Midterm election aftermath: 3 things investors should expect if Democrats take the House

Wall Street can agree on one thing ahead of Tuesday’s hotly contested midterm elections: Democrats are likely to gain control of the House of Representatives and that it would have certain implications for investors.

“For markets, the key issues are whether to expect further fiscal stimulus, and what the implications are for trade policy. On the former, unified Republican control is likely more bullish, while on the latter, divided government could de-escalate the current trade conflict,” writes Deutsche Bank strategist Quinn Brody.

Wells Fargo strategist Sam Bullard sounds a slightly more hawkish tone.

“If the base case of a split Congress materializes, prospects of legislative gridlock would increase. In turn, a divided Congress would likely leave the direction of fiscal policy largely unchanged, with no major changes to spending, taxes, or trade policies,” said Bullard in a note.

Yahoo Finance quickly assesses three things likely to emerge if the Dems steal the headlines on Tuesday.

Increased policy uncertainty

Wall Street is clinging to the notion that because historical data says stocks often rally after midterm elections (by about 8%) that they will do so again. Policy gridlock — caused by a Democratic taking of the House — is being seen as a check on President’s Donald Trump’s trade war ambitions. That would be a win for corporations.

Ultimately the only thing gridlock sows is uncertainty across many sectors of the stock market, which investors would probably hate.

Cautions Goldman Sachs strategist Ben Snider, “If the consensus expectation of a divided government turns out to be correct, the most likely political consequences would be an increase in investigations and uncertainty surrounding fiscal deadlines.”

Good luck going long Boeing (BA) and Amazon (AMZN) in that tumultuous backdrop.

Adds Snider, “Defense stocks and others directly exposed to government spending could face pressure if an inability to reach bipartisan compromise leads to fiscal tightening.”

Couple this backdrop with a Federal Reserve on track to raise interest rates at least three times in 2019, and investors could be in for a wild ride.

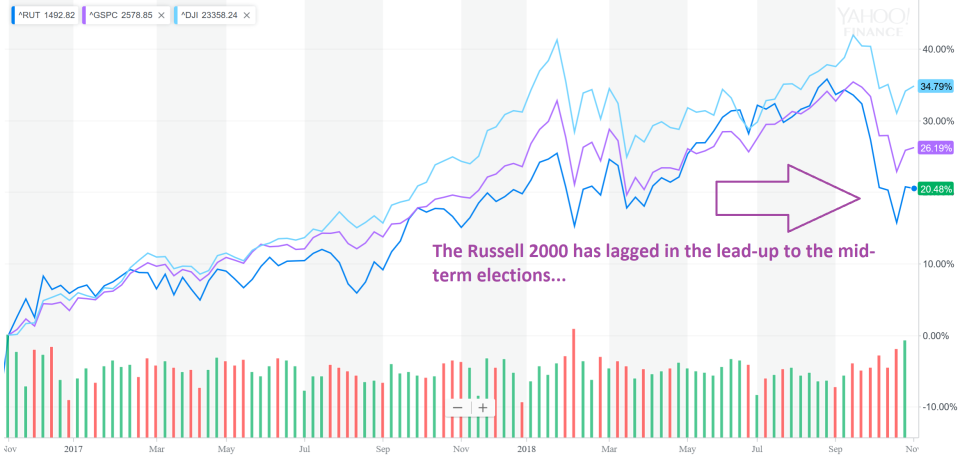

Small-cap stocks could tank

Shares of small-cap companies have been on fire under the Trump presidency. The small-cap Russell 2000 has logged a solid 20% gain over the past two years. It has only begun to underperform the S&P 500 since September in the lead-up to the midterms.

But before the recent slump, the market viewed these companies as the prime beneficiaries of Trump’s push to deregulate Corporate America.

If the Democrats gain the House, investors could see that as a sign the friendly backdrop for small-cap stocks/companies is poised to end.

“If midterm election results signal an obstacle to the current Republican government’s stated goal of deregulation, small business sentiment and the performance of these firms may be vulnerable,” Snider writes. “This ‘policy premium’ [for smaller companies] has diminished in recent months but could fall further if the results of elections this fall lead investors to expect a less friendly regulatory environment in the future.”

Kiss Trump’s big tax cut 2.0 goodbye

Should the Democrats win the House, investors will likely grow worried about rising personal income taxes. Under Trump’s tax plan, passed in 2017, personal income taxes are set to rise starting in 2025. Trump may not have the support to pass a 10% tax cut, as he has recently articulated, or extend the ones he put in place in 2017.

“Unless Republicans are able to secure a 60-seat majority in the Senate, however, this would require bipartisan support or some way to offset the cost of making the tax cuts permanent. This is because the reconciliation process, which was used to pass the TCJA with less than 60 votes, is likely not an option for making the individual tax cuts permanent,” explained Wells Fargo’s Jay Bryson in a note.

“Thus, from our point of view, the likelihood of a significant fiscal contraction or expansion from a change in tax policy next year is relatively small, absent a major change in economic conditions.”

It’s unlikely consumer companies such as Walmart (WMT) or Target (TGT) would see a harsh market reaction in response to the midterms owing to fears of tax increases. But it’s something to keep in mind for those investing beyond 2025.

—

Brian Sozzi is an editor-at-large at Yahoo Finance. Follow him on Twitter @BrianSozzi

Read more:

Coca-Cola CEO: Why we aren’t getting into the alcohol business

Hershey CEO: We are having a game-changing year

Panera Bread CEO: Here’s how you will order your food in the future

PepsiCo CFO: There are no plans to break up the company

Former Cisco CEO John Chambers on tech’s biggest problem

Burger King’s CEO shrugs off Wall Street’s worries

Roku Founder: The golden age of TV is just beginning

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.