Microvision Inc (MVIS) Reports Revenue Growth in Q4 2023 Amidst Widening Net Loss

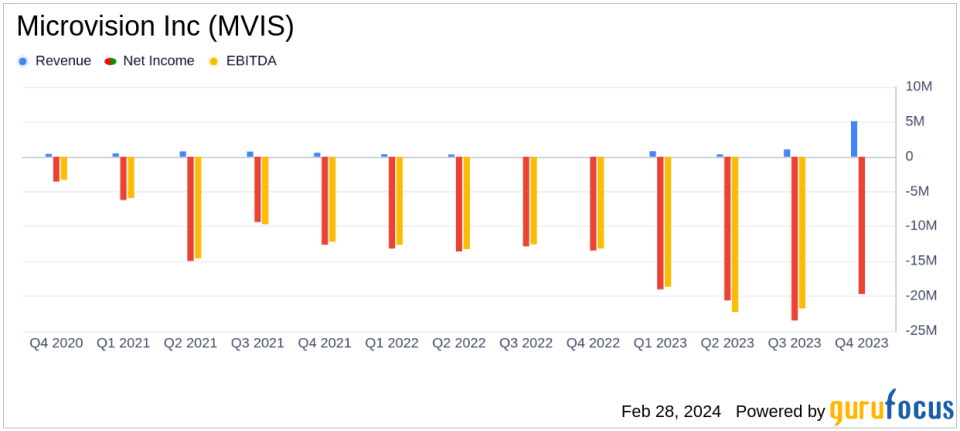

Revenue: Q4 2023 revenue was $5.1 million, a significant increase from zero in Q4 2022.

Net Loss: Q4 2023 net loss widened to $19.7 million, or $0.10 per share, compared to a net loss of $13.5 million, or $0.08 per share in Q4 2022.

Operating Expenses: Research and development expenses increased to $14.6 million in Q4 2023 from $7.6 million in Q4 2022.

Cash Position: Ended Q4 2023 with $73.8 million in cash and cash equivalents, down from $82.7 million at the end of 2022.

Adjusted EBITDA: Adjusted EBITDA for Q4 2023 was a loss of $13.6 million, compared to a loss of $9.7 million in Q4 2022.

On February 28, 2024, Microvision Inc (NASDAQ:MVIS) released its 8-K filing, announcing its fourth quarter and full year 2023 results. The company, known for its MEMS-based solid-state automotive lidar and ADAS solutions, reported a significant increase in revenue for the fourth quarter of 2023, amounting to $5.1 million, primarily driven by revenue related to its contract with Microsoft. This marks a notable rise from the zero revenue reported in the fourth quarter of 2022.

Despite the revenue increase, Microvision Inc (NASDAQ:MVIS) experienced a widening net loss of $19.7 million, or $0.10 per share, for the fourth quarter of 2023. This loss includes $4.6 million of non-cash, share-based compensation expense. In comparison, the net loss for the fourth quarter of 2022 was $13.5 million, or $0.08 per share, which included $3.5 million of non-cash, share-based compensation expense.

The company's operating expenses also saw a significant increase, with research and development expenses climbing to $14.6 million in the fourth quarter of 2023 from $7.6 million in the same period of the previous year. Sales, marketing, general, and administrative expenses rose to $9.5 million from $6.4 million in the fourth quarter of 2022.

Microvision Inc (NASDAQ:MVIS) ended the fourth quarter with $73.8 million in cash and cash equivalents, including investment securities, a decrease from $82.7 million at the end of 2022. The adjusted EBITDA for the fourth quarter of 2023 was a loss of $13.6 million, compared to a loss of $9.7 million for the same period in 2022.

CEO Sumit Sharma highlighted the company's engagement in nine automotive RFQs and the maturity of their products as differentiators in the marketplace. Sharma also emphasized the strategic focus on securing revenue streams from non-automotive applications to scale the business and improve gross margins.

Financial Performance Analysis

Microvision Inc (NASDAQ:MVIS)'s financial performance in the fourth quarter of 2023 reflects a company in transition, with increased revenue from strategic contracts but also rising operating expenses and net losses. The company's focus on expanding its product offerings and engaging with automotive RFQs suggests a strategic push towards growth and market penetration. However, the increased net loss and cash used in operations, which rose to $16.6 million from $8.4 million in the fourth quarter of 2022, indicate that the path to profitability may be challenging.

The company's balance sheet remains solid with a healthy cash position, although it has decreased from the previous year-end. This financial cushion provides Microvision Inc (NASDAQ:MVIS) with the resources to continue its research and development efforts and to pursue strategic opportunities. Nonetheless, the widening adjusted EBITDA loss points to the need for careful financial management and operational efficiency moving forward.

Value investors and potential GuruFocus.com members interested in the hardware industry and companies like Microvision Inc (NASDAQ:MVIS) should consider both the opportunities presented by the company's technological advancements and the financial challenges it faces. The full year and quarterly financial details, including income statements, balance sheets, and cash flow statements, are available in the company's 8-K filing.

For more detailed information and analysis, investors are encouraged to review the full 8-K filing and consider attending the company's conference call and webcast to discuss the financial results and business updates.

Explore the complete 8-K earnings release (here) from Microvision Inc for further details.

This article first appeared on GuruFocus.