Microchip Technology Inc (MCHP) Faces Headwinds as Q3 FY2024 Earnings Dip Amid Market Challenges

Net Sales: $1.766 billion, a decrease of 18.6% year-over-year.

Gross Profit: On a GAAP basis, 63.4%; on a Non-GAAP basis, 63.8%.

Operating Income: GAAP operating income of $529.4 million; Non-GAAP operating income of $728.1 million.

Net Income: GAAP net income of $419.2 million; Non-GAAP net income of $592.7 million.

Earnings Per Share (EPS): GAAP EPS of $0.77; Non-GAAP EPS of $1.08.

Dividends and Buybacks: Returned $352.0 million to shareholders through dividends and stock repurchases.

Debt Reduction: Paid down $392.0 million of debt, reducing net leverage to 1.27x.

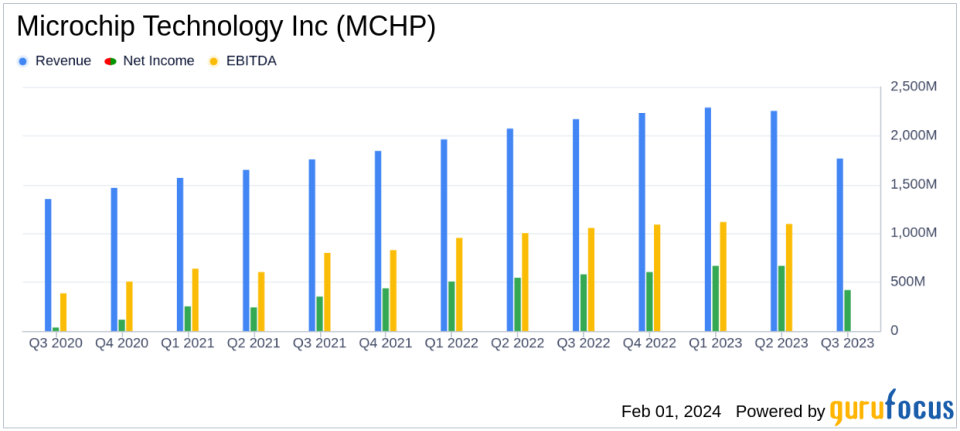

On February 1, 2024, Microchip Technology Inc (NASDAQ:MCHP) released its 8-K filing, detailing the financial outcomes for the third quarter of fiscal year 2024. The company, known for its microcontroller and analog semiconductors, faced a challenging quarter with net sales of $1.766 billion, marking a significant decline of 21.7% sequentially and 18.6% from the same quarter last year. This performance was slightly better than the preliminary results provided on January 8, 2024, which anticipated a 22% sequential decrease.

Microchip Technology, which became independent in 1989, is a key player in the semiconductor industry, particularly known for its microcontrollers (MCUs). The company's portfolio is diverse, with a strong presence in lower-end 8-bit MCUs, and it has expanded into higher-end MCUs and analog chips. These products are critical in a wide range of electronic devices, from simple remote controls to complex automotive power systems.

Financial Performance and Challenges

The company's GAAP gross profit stood at 63.4%, with operating income at 30.0% of net sales, resulting in a net income of $419.2 million and EPS of $0.77 per diluted share. These figures surpassed the previously issued guidance of $0.68 to $0.76 per diluted share. On a Non-GAAP basis, the gross profit was slightly higher at 63.8%, with operating income at 41.2% of net sales, net income at $592.7 million, and EPS at $1.08 per diluted share, which was within the lower range of the guidance provided.

The company's performance is critical as it reflects the health of the broader semiconductor industry, which is facing a downturn due to weaker business conditions. Microchip Technology's results are particularly important given its role in supplying MCUs for a variety of electronic applications. The decline in net sales and profits suggests that the company, like many in the sector, is grappling with a challenging economic environment characterized by softening demand and inventory adjustments by customers.

Financial Achievements and Industry Significance

Despite the downturn, Microchip Technology has achieved significant financial milestones. The company returned approximately $352.0 million to shareholders through dividends and stock repurchases, showcasing its commitment to delivering shareholder value. Additionally, the company continued its debt reduction strategy, paying down $392.0 million of debt during the quarter and reducing its net leverage to 1.27x. This fiscal discipline is particularly noteworthy in the semiconductor industry, where companies often carry significant debt due to the capital-intensive nature of the business.

Management Commentary and Future Outlook

"Our December quarter performance fell short of our November guidance, primarily due to weaker business conditions," said Ganesh Moorthy, President and Chief Executive Officer. "We are proactively taking measures to navigate these short-term challenges, with our focus firmly set on ensuring the long-term sustainability and growth of our business."

"While we remain confident in the long-term opportunities for our business, we are cautious about demand in the near term given the weak macro environment and customers' ongoing actions to reduce inventory," Moorthy added.

Looking ahead, Microchip Technology anticipates net sales in the March quarter to be between $1.225 billion and $1.425 billion. The company remains focused on its strategic imperatives and is confident in its ability to drive long-term growth despite the current market volatility.

For detailed financial tables and a complete reconciliation of GAAP to Non-GAAP measures, please refer to the full earnings release.

For more information and analysis on Microchip Technology Inc (NASDAQ:MCHP) and the semiconductor industry, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Microchip Technology Inc for further details.

This article first appeared on GuruFocus.