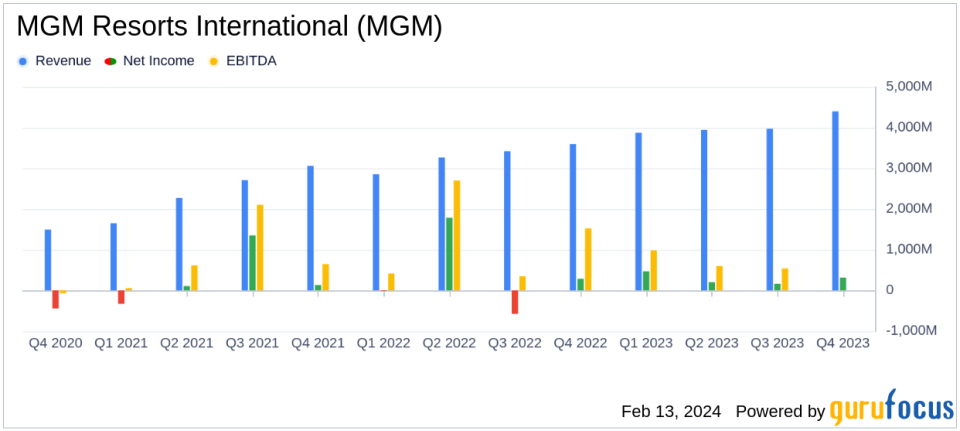

Consolidated Net Revenues: $4.4 billion in Q4, a 22% increase year-over-year.

Operating Income: $419 million in Q4, a significant rise from an operating loss of $2 million in the same quarter last year.

Net Income Attributable to MGM Resorts: $313 million in Q4, up from $284 million year-over-year.

Diluted Earnings Per Share: $0.92 in Q4, compared to $0.69 in the prior year quarter.

Adjusted Property EBITDAR: Record levels for both Las Vegas Strip Resorts and MGM China.

Share Repurchases: Approximately 54 million shares repurchased in 2023, totaling $7.1 billion since 2021.

Free Cash Flow: $1.8 billion for the twelve months ended December 31, 2023.

MGM Resorts International (NYSE:MGM) released its 8-K filing on February 13, 2024, revealing a record-setting performance for the fourth quarter and the full year of 2023. The company, a leading global entertainment organization, operates iconic resorts and casinos, including major properties on the Las Vegas Strip, regional assets across the U.S., and the MGM China casinos.

The Las Vegas Strip, home to renowned MGM properties such as MGM Grand, Mandalay Bay, and Bellagio, contributed significantly to the company's success, with record net revenue and Adjusted Property EBITDAR in both the fourth quarter and the full year. MGM China also saw a substantial increase in revenue and Adjusted Property EBITDAR, benefiting from the easing of COVID-19 related entry restrictions in Macau.

Despite these achievements, the company faced challenges in its Regional Operations, where net revenues and Adjusted Property EBITDAR decreased due to various factors, including a union strike at MGM Grand Detroit and a decrease in high-end table volume at MGM National Harbor. These challenges highlight the importance of MGM's diverse portfolio and the need to manage operational risks effectively.

The company's financial strength was further demonstrated by its aggressive share repurchase program, with $2.3 billion in shares repurchased in 2023, signaling confidence in its value proposition. This strategy is particularly significant for MGM Resorts and the broader Travel & Leisure industry, as it reflects a commitment to enhancing shareholder value and a belief in the company's long-term growth potential.

Key financial metrics from the earnings report underscore the company's robust performance:

Financial Metric | Q4 2023 | Full Year 2023 |

|---|---|---|

Consolidated Net Revenues | $4.4 billion | $16.2 billion |

Operating Income | $419 million | $1.9 billion |

Net Income Attributable to MGM Resorts | $313 million | $1.1 billion |

Diluted Earnings Per Share | $0.92 | $3.19 |

Adjusted Property EBITDAR - Las Vegas Strip Resorts | $864 million | $3.2 billion |

Adjusted Property EBITDAR - MGM China | $262 million | $867 million |

Free Cash Flow | $1.8 billion | |

These figures are crucial for understanding MGM Resorts' operational efficiency and profitability. Adjusted Property EBITDAR, a key metric for the gaming and hospitality industry, reflects the earnings before interest, taxes, depreciation, amortization, and rent costs, providing a clear picture of the company's core operational performance.

As MGM Resorts continues to navigate the post-pandemic recovery and capitalize on strategic opportunities, such as its recent expansion of the senior secured credit facility and the launch of its Marriott relationship, investors and stakeholders can anticipate the company's sustained focus on growth and profitability.

The company's financial resilience and strategic initiatives position it well for future success, as it leverages its premium offerings and iconic brand to attract visitors and drive revenue growth. With the inaugural Formula 1 race and the first Super Bowl in Las Vegas serving as recent examples, MGM Resorts is well-positioned to benefit from major events and an increasing international mix.

For more detailed information on MGM Resorts International's financial performance, investors are encouraged to review the full 8-K filing and consider the implications of the company's strategic decisions and market position within the broader context of the Travel & Leisure industry.

Explore the complete 8-K earnings release (here) from MGM Resorts International for further details.

This article first appeared on GuruFocus.