MidWestOne Financial Group Inc Reports Mixed Results Amid Strategic Shifts

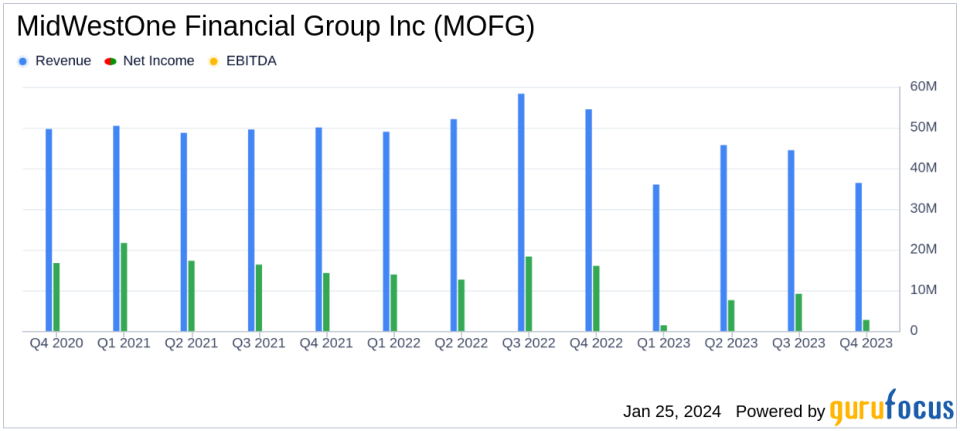

Net Income: Q4 net income of $2.7 million, full-year net income of $20.9 million.

Loan Growth: Annualized loan growth of 6.1% in Q4.

Deposits: Core deposit growth in Q4, with a slight increase of 0.6% excluding brokered deposits.

Balance Sheet Repositioning: Sold $115.2 million of securities in Q4, proceeds used to purchase higher yielding debt securities and reduce short-term borrowings.

Net Interest Margin: Decreased to 2.22% in Q4 from 2.35% in the previous quarter.

Tangible Book Value: Increased by 9% to $27.90.

Dividend: Declared a cash dividend of $0.2425 per common share, payable on March 15, 2024.

On January 25, 2024, MidWestOne Financial Group Inc (NASDAQ:MOFG) released its 8-K filing, detailing the financial results for the fourth quarter and full year of 2023. The company, a bank holding company known for its relationship-based business and personal banking products and services, faced both growth and challenges during the period.

Performance and Challenges

MidWestOne Financial Group Inc reported a net income of $2.7 million, or $0.17 per diluted common share for the fourth quarter, which included securities net losses and other costs. For the full year, net income stood at $20.9 million, or $1.33 per diluted common share. The company's performance reflects its strategic initiatives, including balance sheet repositioning and loan growth. However, funding cost pressure continued to impact margins and earnings, with the net interest margin decreasing to 2.22% in Q4 from 2.35% in the previous quarter.

Despite these challenges, the company's loan portfolio grew by an annualized rate of 6.1% in the fourth quarter, and deposits, excluding brokered deposits, increased by $31.4 million. The tangible book value also saw a significant increase of 9% to $27.90. These achievements are crucial for the bank as they indicate a solid foundation for future growth and stability in the competitive banking industry.

Financial Highlights

MidWestOne's balance sheet repositioning involved the sale of $115.2 million of securities, with proceeds used to purchase higher yielding debt securities and reduce short-term borrowings. This strategic move is aimed at improving the bank's interest income in the face of rising interest rates.

The bank's efficiency ratio, a key metric indicating the cost of generating revenue, stood at 70.16% for the quarter, reflecting the bank's ongoing efforts to manage expenses and improve operational efficiency.

"We are well ahead of plan in executing our strategic initiatives designed to improve our performance and position the Bank to deliver financial results at the median of our peer group by the end of 2025," said Charles (Chip) Reeves, Chief Executive Officer of the Company.

The bank's credit quality remained stable, with a nonperforming assets ratio of 0.47% and a net charge-off ratio of 0.20%. The allowance for credit losses ratio was 1.25% at the end of the year.

Looking Ahead

MidWestOne Financial Group Inc is poised to close on the acquisition of Denver Bankshares, Inc early in the first quarter of 2024, which is expected to further strengthen its market position. The bank also declared a cash dividend of $0.2425 per common share, signaling confidence in its financial stability and commitment to shareholder returns.

The company's CEO expressed optimism about the bank's ability to grow its core deposit franchise and highlighted the expansion of major market banking teams as a key driver of growth. With strategic hires and the expansion of specialty business lines, MidWestOne is focused on scaling in core markets and improving growth and returns.

Value investors may find MidWestOne's strategic initiatives and focus on core growth areas appealing, as the bank positions itself for improved financial performance in the coming years.

Explore the complete 8-K earnings release (here) from MidWestOne Financial Group Inc for further details.

This article first appeared on GuruFocus.