Micron Technology Inc (MU) Posts Strong Q2 Fiscal 2024 Results Amid AI Demand Surge

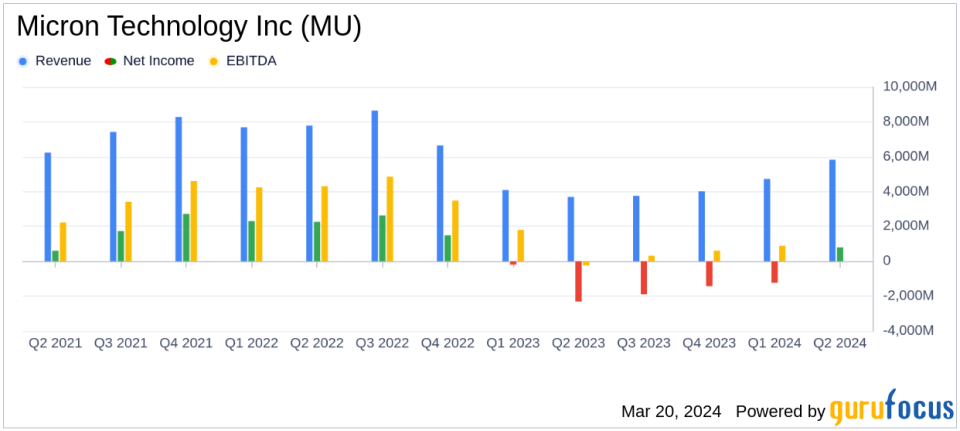

Revenue: Increased to $5.82 billion in Q2, up from $4.73 billion in the previous quarter and $3.69 billion year-over-year.

Net Income: GAAP net income reached $793 million, with diluted earnings per share of $0.71.

Gross Margin: Improved to 18.5% of revenue, a significant rise from the negative margin in the previous quarter.

Operating Cash Flow: Reported at $1.22 billion, showing robust operational efficiency.

Capital Expenditures: Investments in capital expenditures netted $1.25 billion, with adjusted free cash flows at negative $29 million.

Dividend: Announced a quarterly dividend of $0.115 per share, payable on April 16, 2024.

Guidance: Q3 revenue is projected to be around $6.60 billion, with a gross margin of approximately 25.5%.

On March 20, 2024, Micron Technology Inc (NASDAQ:MU) released its 8-K filing, announcing a significant turnaround in its financial performance for the second quarter of fiscal 2024. Micron, a global leader in memory and storage solutions, reported a substantial increase in revenue and profitability, driven by heightened demand for artificial intelligence (AI) applications and a tight supply environment.

Company Overview

Micron Technology Inc (NASDAQ:MU) is one of the world's leading semiconductor companies, known for its dynamic random access memory (DRAM) and NAND flash memory chips. These products are integral to a variety of applications, including data centers, mobile phones, consumer electronics, and industrial and automotive technologies. With its vertical integration strategy, Micron has established a strong presence in the global market, delivering innovative memory and storage solutions.

Financial Performance and Challenges

The company's revenue for the quarter stood at $5.82 billion, a marked increase from $4.73 billion in the prior quarter and $3.69 billion in the same period last year. This performance is particularly noteworthy given the previous negative gross margin, which has now rebounded to 18.5% of revenue. The return to profitability, with a GAAP net income of $793 million, underscores Micron's successful navigation through a challenging semiconductor market.

Despite these positive results, Micron faces ongoing industry challenges, including fluctuating demand and the cyclical nature of the semiconductor market. The company's adjusted free cash flows were negative $29 million, reflecting the substantial investments in capital expenditures, which totaled $1.25 billion for the quarter. These investments are crucial for maintaining technological leadership and meeting future demand, but they also highlight the need for careful financial management.

Financial Achievements and Industry Significance

Micron's financial achievements this quarter are significant for the semiconductor industry. The company's ability to generate a strong operating cash flow of $1.22 billion demonstrates operational efficiency and resilience in a competitive market. Moreover, the declaration of a quarterly dividend signals confidence in Micron's financial health and its commitment to shareholder returns.

The company's President and CEO, Sanjay Mehrotra, commented on the results:

"Micron delivered fiscal Q2 results with revenue, gross margin and EPS well above the high-end of our guidance range a testament to our teams excellent execution on pricing, products and operations. Our preeminent product portfolio positions us well to deliver a strong fiscal second half of 2024. We believe Micron is one of the biggest beneficiaries in the semiconductor industry of the multi-year opportunity enabled by AI."

Analysis of Financial Statements

Key details from Micron's financial statements reveal a robust balance sheet with cash, marketable investments, and restricted cash totaling $9.72 billion. The company's commitment to research and development, with expenses of $832 million for the quarter, emphasizes its focus on innovation and future growth.

Looking ahead, Micron provided guidance for the third quarter of fiscal 2024, projecting revenue of approximately $6.60 billion and a gross margin of 25.5%. These figures suggest continued positive momentum and an optimistic outlook for the company's performance.

In conclusion, Micron Technology Inc (NASDAQ:MU)'s second-quarter results reflect a strong recovery and a promising outlook for the remainder of the fiscal year. The company's strategic focus on AI and its robust product portfolio position it well to capitalize on future industry trends. Investors and stakeholders can look forward to Micron's continued growth and financial stability in the dynamic semiconductor market.

Explore the complete 8-K earnings release (here) from Micron Technology Inc for further details.

This article first appeared on GuruFocus.