Michael Burry's Scion Asset Management Makes a Big Play on Nexstar Media Group

Insights into the Latest 13F Filings Reveal Strategic Portfolio Adjustments

Renowned for his prescient bet against the housing bubble, Michael Burry (Trades, Portfolio), the founder of Scion Asset Management, has once again attracted attention with his latest 13F filings for the third quarter of 2023. Burry, whose story was famously depicted in the movie "The Big Short," is known for his deep value investing strategy and contrarian bets. His recent filings provide a window into his investment moves during a period of market volatility.

New Additions to the Portfolio

Michael Burry (Trades, Portfolio)'s Scion Asset Management has expanded its portfolio with the addition of three new stocks:

Booking Holdings Inc (NASDAQ:BKNG) leads the new entries with 1,500 shares, making up 4.67% of the portfolio and valued at $4.63 million.

Alibaba Group Holding Ltd (NYSE:BABA) follows closely, comprising 4.38% of the portfolio with 50,000 shares, totaling $4.34 million.

JD.com Inc (NASDAQ:JD) rounds out the top three, accounting for 3.68% of the portfolio with 125,000 shares, valued at $3.64 million.

Key Position Increases

Notably, Burry has also increased his stakes in six companies, with the most significant boost in:

Nexstar Media Group Inc (NASDAQ:NXST), where an additional 33,651 shares were acquired, bringing the total to 48,651 shares. This represents a substantial 224.34% increase in share count and a 4.88% impact on the current portfolio, valued at $6.98 million.

Euronav NV (NYSE:EURN) also saw a significant increase, with an additional 197,100 shares, bringing the total to 250,000 shares. This adjustment marks a 372.59% increase in share count, with a total value of $4.11 million.

Exiting Positions

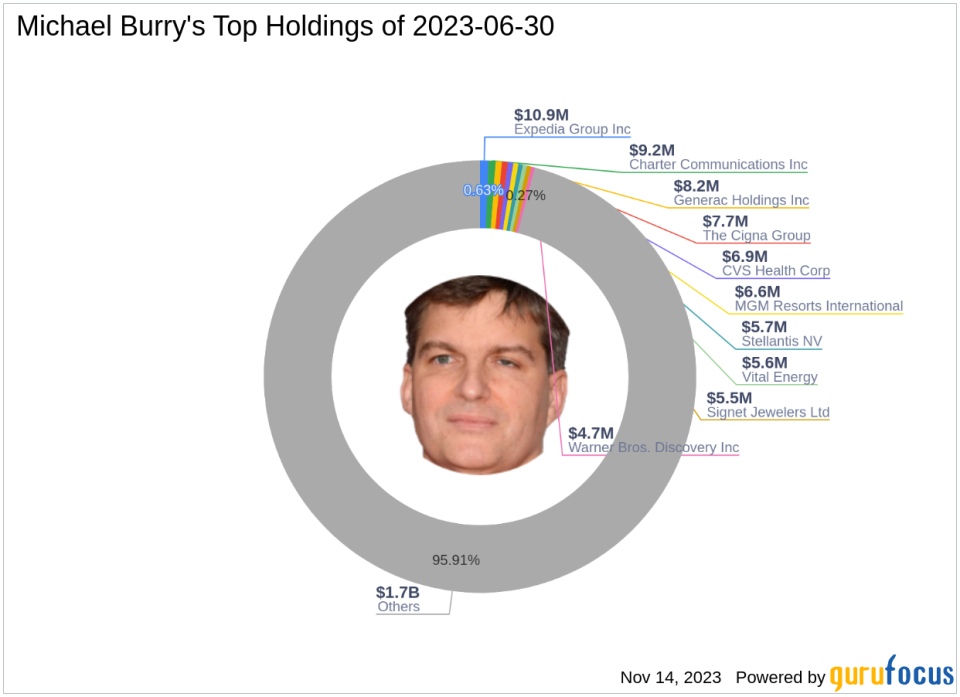

The third quarter also saw Michael Burry (Trades, Portfolio) exiting 23 holdings, with notable sell-offs including:

Expedia Group Inc (NASDAQ:EXPE), where all 100,000 shares were sold, impacting the portfolio by -0.63%.

