MILLENNIUM MANAGEMENT LLC Bolsters Portfolio with Enanta Pharmaceuticals Inc (ENTA) Shares

Introduction to the Transaction

On November 7, 2023, MILLENNIUM MANAGEMENT LLC (Trades, Portfolio), a prominent investment firm, expanded its investment portfolio by adding shares of Enanta Pharmaceuticals Inc (NASDAQ:ENTA). This strategic move involved the acquisition of 1,024,676 shares in the biotechnology company, reflecting the firm's confidence in Enanta's market potential and future growth prospects.

Profile of Millennium Management LLC

Founded in 1989 by Israel Englander and Ronald Shear, MILLENNIUM MANAGEMENT LLC (Trades, Portfolio) has evolved from its initial $35 million in seed money to a significant player in the hedge fund industry. The firm's investment strategies include statistical arbitrage, fundamental long-short pairing, merger arbitrage, and convertible arbitrage. With a global investment approach, MILLENNIUM MANAGEMENT LLC (Trades, Portfolio) aims for absolute returns, emphasizing capital preservation and risk minimization across diversified portfolios. The firm's structure allows individual trading teams to focus on specialized opportunities while maintaining overall risk oversight by the executive team. As of 2015, the firm boasts over 1,650 employees and has surpassed $30 billion in assets under management.

Enanta Pharmaceuticals Inc at a Glance

Enanta Pharmaceuticals Inc, headquartered in the USA, is a biotechnology firm dedicated to developing molecule drugs for viral infections and liver diseases. Since its IPO on March 21, 2013, Enanta has been at the forefront of research, particularly in creating antiviral inhibitors for hepatitis C. Despite its innovative approach, the company's financial health and stock performance have been under scrutiny, with a current market capitalization of $182.971 million and a stock price of $8.69, indicating challenges in the highly competitive biotechnology sector.

Transaction Specifics

The transaction on November 7 saw MILLENNIUM MANAGEMENT LLC (Trades, Portfolio) add 791,189 shares of ENTA at a trade price of $9.11. This increased the firm's total holdings in Enanta Pharmaceuticals to 1,024,676 shares, representing a 4.90% stake in the company. However, the trade did not significantly impact the firm's portfolio due to the zero trade impact reported.

Analysis of Enanta Pharmaceuticals' Market Position

Enanta Pharmaceuticals' current market position is somewhat precarious, with a stock price-to-GF Value ratio of 0.21, suggesting that the stock may be undervalued. However, the GF Value designation of "Possible Value Trap, Think Twice" indicates that investors should exercise caution. The stock has experienced a -4.61% decline since the transaction and a significant -81.01% drop year-to-date, reflecting the stock's volatility and the market's uncertain response to its prospects.

