Middlefield Banc Corp. (MBCN) Reports Record Annual Net Income for 2023

Net Interest Income: Increased by 29.9% to $65.2 million for the full year 2023.

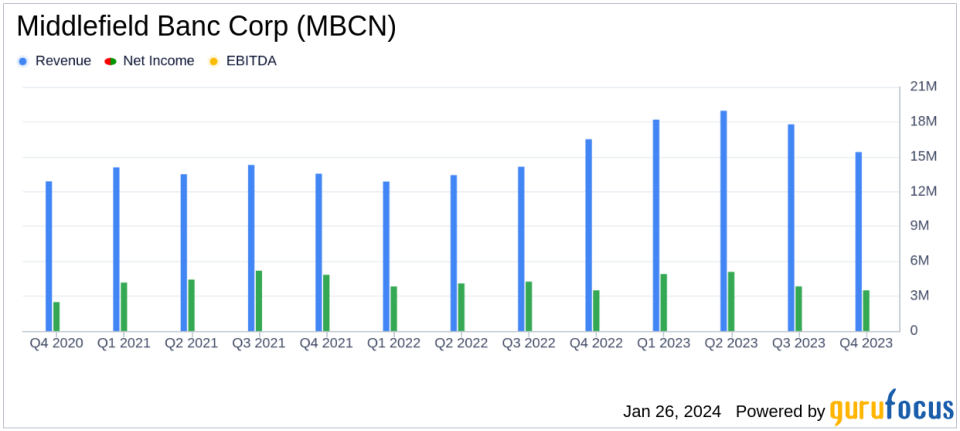

Net Income: Reached $17.4 million for 2023, translating to $2.14 per diluted share.

Total Assets: Grew by 8.0% to $1.82 billion as of December 31, 2023.

Loan Portfolio: Expanded by 9.3% year-over-year, totaling $1.48 billion.

Dividends: Increased by 4.9% to $0.85 per share for the full year 2023.

Asset Quality: Remains strong with a conservative underwriting approach and balanced portfolio.

Stockholders Equity: Increased by 4.0% to $205.7 million at the end of 2023.

Middlefield Banc Corp. (NASDAQ:MBCN) released its 8-K filing on January 26, 2024, detailing its financial results for the three and twelve months ended December 31, 2023. The Ohio-based bank holding company, which provides a range of banking services including commercial loans and deposit accounts, reported a historic year with record total assets, stockholders equity, and annual net income.

Financial Performance and Strategic Growth

Ronald L. Zimmerly, Jr., President and CEO, highlighted the successful integration of the Liberty Bancshares, Inc. merger as a key driver for the year's achievements. The merger expanded Middlefield's presence in Western and Central Ohio, enhancing the company's management team and banking capabilities. Despite the uncertain economic outlook for 2024, Zimmerly expressed confidence in the company's growth and profitability, underpinned by stable economic activity and employment within Ohio markets.

Income Statement Highlights

Net interest income for 2023 surged by 29.9% to $65.2 million, with a net interest margin of 4.04%. The fourth quarter saw a 9.2% increase in net interest income to $15.4 million. Noninterest income remained stable at $6.7 million for the year, while noninterest expenses rose to $48.1 million, largely due to the Liberty merger and increased personnel expenses. Net income for the year reached $17.4 million, or $2.14 per diluted share, with pre-tax, pre-provision net income growing by 25.7% to $23.8 million.

Balance Sheet Strength

Total assets grew to $1.82 billion, with loans increasing by 9.3% to $1.48 billion. Total liabilities also rose to $1.62 billion. The company's deposit portfolio grew modestly by 1.8%, with a notable increase in brokered deposits. The investment securities available for sale portfolio stood at $170.8 million.

Asset Quality and Stockholders' Equity

Michael Ranttila, CFO, emphasized the company's historically strong asset quality, with a conservative underwriting standard and balanced portfolio composition. Stockholders' equity increased by 4.0% to $205.7 million, with tangible stockholders' equity at $162.7 million. The company declared cash dividends of $0.85 per share for the full year, a 4.9% increase from the previous year.

Asset Quality Metrics

Provisions for credit losses were $3.0 million for the year, reflecting the adoption of new accounting standards. Net recoveries were $31,000, with nonperforming loans at $10.9 million, up from $2.1 million the previous year. The allowance for credit losses stood at $21.7 million, or 1.47% of total loans.

Conclusion

Middlefield Banc Corp. (NASDAQ:MBCN) has demonstrated resilience and strategic growth in a challenging economic climate. With a strong balance sheet, robust asset quality, and a focus on shareholder returns, the company is well-positioned for continued success in the coming year.

For a detailed analysis of Middlefield Banc Corp.'s financial results and strategic outlook, investors and interested parties can access the full earnings report here.

Explore the complete 8-K earnings release (here) from Middlefield Banc Corp for further details.

This article first appeared on GuruFocus.