Middlefield (MBCN) Stock Gains on Special Dividend Announcement

Middlefield Banc Corp.’s MBCN shares have rallied 5.6% in the Nov 14 trading session in response to the announcement of a special dividend of 5 cents per share.

The company also announced a regular quarterly dividend of 20 cents per share. Both dividends will be paid out on Dec 15 to shareholders on record as of Dec 1. Prior to this, it had declared a special dividend in November 2022.

James R. Heslop, II, CEO of MBCN, commented, “The ability to increase our dividend in 2023, combined with this year’s special dividend, reflects the strength of our balance sheet and business model, as well as our long-standing commitment to reward shareholders. In fact, our annual cash dividend has increased from $0.57 per share in 2019 to $0.85 per share in 2023, representing a 10.5% compound annual growth rate.”

Middlefield regularly hikes its dividend. The company last increased its dividend by 17.6% to 20 cents per share in November 2022. Based on the last day’s closing price of $28.73, its dividend yield currently stands at 2.95%.

MBCN raised its quarterly dividend five times in the last five years. It also has a five-year annualized dividend growth of 8.5%. Currently, the company's payout ratio is 32% of earnings.

Apart from the regular dividend payments, MBCN has a share repurchase program in place. In February 2022, the company announced a new share repurchase program, under which it is authorized to repurchase up to 300,000 common shares. This February, it announced the repurchase of an additional 300,000 shares under the program. As of Sep 30, 2023, Middlefield repurchased 306,090 shares.

In the last three to five years, the company witnessed earnings per share growth of 13% compared with the industry’s average of 10.9%. Further, its debt/equity ratio of 0.06 compares favorably with the industry average of 0.40. This reflects the company’s strong financial health.

Supported by its earnings strength and capital position, it is expected to continue with efficient capital distribution activities. Through this, Middlefield will keep enhancing shareholder value.

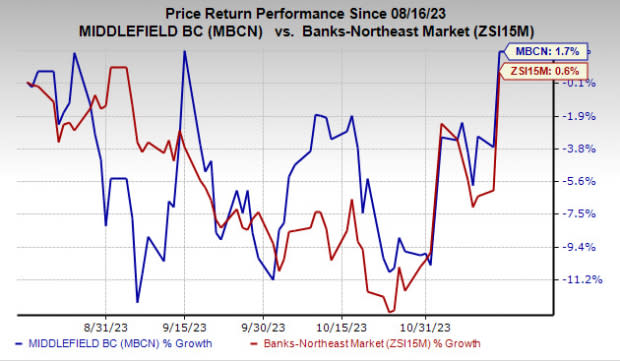

In the past three months, shares of MBCN have gained 1.7% compared with the industry’s rise of 0.6%.

Image Source: Zacks Investment Research

Middlefield currently carries a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Companies Taking Similar Steps

Last month, Bank OZK OZK and City Holding Company CHCO announced increases in their quarterly dividend payouts.

OZK declared a quarterly cash dividend of 37 cents per share, marking an increase of 2.8% from the prior quarter. The dividend was paid out on Oct 20, to shareholders of record as of Oct 30. This represented the 53rd consecutive quarter of a dividend hike.

Prior to the recent hike, Bank OZK raised its dividend by 2.8% to 36 cents per share in July. Also, the company has a five-year annualized dividend growth of 10.6%. Currently, its payout ratio is 25% of earnings.

CHCO announced a quarterly cash dividend of 71.5 cents per share, indicating an increase of 10% from the prior payout. The dividend was paid out on Oct 31 to shareholders of record as of Oct 13.

Prior to the recent hike, it increased its dividend by 8.3% in September 2022. CHCO raised its quarterly dividend five times in the last five years. Also, it has a five-year annualized dividend growth of 4.5%. Currently, the company's payout ratio is 32% of earnings.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

City Holding Company (CHCO) : Free Stock Analysis Report

Middlefield Banc Corp. (MBCN) : Free Stock Analysis Report

Bank OZK (OZK) : Free Stock Analysis Report