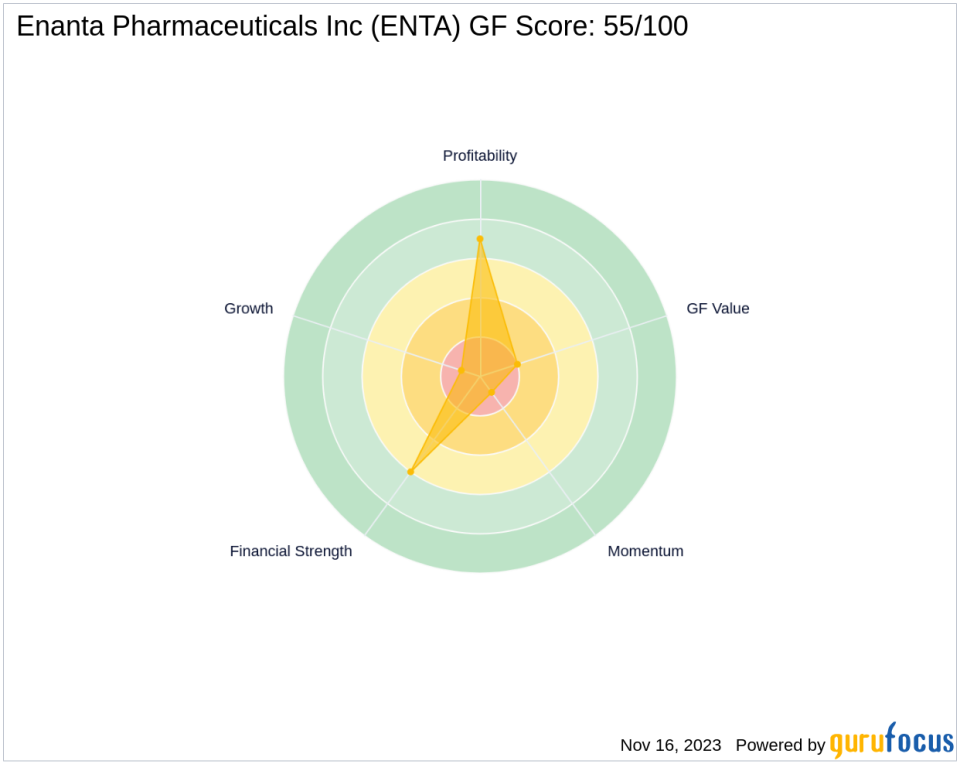

Performance Metrics and Rankings

Enanta's GF Score stands at 55/100, indicating a potential for poor future performance. The company's financial strength and profitability rank at 6/10 and 7/10, respectively, while its growth rank is a concerning 1/10. The GF Value Rank and Momentum Rank are also low at 2/10 and 1/10, respectively. These metrics, combined with a Piotroski F-Score of 2 and an Altman Z score of 0.17, paint a picture of a company with significant challenges ahead.

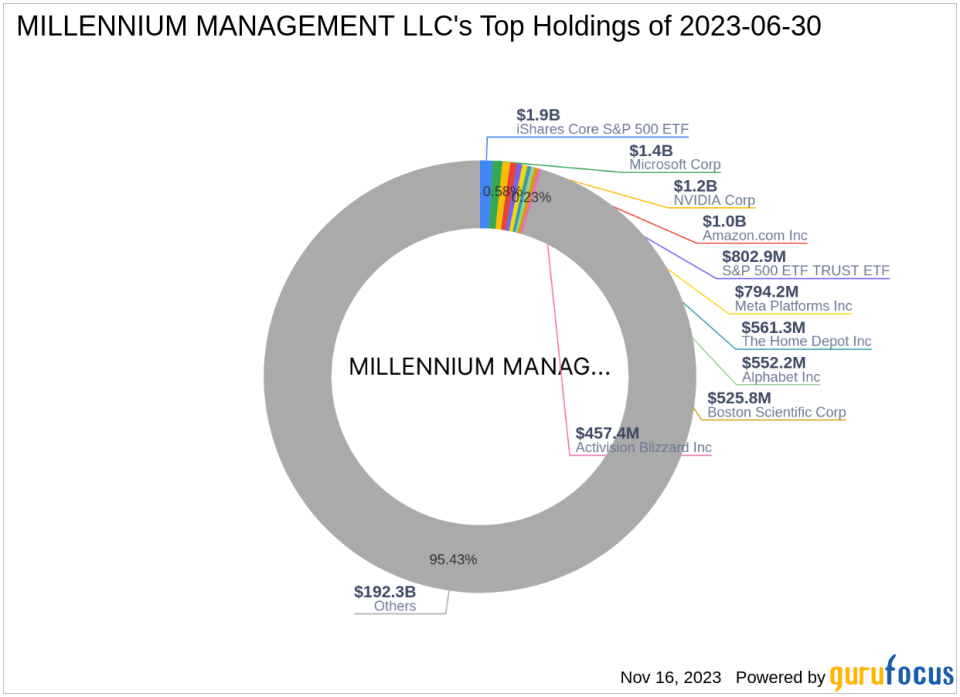

Millennium Management LLC's Top Holdings and Sectors

MILLENNIUM MANAGEMENT LLC (Trades, Portfolio)'s top holdings include major players in the technology and healthcare sectors, such as iShares Core S&P 500 ETF (IVV), S&P 500 ETF TRUST ETF (SPY), Amazon.com Inc (NASDAQ:AMZN), Microsoft Corp (NASDAQ:MSFT), and NVIDIA Corp (NASDAQ:NVDA). The firm's equity stands at $201.48 billion, with technology and healthcare being the top sectors of focus. Enanta Pharmaceuticals' position within the firm's portfolio is relatively small, reflecting a cautious investment approach.

Market Reaction and Future Outlook

Since MILLENNIUM MANAGEMENT LLC (Trades, Portfolio)'s acquisition of ENTA shares, the stock price has not shown significant movement, indicating a muted market reaction. The future outlook for Enanta Pharmaceuticals will depend on its ability to navigate the challenges within the biotechnology industry and leverage its innovative drug pipeline to achieve profitability and growth. MILLENNIUM MANAGEMENT LLC (Trades, Portfolio)'s investment strategy, which prioritizes diversification and risk management, will continue to influence its decisions regarding Enanta Pharmaceuticals and other portfolio holdings.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.