Mid-America Apartment (MAA) Q3 FFO & Revenues Beat Estimates

Mid-America Apartment Communities MAA reported third-quarter 2023 core funds from operations (FFO) per share of $2.29, which surpassed the Zacks Consensus Estimate by a penny. Moreover, the reported figure climbed 4.6% year over year.

This residential REIT’s quarterly results were driven by an increase in the average effective rent per unit for the same-store portfolio. MAA also revised its outlook for 2023.

Reflecting positive sentiments, shares of MAA were up more than 4% during the pre-market hours today.

Rental and other property revenues were $542 million, outpacing the Zacks Consensus Estimate of $540.3 million. The reported figure was 4.1%, higher than the year-ago quarter’s $520.8 million.

Per Eric Bolton, the chairman and chief executive officer of MAA, “Stable employment conditions along with continued positive migration trends to our markets and historically low resident move-outs are combining to drive solid demand. The delivery of new apartment supply is currently impacting rent growth performance associated with new move-in residents, and we expect this pressure to persist for another few quarters.”

Quarter in Detail

The same-store portfolio’s revenues grew 4.1% on a year-over-year basis due to a rise of 4.5% in the average effective rent per unit.

However, the average physical occupancy for the same-store portfolio in the third quarter declined 10 basis points year over year to 95.7%. Our expectation for the same was pegged at 95.6%.

As of Sep 30, 2023, resident turnover remained low at 45.2% on a trailing 12-month basis. This stemmed from historically low levels of move-outs related to buying single-family homes. Same-store portfolio operating expenses increased 4.7%.

On a blended basis, effective during the third quarter, the same-store portfolio lease pricing for new and renewing leases rose 1.6% from the prior lease. This was driven by a 5% increase in renewing leases and a 2.2% decrease for leases to new move-in residents.

Moreover, the same-store net operating income (NOI) reflected year-over-year growth of 3.7%. Our expectation for the same was pegged at 5.0%.

Balance Sheet Position

MAA exited the third quarter of 2023 with cash and cash equivalents of $161.9 million, up from $150.2 million recorded as of Jun 30, 2023.

As of Sep 30, 2023, MAA had a strong balance sheet with $1.4 billion in combined cash and capacity available under its unsecured revolving credit facility. Also, it had a historically low Net Debt/Adjusted EBITDAre ratio of 3.4.

As of the same date, the total debt outstanding was $4.4 billion. Its total debt average years to maturity was 7.2 years. As of Sep 30, 2023, unencumbered NOI was 95.8% of the total NOI.

Portfolio Activity

In the third quarter of 2023, MAA redeveloped 2,258 apartment homes, while Smart Home technology installations completed were in 413 units.

As of Sep 30, 2023, MAA had five communities under development, with a total projected cost of $642.7 million and an estimated $296.4 million remaining to be funded. The projected average stabilized NOI yield on the five communities expected to start leasing in the coming quarter or are currently leasing is 6.7%.

2023 Guidance Revised

This residential REIT revised its guidance for 2023 core FFO per share to the range of $9.06-$9.22 from $9-$9.28 projected earlier. However, the midpoint remained the same at $9.14. The Zacks Consensus Estimate is currently pegged at $9.18, which lies within the guided range.

For the full year, management revised its outlook for same-store property revenue growth to 5.75-6.75% from 5.50-7% guided earlier. Also, the operating expense growth is now expected in the range of 6-7%, revised from 5.30-6.80% stated earlier.

As a result, the same-store NOI growth is now estimated in the band of 5.50-6.50%, revised from 5.60-7.10% anticipated earlier. Expectations for average physical occupancy for the same-store portfolio currently is 95.50-95.70%, with the midpoint being 95.60%.

MAA projects fourth-quarter 2023 core FFO per share in the band of $2.21-$2.37, with the midpoint being $2.29. The Zacks Consensus Estimate is currently pegged at $2.33.

MAA currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

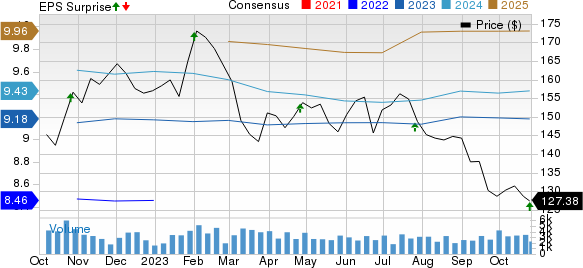

Mid-America Apartment Communities, Inc. Price, Consensus and EPS Surprise

Mid-America Apartment Communities, Inc. price-consensus-eps-surprise-chart | Mid-America Apartment Communities, Inc. Quote

Performance of Another Residential REIT

AvalonBay Communities AVB reported a third-quarter 2023 core FFO per share of $2.66, beating the Zacks Consensus Estimate of $2.64. Moreover, the figure climbed 6.4% from the prior-year quarter’s tally. The quarterly results reflected a year-over-year increase in same-store residential rental revenues.

Upcoming Earnings Release

We look forward to the earnings release of another residential REIT — Equity Residential EQR — which is slated to report its results on Oct 31.

The Zacks Consensus Estimate for Equity Residential’s third-quarter 2023 FFO per share is pegged at 97 cents, suggesting year-over-year growth of 5.4%. EQR currently carries a Zacks Rank #3.

Note: Anything related to earnings presented in this write-up represents FFO — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AvalonBay Communities, Inc. (AVB) : Free Stock Analysis Report

Equity Residential (EQR) : Free Stock Analysis Report

Mid-America Apartment Communities, Inc. (MAA) : Free Stock Analysis Report