Microsoft Dials Up Merger With Nuance Communications

- By James Li

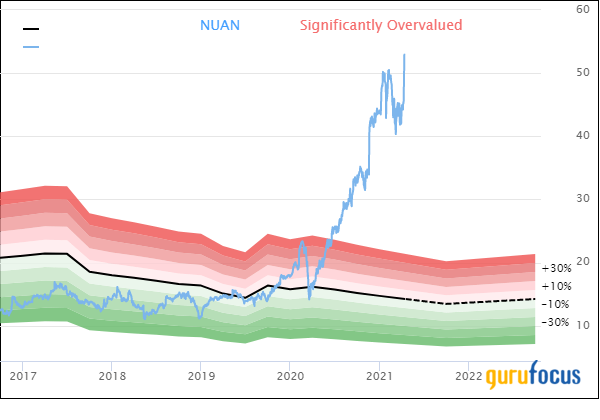

On Monday, shares of Nuance Communications Inc. (NASDAQ:NUAN) surged more than 16% on the heels of announcing that software giant Microsoft Corp. (NASDAQ:MSFT) has agreed to acquire it in an all-cash transaction valued at approximately $19.7 billion, inclusive of net debt.

Per the transaction terms, the Redmond, Washington-based company will acquire Nuance for $56 per share, implying a premium of approximately 22.86% from its close of $45.58 on Friday.

Target company background and merger synergy discussion

Microsoft CEO Satya Nadella said Nuance provides the software company an artificial intelligence layer "at the health care point of delivery." The Burlington, Massachusetts-based company provides conversational artificaial intelligence and cloud-based ambient clinical intelligence for health care workers through products like Dragon Ambient eXperience and Dragon Medical One.

The software giant's acquisition of Nuance bolsters the partnership between the two companies announced in late 2019. Nuance CEO Mark Benjamin said that Nuance needed a software platform to expand its AI products to a global network of connections: Microsoft brings its "intelligent cloud-based services at scale."

The merger, which has been unanimously approved by both companies' board of directors, is expected to close by the end of 2021 subject to approval from Nuance's shareholders, satisfaction of certain regulatory approvals and other customary closing conditions. Microsoft expects to record Nuance's financial performance data within its Intelligent Cloud segment.

Target financial strength and profitability overview

According to GuruFocus, Nuance's financial strength is 4 out of 10 on several warning signs, which include interest coverage and debt ratios underperforming more than 90% of global competitors. Despite this, Nuance has a strong Altman Z-score of 3.21 and a solid Piotroski F-score of 5, suggesting moderately good business operations.

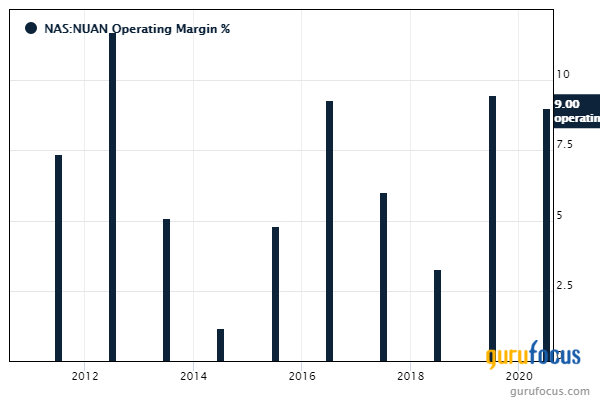

GuruFocus ranks Nuance's profitability 4 out of 10: Net margins and returns underperform over 57% of global competitors, though the company's operating margin has increased approximately 7.7% per year on average over the past five years and is outperforming over 63% of global software companies.

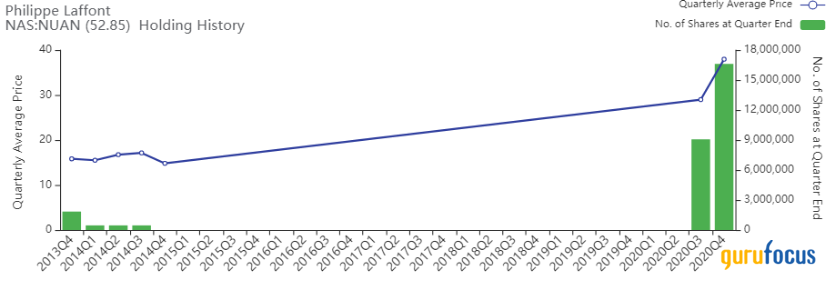

Gurus with large holdings in Nuance include Philippe Laffont (Trades, Portfolio)'s Coatue Management, Andreas Halvorsen (Trades, Portfolio)'s Viking Global Partners and Steve Mandel (Trades, Portfolio)'s Lone Pine Capital.

Disclosure: No positions.

Read more here:

3 Stocks Paying Special Dividends During the 2nd Quarter

737 Max Production Issues Resume Haunting Boeing

Levi Strauss Surges on Upbeat 1st-Half Guidance

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.