MidCap Financial Investment Corp Reports Strong Quarterly and Annual Performance

Net Investment Income: $0.46 per share for Q4 2023, up from $0.43 in Q3 2023.

Net Asset Value (NAV): Increased to $15.41 per share as of December 31, 2023, from $15.28 in the previous quarter.

Dividend: Declared at $0.38 per share, payable on March 28, 2024.

Total Assets: Grew slightly to $2.50 billion as of December 31, 2023.

Debt-to-Equity Ratio: Remained stable at 1.45x, reflecting prudent capital management.

Investment Activity: Net investment activity was negative $46.5 million for Q4, with new investments totaling $134.1 million.

Share Repurchase Program: No shares repurchased in Q4, with $26.9 million remaining under the current authorization.

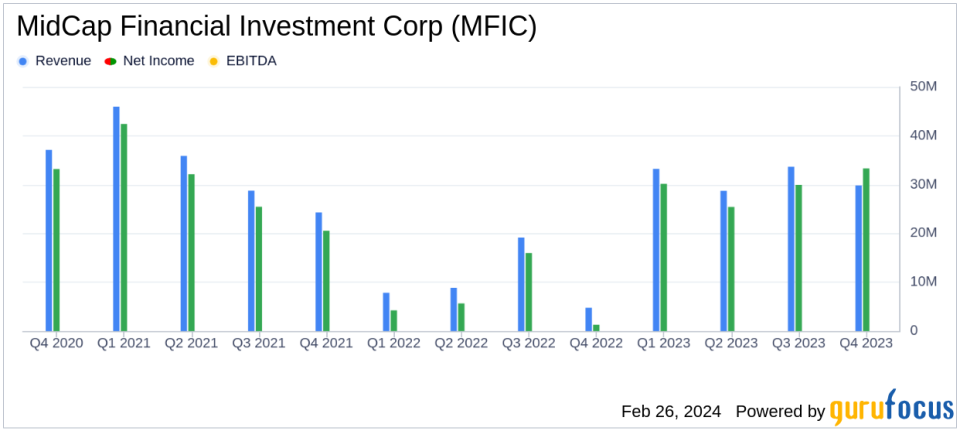

On February 26, 2024, MidCap Financial Investment Corp (NASDAQ:MFIC) released its 8-K filing, detailing its financial results for the quarter and fiscal year ended December 31, 2023. MFIC, an externally managed Business Development Company focused on senior debt solutions to middle market companies, has reported a solid increase in net investment income and net asset value per share, alongside a stable dividend payout.

Financial Performance and Strategic Highlights

CEO Tanner Powell expressed satisfaction with the year's strong results, emphasizing the increase in net investment income and NAV, as well as stable credit quality. The strategic shift towards first lien floating rate loans was highlighted as a key factor in the year's success. CFO Gregory W. Hunt noted the execution of two transactions to diversify and extend the maturity of MFIC's funding sources, including a first CLO transaction and the raising of unsecured debt.

Portfolio and Investment Activity

MFIC's investment portfolio saw a fair value decrease to $2.33 billion from $2.37 billion in the previous quarter. The company made significant new investments in portfolio companies, although net investment activity was negative due to repayments. The number of portfolio companies increased to 152 by the end of the period.

Operating Results and Liquidity

The company's net investment income for the fourth quarter was $29.8 million, and the net increase in net assets resulting from operations was $33.3 million. MFIC's liquidity position remains strong, with a diverse set of debt obligations and substantial available capacity under its revolving credit facility.

Market Position and Future Outlook

MFIC's performance reflects a well-managed portfolio and a strategic approach to investment in the middle market sector. The proposed merger with Apollo Senior Floating Rate Fund Inc. and Apollo Tactical Income Fund Inc. is anticipated to create a larger, more scaled BDC focused on middle market direct lending, which could further enhance MFIC's market position.

Investors and stakeholders are encouraged to review the full 8-K filing for a detailed understanding of MFIC's financials and strategic direction. The company will host a conference call to discuss the earnings report and provide additional insights into its performance and outlook.

For further information and to access the supplemental information package, please visit the Shareholders section of MFIC's website at www.midcapfinancialic.com.

Contact Elizabeth Besen, Investor Relations Manager, at 212.822.0625 or ebesen@apollo.com for any inquiries.

Explore the complete 8-K earnings release (here) from MidCap Financial Investment Corp for further details.

This article first appeared on GuruFocus.