Charter Communications Inc (NASDAQ:CHTR), with a complete liquidation of 25,000 shares, causing a -0.53% impact on the portfolio.

Reduced Holdings

Burry's strategic moves also involved reducing positions in two stocks:

The RealReal Inc (NASDAQ:REAL) saw a 50% reduction of 750,000 shares, impacting the portfolio by -0.1%. The stock traded at an average price of $2.44 during the quarter and has seen varied returns over the past months.

Crescent Energy Co (NYSE:CRGY) experienced an 18.02% reduction of 43,963 shares, with a -0.03% portfolio impact. The stock's performance has fluctuated, reflecting the dynamic energy sector.

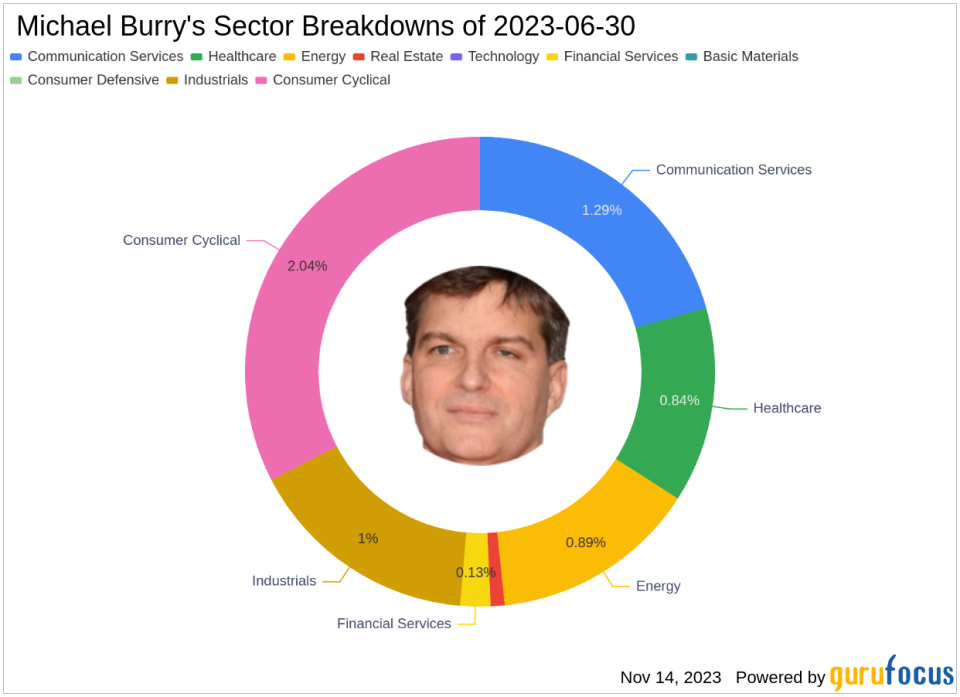

Portfolio Overview

As of the third quarter of 2023, Michael Burry (Trades, Portfolio)'s portfolio is composed of 13 stocks. The top holdings include 7.73% in Stellantis NV (NYSE:STLA), 7.05% in Nexstar Media Group Inc (NASDAQ:NXST), and 4.87% in Star Bulk Carriers Corp (NASDAQ:SBLK), among others. The investments are predominantly concentrated in five industries: Consumer Cyclical, Communication Services, Energy, Industrials, and Real Estate, reflecting Burry's diverse yet focused investment approach.

Value investors and those interested in the strategies of high-profile investors like Michael Burry (Trades, Portfolio) can find more detailed analyses and updates on GuruFocus.com.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.