Microchip (MCHP) Q3 Preliminary Results Disappoint, Shares Fall

Microchip MCHP reported disappointing third-quarter fiscal 2024 preliminary results, with revenues now estimated to decline 22% sequentially compared with the previous guidance range of 15-20% decline.

Microchip cited lower shipments, primarily due to a weakening economic environment. It has been suffering from a slowdown in business across most end markets due to a challenging macroeconomic environment and heightened inventory levels with end customers.

Microchip had projected net sales between $1.803 billion and $1.916 billion for the third quarter of fiscal 2024. Non-GAAP earnings were anticipated between $1.09 per share and $1.17 per share.

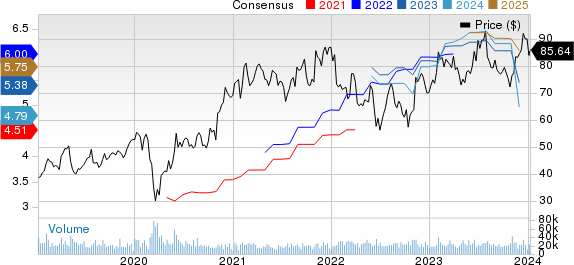

Shares of Microchip were down 4.24% in pre-market trading. The company’s shares have declined 13.5% in the past year, underperforming the Zacks Computer & Technology sector’s return of 43.9%.

Microchip Technology Incorporated Price and Consensus

Microchip Technology Incorporated price-consensus-chart | Microchip Technology Incorporated Quote

Microchip Suffers From Weak Macroeconomic Conditions

Persistent inflation and high interest rates have been contributing to the weak macro environment. This has been detrimental to MCHP’s prospects.

Microchip has paused internal capacity expansion that is expected to lower capital expenditure spending in fiscal 2024 and 2025 due to the weakening demand and challenging macroeconomic environment.

The company has been striving to lower lead times, which it believes is the best way to help customers during a period of macro weakness and growing uncertainty. However, shorter lead times are resulting in lower bookings and reduced short-term visibility.

Nevertheless, Microchip’s expanding portfolio with the launch of the PIC18-Q24, low-pin-count MCU family, the PIC18 Q20 product line and the MPLAB Machine Learning Development suite is expected to boost prospects over the long run.

Zacks Rank & Stocks to Consider

Microchip currently has a Zacks Rank #4 (Sell).

DigitalOcean DOCN, Ceridian HCM CDAY and Meta Platforms META are some better-ranked stocks that investors can consider in the broader sector, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

CDAY, DOCN and META shares have returned 4.2%, 40.1% and 169.7%, respectively, in the past 12 months.

Long-term earnings growth rates for DigitalOcean, Ceridian HCM and Meta Platforms are pegged at 31.26%, 44.15% and 21.34%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Microchip Technology Incorporated (MCHP) : Free Stock Analysis Report

Ceridian HCM (CDAY) : Free Stock Analysis Report

DigitalOcean Holdings, Inc. (DOCN) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report