MGP Ingredients Inc (MGPI) Reports Robust Growth in Q4 and Full Year 2023 Earnings

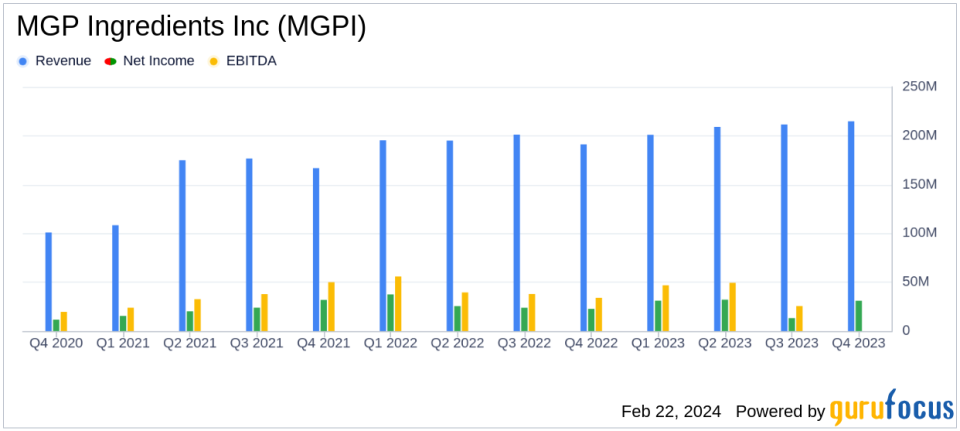

Sales Growth: Q4 sales rose by 13% to $214.9 million, with full-year sales up 7% to $836.5 million.

Gross Profit Surge: Gross profit for the year increased by 20% to $304.7 million, representing 36.4% of sales.

Net Income: Q4 net income climbed 38% to $31.0 million, while full-year net income saw a slight decrease of 2% to $107.1 million.

Earnings Per Share (EPS): Adjusted basic EPS for Q4 increased to $1.64 per share, with full-year adjusted basic EPS up to $5.90 per share.

Adjusted EBITDA: Q4 adjusted EBITDA jumped 60% to $56.2 million, with a 20% increase to $202.5 million for the full year.

On February 22, 2024, MGP Ingredients Inc (NASDAQ:MGPI), a distinguished producer and supplier of distilled spirits and specialty wheat protein and starch food ingredients, announced its financial results for the fourth quarter and full year ended December 31, 2023. The company's 8-K filing revealed significant growth in sales, gross profit, and net income, underscoring the success of its strategic initiatives across its Distillery Solutions, Branded Spirits, and Ingredient Solutions segments.

Financial Highlights and Segment Performance

MGP Ingredients Inc's robust performance in Q4 and throughout 2023 is a testament to the company's resilience and strategic execution. The Distillery Solutions segment, which is the largest revenue contributor, saw an 8% increase in Q4 sales, with a notable 22% rise in premium beverage alcohol sales. The Branded Spirits segment experienced a 19% surge in Q4 sales, driven by a 50% growth in premium plus price tier spirit brands. The Ingredient Solutions segment also reported a 15% increase in Q4 sales, highlighting the growing demand for specialty wheat proteins and starches.

The company's financial achievements are particularly significant in the Beverages - Alcoholic industry, where competition is fierce, and consumer preferences are rapidly evolving. MGP Ingredients Inc's ability to deliver premium products and maintain a strong gross margin expansion is indicative of its competitive edge and operational efficiency.

Challenges and Outlook

Despite the impressive financial results, MGP Ingredients Inc faced challenges, including the planned closure of its Atchison, Kansas distillery and the impact of inventory levels at distributors on the industry. The company's CEO, David Bratcher, expressed confidence in the long-term sustainability of the business model and the company's unique position to grow amidst these challenges.

Looking ahead to fiscal 2024, MGP Ingredients Inc anticipates sales to range between $742 million and $756 million, with adjusted EBITDA expected to be between $213 million and $217 million. The company's adjusted basic EPS is forecasted to be in the $6.12 to $6.23 range, reflecting continued optimism for growth despite industry headwinds.

Investor and Analyst Information

MGP Ingredients Inc will host a conference call for analysts and institutional investors to discuss these results and current business trends. The call and webcast details are available on the company's investor relations website.

For value investors and potential GuruFocus.com members, MGP Ingredients Inc's strong financial performance, coupled with its strategic focus on premiumization and innovation, presents a compelling investment narrative. The company's ability to navigate industry challenges and its positive outlook for 2024 further reinforce its position as a resilient player in the Beverages - Alcoholic sector.

For more detailed financial information and to explore the full potential of MGP Ingredients Inc as an investment opportunity, readers are encouraged to visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from MGP Ingredients Inc for further details.

This article first appeared on GuruFocus.