Middle East Military Vehicles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

Middle East Military Vehicles Market Middle East Military Vehicles

Dublin, March 15, 2024 (GLOBE NEWSWIRE) -- The "Middle East Military Vehicles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)" report has been added to ResearchAndMarkets.com's offering.

The Middle East Military Vehicles Market size is estimated at USD 32.22 billion in 2024, and is expected to reach USD 43.73 billion by 2029, growing at a CAGR of 6.30% during the forecast period (2024-2029).

While countries like Saudi Arabia, Israel, and the United Arab Emirates operate modern military vehicles, several countries in the region possess Soviet-era vehicles that require modernization. Hence, these countries are investing in the procurement of new military vehicles.

In addition, the aging fleet of military vehicles is also forcing some countries to invest in upgrade programs to improve the efficiency, lethality, and sophistication of the vehicles if they are slated to be effectively functional for some more years.

While the modernization and expansion of the region's vehicle fleets continue at a healthy pace, the region is also becoming increasingly self-sufficient and independent of foreign countries by developing indigenous manufacturing capabilities. Several countries have been developing military vehicles on their own or are partnering with their foreign counterparts and manufacturing vehicles locally with the help of technology transfer agreements.

However, factors like fluctuations in oil prices are affecting the economies of several countries in Middle East, in turn affecting growth in military spending.

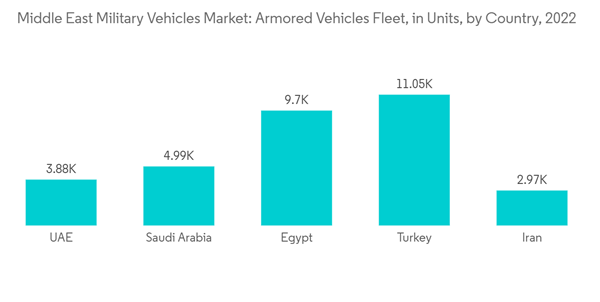

Turkey to Dominate Market Share During the Forecast Period

Turkey has been significantly investing in its defense industry and expanding production. The recent focus on domestic design and production stems from an increase in potential threats from Russia and various militant groups and from sanctions placed on Turkey's defense industry by its NATO allies. In this context, in May 2023, Turkey's FNSS Defence Systems was contracted to provide capability enhancement to the Turkish Army's ACV-15 advanced armored personnel carriers (AAPCs). The agreement was signed to boost the vehicle's performance and extend its service life for an additional 20 years. According to the company, an undisclosed number of AAPCs will be fitted with modern subsystems to support more missions and help address sophisticated threats on the battlefield.

Turkey's procurement and defense authorities have launched a program designed to increase the structural life of the country's existing fleet of F-16 Block 30 jets from 8,000 flight hours to 12,000. The upgrades may cover 1,200 to 1,500 parts per aircraft.

In addition, Turkey has vastly advanced in armored vehicle manufacturing and is acquiring new vehicles to modernize its fleet and with its interest in upgrading its naval fleet to further contribute to the growth of the market. For instance, in April 2023, the Turkish Navy received its largest vessel, the amphibious assault ship TCG Anadolu which is Turkey's first landing platform dock. The military will deploy heavy helicopters, drones and light-attack aircraft from the vessel.

Middle East Military Vehicles Industry Overview

The Middle East military vehicles market is semi-consolidated and is marked by the presence of several local and international players vying for a larger market share. Some of the prominent players include Rostec, Lockheed Martin Corporation, The Boeing Company, Saudi Arabian Military Industries (SAMI), and Leonardo S.p.A.

The growing focus on indigenous manufacturing of military vehicles is anticipated to increase the market share of local players during the forecast period. Countries like Turkey, Saudi Arabia, and the United Arab Emirates are the frontrunners in indigenous manufacturing. For instance, Saudi Arabia is focused on enhancing its defense weapon and ammunition manufacturing capability to reduce its dependency on the export of military equipment and weapons in line with the Saudi government's Vision 2030. The government plans to increase the local military equipment spending to 50% by 2030. Saudi Arabian Military Industries (SAMI), BMC Otomotiv Sanayi ve Ticaret AS, and Denel SOC Ltd are prominent local manufacturers.

A selection of companies mentioned in this report includes

ROSTEC

Lockheed Martin Corporation

The Boeing Company

Abu Dhabi Ship Building Co.

Israel Aerospace Industries Ltd

BMC Otomotiv Sanayi ve Ticaret A.S.

Fincantieri SpA

Saudi Arabian Military Industries (SAMI)

Dassault Aviation SA

Naval Group

Denel SOC Ltd

BAE Systems PLC

Oshkosh Corporation

Airbus SE

Leonardo SpA

Patria Group

FNSS Savunma Sistemleri A.S.

For more information about this report visit https://www.researchandmarkets.com/r/fr48x6

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900