Micron Technology (NASDAQ:MU) Reports Strong Q1, Stock Jumps 10.6%

Memory chips maker Micron (NYSE:MU) reported results ahead of analysts' expectations in Q1 CY2024, with revenue up 57.7% year on year to $5.82 billion. On top of that, next quarter's revenue guidance ($6.6 billion at the midpoint) was surprisingly good and 9.9% above what analysts were expecting. It made a non-GAAP profit of $0.42 per share, improving from its loss of $1.91 per share in the same quarter last year.

Is now the time to buy Micron Technology? Find out by accessing our full research report, it's free.

Micron Technology (MU) Q1 CY2024 Highlights:

Revenue: $5.82 billion vs analyst estimates of $5.35 billion (8.8% beat)

EPS (non-GAAP): $0.42 vs analyst estimates of -$0.24 ($0.66 beat)

Revenue Guidance for Q2 CY2024 is $6.6 billion at the midpoint, above analyst estimates of $6.00 billion

Gross Margin (GAAP): 18.5%, up from -32.7% in the same quarter last year

Inventory Days Outstanding: 162, up from 158 in the previous quarter

Free Cash Flow was -$29 million compared to -$395 million in the previous quarter

Market Capitalization: $103.8 billion

Founded in the basement of a Boise, Idaho dental office in 1978, Micron (NYSE:MU) is a leading provider of memory chips used in thousands of devices across mobile, data centers, industrial, consumer, and automotive markets.

Memory Semiconductors

The rapid growth in data generation and the need to support increases in processing power for everything from consumer devices to data center servers are driving the demand for memory chips. From the content delivery networks and edge computing to the cloud, data storage is a key component underpinning the global technology architecture. On top of that, secular growth drivers like machine learning and the boom in media-rich digital content are further accelerating the need for storage. Like all semiconductor segments, memory makers are highly cyclical, driven by supply and demand imbalances and exposure to consumer product cycles.

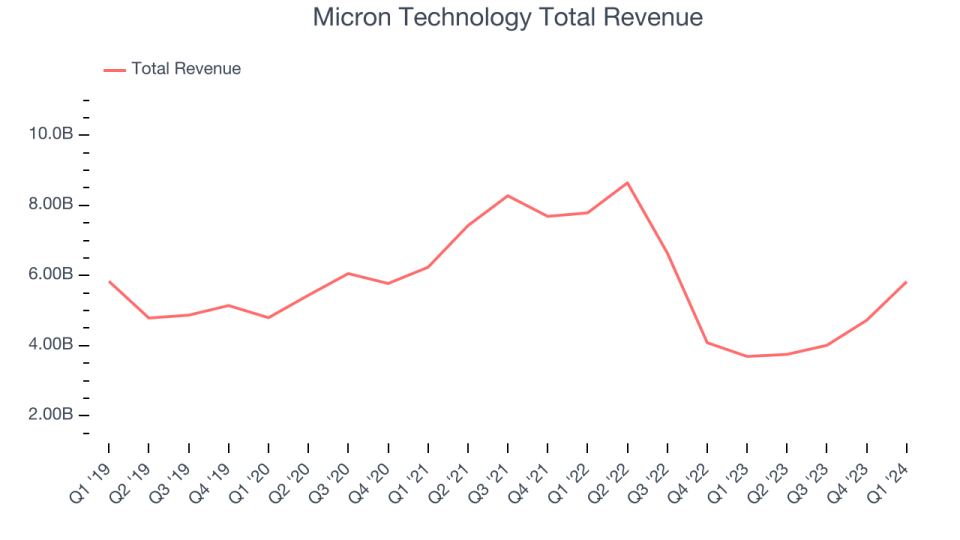

Sales Growth

Micron Technology's revenue growth over the last three years has been unimpressive, averaging 0.5% annually. As you can see below, this was a weaker quarter for the company, with revenue growing from $3.69 billion in the same quarter last year to $5.82 billion. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions (which can sometimes offer opportune times to buy).

Micron Technology had a fantastic quarter as its 57.7% year-on-year revenue growth beat analysts' estimates by 8.8%. We believe the company is still in the early days of an upcycle, as this was just the second consecutive quarter of growth and a typical upcycle tends to last 8-10 quarters.

Micron Technology's management team believes its revenue growth will accelerate, guiding to 75.9% year-on-year growth next quarter. Wall Street expects the company to grow its revenue by 57.1% over the next 12 months.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

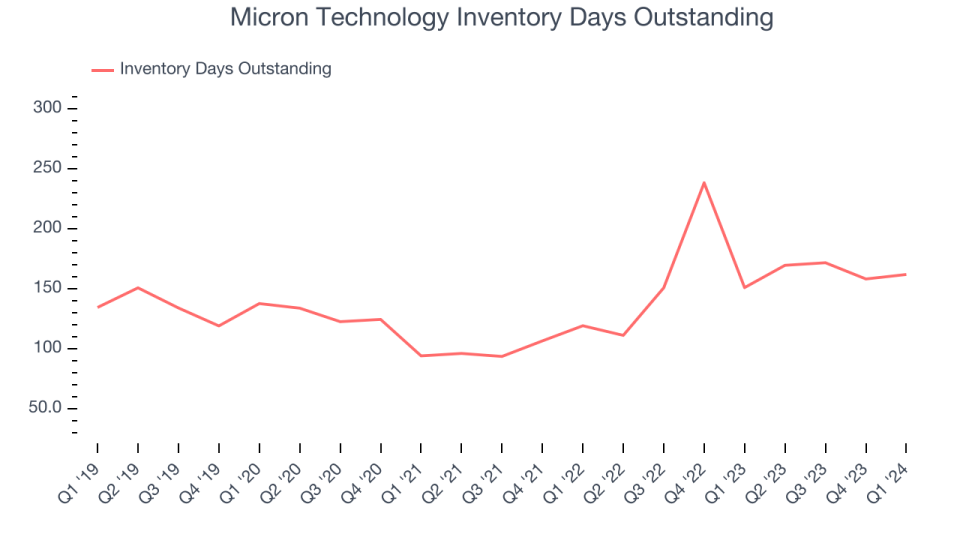

Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business' capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Micron Technology's DIO came in at 162, which is 25 days above its five-year average, suggesting that the company's inventory has grown to higher levels than we've seen in the past.

Key Takeaways from Micron Technology's Q1 Results

We were impressed by Micron Technology's strong gross margin improvement this quarter. We were also excited by how much its revenue and EPS outperformed Wall Street's estimates. On the other hand, its inventory levels increased. Looking ahead, its revenue, gross margin, and EPS guidance of $6.6 billion, 25.5%, and $0.17 per share for the next quarter crushed analysts' projections.

During the earnings release, the company declared a quarterly dividend of $0.115 per share, payable on April 16, 2024, to shareholders as of April 1, 2024.

Overall, we think this was a fantastic "beat-and-raise" quarter that should have shareholders cheering. The stock is up 10.6% after reporting and currently trades at $106.46 per share.

Micron Technology may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.