Mid Penn Bancorp Inc Reports Robust Earnings Growth and Declares Dividend

Net Income: Q4 net income available to common shareholders increased by 31.0% to $12.1 million.

Earnings Per Share: Diluted EPS for Q4 rose to $0.73, up from $0.56 in Q3.

Loan Growth: Organic loan growth for the year ended December 31, 2023, was $423.6 million, a 10.8% increase.

Interest Income: Total interest income for Q4 increased by 4.26% to $66.1 million.

Dividend: A quarterly cash dividend of $0.20 per share was declared, payable on February 20, 2024.

Asset Quality: Nonperforming assets were $14.5 million at the end of Q4, with a decrease in provision for credit losses.

Capital Strength: Shareholders equity increased by 6.15% year-over-year to $543.6 million.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

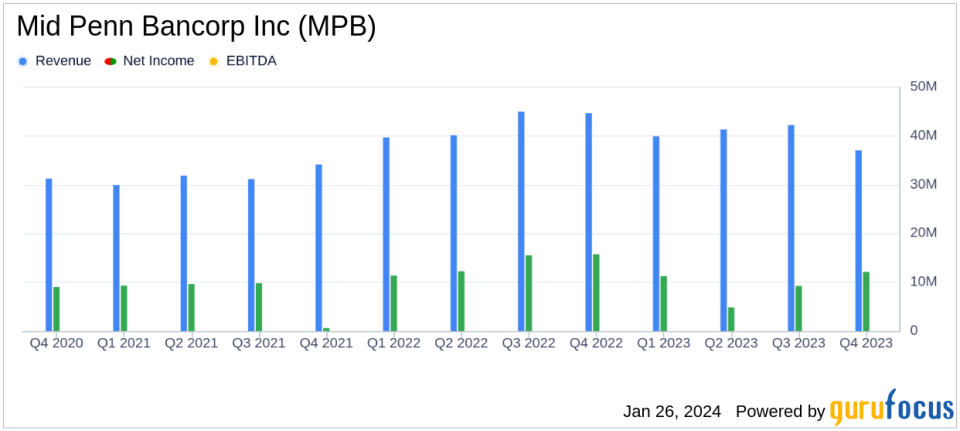

On January 26, 2024, Mid Penn Bancorp Inc (NASDAQ:MPB) released its 8-K filing, detailing a strong financial performance for the fourth quarter of 2023. The company, which operates in the financial services sector providing a range of banking and trust services in the United States, reported a significant increase in net income and earnings per share (EPS) compared to the previous quarter.

Mid Penn Bancorp Inc's net income available to common shareholders for Q4 2023 was $12.1 million, or $0.73 per diluted common share, representing a 31.0% increase from the $9.2 million, or $0.56 per diluted common share, reported in the third quarter of the same year. This growth is attributed to a robust loan expansion, with organic loan growth reaching $423.6 million, or 10.8%, excluding loans acquired from the Brunswick acquisition.

The company's total interest income rose to $66.1 million for the quarter, driven by an increase in interest income on loans. However, Mid Penn also faced challenges, including an inverted yield curve and intense competition for core deposits, which impacted performance. Despite these challenges, the bank's strategic measures, such as controlling loan growth and cutting operating expenses, contributed to the quarter's improvements and positioned the company for the fiscal year 2024.

"Our performance in the fourth quarter of 2023, while an improvement over the linked third quarter of 2023, was still heavily impacted by the continuation of an inverted yield curve and the rigorous competition for core deposits," stated Rory G. Ritrievi, Chair, President, and CEO of Mid Penn Bancorp Inc. He also noted that the bank expects 2024 to be another challenging year, particularly for financial institutions with a heavy reliance on the spread business.

Mid Penn's total noninterest income for Q4 decreased slightly to $5.1 million from $5.3 million in the previous quarter. Noninterest expense saw a decrease of $2.4 million to $27.5 million in Q4 from $29.9 million in Q3. The bank's asset quality showed improvement, with nonperforming assets totaling $14.5 million at the end of Q4, and the provision for credit losses on loans decreasing to $221.0 thousand for the quarter.

Shareholders equity increased year-over-year by 6.15% to $543.6 million, primarily due to the acquisition of Brunswick Bancorp. The bank's regulatory capital ratios indicate that it is well-capitalized, and a quarterly cash dividend of $0.20 per share was declared, underscoring the bank's capital strength.

Overall, Mid Penn Bancorp Inc's Q4 earnings report reflects a strong financial position, with significant loan growth and improved asset quality. The bank's strategic focus on growth and expense control, despite a challenging interest rate environment, positions it well for the future.

Explore the complete 8-K earnings release (here) from Mid Penn Bancorp Inc for further details.

This article first appeared on GuruFocus.