Middleby (MIDD) Q3 Earnings Miss, Revenues Jump 22% Y/Y

The Middleby Corporation MIDD reported third-quarter 2022 adjusted earnings (excluding 26 cents from non-recurring items) of $2.18 per share, which missed the Zacks Consensus Estimate of $2.36. The bottom line increased 13.5% year over year on higher sales.

Net sales of $992.9 million missed the Zacks Consensus Estimate of $1,021.3 million. The top line jumped 21.5% year over year. Organic revenues in the reported quarter increased 14.2% year over year due to improved market conditions and strong consumer demand. Acquired assets boosted sales by 10.9%, while movements in foreign currencies had a negative impact of 3.6%.

Segmental Results

Sales from the Commercial Foodservice Equipment Group (representing 62.8% of the net sales) were $623.66 million, up 21.9% year over year. Organic sales in the reported quarter increased 17%. Buyouts boosted sales by 7.4%, while movements in foreign currencies had a headwind of 2.5%.

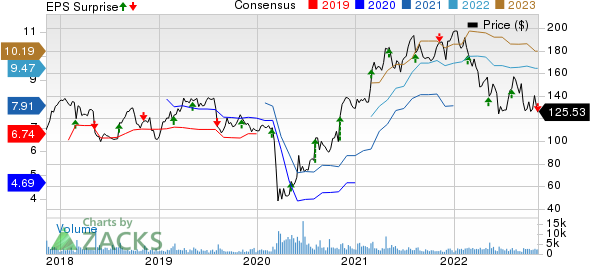

The Middleby Corporation Price, Consensus and EPS Surprise

The Middleby Corporation price-consensus-eps-surprise-chart | The Middleby Corporation Quote

Sales from the Residential Kitchen Equipment Group (representing 22.3% of the reported quarter’s net sales) totaled $220.97 million, up 14.3% year over year. Organic sales in the quarter under review increased 2.3%. Buyouts had a positive impact of 17.7%, whereas movements in foreign currencies had a negative impact of 5.7%.

Sales from the Food Processing Equipment Group (representing 14.9% of the reported net sales) summed $148.24 million, up 31.6% year over year. Organic sales in the quarter jumped 21.7%, while movements in foreign currencies had a negative impact of 4.8%.

Margin Profile

In the third quarter, Middleby’s cost of sales increased 21.2% year over year to $627.64 million. Gross profit expanded 21.9% to $365.23 million. Gross margin increased to 36.8% from 36.6% in the year-ago quarter.

Selling, general and administrative expenses increased 14.7% year over year to $201.20 million. Operating income in the third quarter dropped 30.7% year over year to $161.71 million. Operating margin decreased to 16.3% from 28.6% in the year-ago period.

Balance Sheet and Cash Flow

Exiting the third quarter, Middleby had cash and cash equivalents of $144.92 million compared with $180.36 million at the end of December 2021. Long-term debt was $2.69 billion at the end of the third quarter compared with $2.39 billion at the end of 2021.

In the first nine months of 2022, MIDD generated net cash of $173.45 million from operating activities compared with $346.04 million at the end of the year-ago period. Capital expenditure (net of sale proceeds) totaled $50.91 million compared with $23.67 million at the end of the first nine months of 2022. Free cash flow was $122.54 million in the first nine months of 2022, down 62% from the year-ago period.

Zacks Rank & Key Picks

Middleby currently carries a Zacks Rank #3 (Hold).

Some better-ranked companies within the broader Industrial Products sector are as follows:

Enerpac Tool Group Corp. EPAC delivered an average four-quarter earnings surprise of 3.4%. EPAC presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks.

Enerpac Tool’s estimated earnings growth rate for the current fiscal year is 44.6%. Shares of the company have jumped 32.3% in the past six months.

Applied Industrial Technologies, Inc. AIT presently flaunts a Zacks Rank #1. The company delivered a trailing four-quarter earnings surprise of 24.8%, on average.

Applied Industrial has an estimated earnings growth rate of 14.3% for the current fiscal year. Shares of the company have gained 23% in the past six months.

IDEX Corporation IEX presently has a Zacks Rank of 2 (Buy). IDEX pulled off a trailing four-quarter earnings surprise of 5.7% on average.

IDEX has an estimated earnings growth rate of 28.3% for the current year. Shares of the company have rallied 21.5% in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

IDEX Corporation (IEX) : Free Stock Analysis Report

The Middleby Corporation (MIDD) : Free Stock Analysis Report

Enerpac Tool Group Corp. (EPAC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research