Middleby (MIDD) Acquires Dublin-Based Marco Beverage System

The Middleby Corporation MIDD has acquired Marco Beverage Systems, a designer and manufacturer of innovative and energy-efficient beverage dispensing solutions. Located in Dublin, Ireland, Marco Beverage generates annual revenues of $30 million. Apart from Dublin, the company has a facility in Ningbo, China.

The acquisition complements Middleby’s existing beverage portfolio, expanding the company’s cold brew dispense, coffee brewers, and a variety of hot, cold and sparkling water dispenser offerings. The buyout also allows MIDD to leverage Macro Beverage’s touchless and in-counter dispense technology solutions, which are in demand due to its space-saving and handy features.

Middleby’s measures to expand market share, product portfolio and customer base by carrying out successive acquisitions are expected to foster growth. Last month it acquired Escher Mixers, a manufacturer of spiral and planetary mixers. The acquisition builds on Middleby’s existing bakery brands, offering full-line integrated solutions for lower operating costs and enhanced production efficiencies.

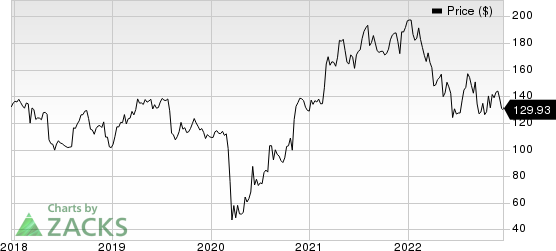

The Middleby Corporation Price

The Middleby Corporation price | The Middleby Corporation Quote

Also, in July, the company acquired Colussi Ermes, expanding its food processing solutions. The buyout of CP Packaging in the same month expanded its manufacturing operations in the Food Processing Equipment Group by boosting packaging equipment offerings. In July, MIDD also acquired Icetro, adding to its growing portfolio of beverage brands, expanding its Asian manufacturing capabilities and providing solutions to support customers in the expanding international markets.

Zacks Rank & Stocks to Consider

MIDD carries a Zacks Rank #4 (Sell) at present.

Some better-ranked companies from the Industrial Products sector are discussed below:

Applied Industrial Technologies, Inc. AIT presently sports a Zacks Rank #1 (Strong Buy) and a trailing four-quarter earnings surprise of 24.8%, on average. You can see the complete list of today’s Zacks #1 Rank stocks.

AIT’s earnings estimates have increased 4.6% for fiscal 2023 in the past 60 days. Shares of Applied Industrial have risen 37.5% in the past six months.

IDEX Corporation IEX presently has a Zacks Rank #2 (Buy). IEX’s earnings surprise in the last four quarters was 5.7%, on average.

In the past 60 days, IDEX’s earnings estimates have increased 1.9% for 2022. The stock has rallied 28.9% in the past six months.

EnerSys ENS delivered an average four-quarter earnings surprise of 2.1%. ENS presently carries a Zacks Rank of 2.

ENS’ earnings estimates have increased 0.6% for fiscal 2023 in the past 60 days. The stock has gained 21.8% in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

IDEX Corporation (IEX) : Free Stock Analysis Report

The Middleby Corporation (MIDD) : Free Stock Analysis Report

Enersys (ENS) : Free Stock Analysis Report