Mill City Ventures III: A Hidden Gem in the Specialty Finance Domain

Some banks have been taking a more cautious approach towards lending as a result of the unfavorable economic situation. When combined with the rate hikes by the Federal Reserve, the gap between banks and specialty finance companies in terms of borrowing costs has narrowed and could present excellent lending opportunities for the latter.

Ordinarily, most non-banking finance companies are known to have a risker and more aggressive lending approach, but the ones with a strong risk management framework in play often end up generating excellent returns in my experience. I recently came across one such specialty finance player within the micro-cap domain that appears to be promising based on its unique credit policy and speedy processing times: Mill City Ventures III Ltd. (NASDAQ:MCVT).

Company overview

Mill City Ventures III is a Minnesota-based specialty finance company that is focused on lending to public and private companies as well as investing in the occasional equity deal. Its investments are mostly in the form of growth capital that funds the borrowers growth, expansion and start-up costs. Apart from financing, the company also offers a certain extent of managerial support to privately held and publicly traded companies. The company seeks some form of active investment and advises the businesses in its portfolio on financial and operational matters.

Like most other specialty finance players, the company's goal is also to provide investment returns that are above the market average. When we talk about the nature of lending and investment products, Mill City Ventures is known to offer litigation finance, asset-backed loans, title loans, tax anticipation loans, real estate bridge loans, mortgages and other financial services.

High-risk, high-return lending

Mill City Ventures started off as a business development company in 2013 and gradually transitioned into a full-fledged specialty finance company and non-banking lender. It falls in the group of specialty finance companies, which are essentially non-bank lenders that extend credit to SMBs who might otherwise have trouble obtaining financing.

They have their own differentiated credit policy to assess each loan application. The company does not have much of a formulaic, ratio-driven approach like the average bank and looks to focus on qualitative factors as well as hard data like the borrower's intention and ability to pay and the asset value of any pledged collateral. As the lending criteria are far more flexible than other financial institutions, Mill City Ventures is able to charge a higher processing fee and a higher interest rate. Its borrowers benefit from a quick processing time, which for some makes up for the higher cost of borrowing, and it also ensures a good flow of lending opportunities into the business.

The companys business structure involves fewer reporting requirements than banks, which give it a lot of flexibility. For example, it could easily lend over 50% of its corpus if it came across a good high-value lending opportunity without going through a regulatory nightmare. Also, a large percentage of its earnings in the form of interest and processing fees trickle down to the bottom-line as it has a relatively small staff, low overheads and a flat organizational structure, implying a significantly lower cost of processing proposals, with speedy loan request decision-making.

Key financial metrics

Banks' and financial institutions financial statements are relatively tricky to analyze as they are very different from those of regular companies. It is easier to directly analyze some very specific financial metrics that can help determine how the company is performing.

First of all, let us look at the capital employed. According to its most recent balance sheet, Mill City Ventures is managing close to $17 million, which it has raised through a combination of debt and equity that it lends in the market. Trailing 12-month revenue of $3.67 million and net income of $1.23 million are currently being reported through the investment of these funds. The company is able to generate after-tax profitability of between 7% and 8% on its capital employed.

It is important to mention that there has been no real non-performing asset reported by the company so far, and interest flows appear to be regular as per cash flows, which means that the risk management policies are robust. Also, the companys capital employed has grown from close to $9 million in 2016 to around $17 million today, but its performance has been reasonably consistent.

Past success stories

Mill City Ventures investor presentation talks about a number of specialized lending scenarios where the company saw success in the past.

Alatus Development LLC, one of their borrowers, raised a loan of $3.9 million to continue working on ongoing apartment development projects. The borrower had a sizable net worth and needed fast capital with repayment taking place after the apartments were sold. Alatus sold various apartment buildings and repaid Mill City Ventures, and the company made a net interest and closing fee income of $365,000.

Another example is Mill City Ventures $3.4 million loan to Villas at 79th, which enabled the company to close on the land and apply for final development approvals. The management claims to have generated a 58.29% return on investment on this short-term lending transaction.

Final thoughts

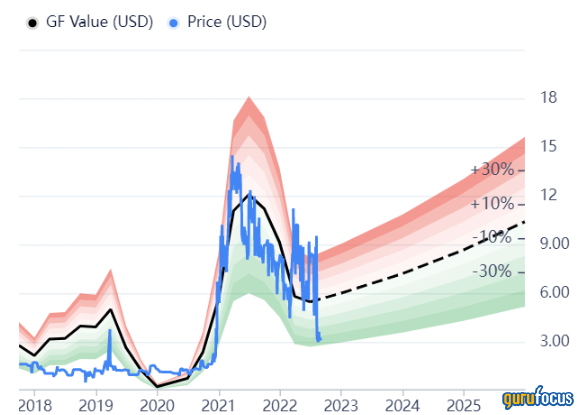

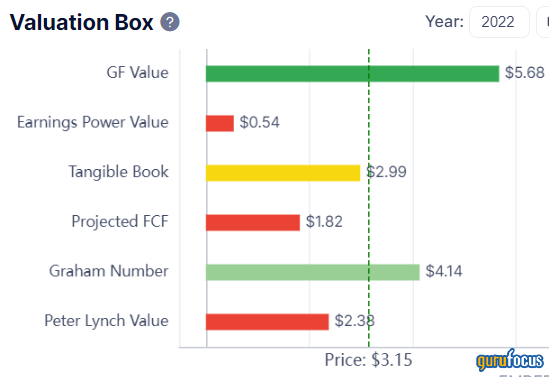

As we can see above, Mill City Ventures' stock is undervalued based on the GF Value chart. The companys current return on assets of 7.21% is well above the average of the credit services industry and its debt-to-equity ratio of 0.15 is also an indicator of a very low amount of leverage.

We can see that the current stock price is well below the GF Value as well as the Graham Number. I am confident in the company's risk management strategy; CEO Douglas Polinsky is a veteran in the investment management industry and has vast experience of lending to public and private companies while being employed at reasonably well-known funds. Overall, I believe Mill City Ventures could be a promising small-cap value opportunity within the specialty finance domain.

This article first appeared on GuruFocus.