MILLENNIUM MANAGEMENT LLC Boosts Stake in Dycom Industries Inc

On August 8, 2023, MILLENNIUM MANAGEMENT LLC, a privately owned hedge fund sponsor, increased its stake in Dycom Industries Inc, a leading provider of specialty contracting services to the telecommunications infrastructure and utility industries. This article will delve into the details of the transaction, the profiles of the guru and the traded company, and the performance and ranking of the traded stock.

Details of the Transaction

The transaction saw MILLENNIUM MANAGEMENT LLC add 371,044 shares of Dycom Industries Inc to its portfolio, representing a 31.83% change in shares. The shares were acquired at a price of $94.15 each. This trade had a 0.02% impact on the guru's portfolio and increased its holdings in the traded stock to 5.20%. Following the transaction, Dycom Industries Inc now represents 0.07% of the guru's portfolio, with a total of 1,536,905 shares held.

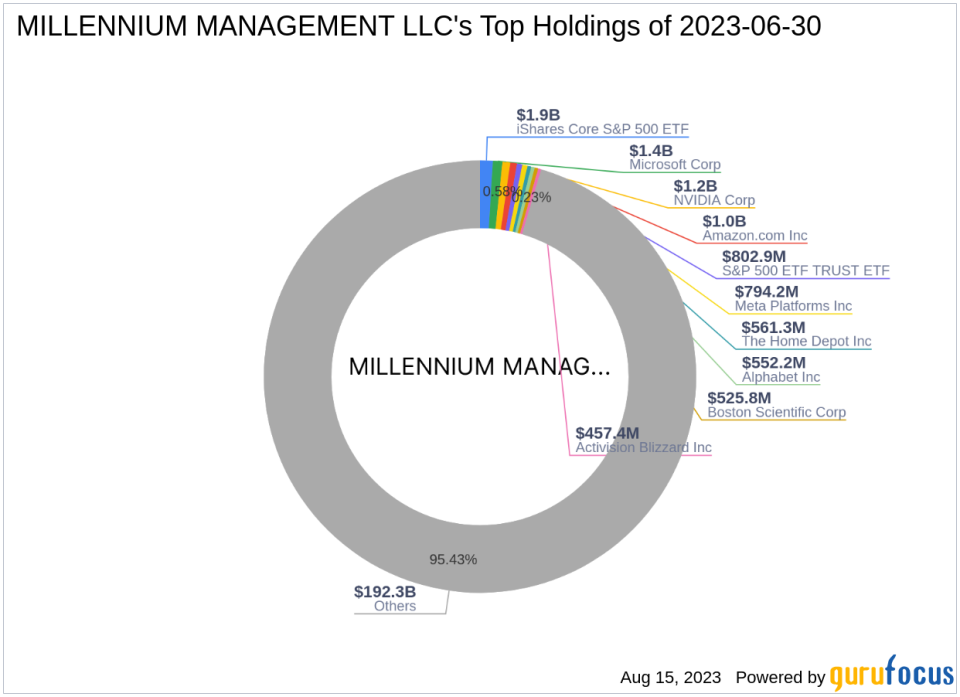

Profile of the Guru: MILLENNIUM MANAGEMENT LLC

MILLENNIUM MANAGEMENT LLC is a hedge fund sponsor founded in 1989 by Israel Englander and Ronald Shear. The firm started with $35 million in seed money and has since grown into a large enterprise with over $30 billion in total assets under management. The firm's investment strategy is broadly diversified, global in scope, and opportunistic, focusing on liquid asset classes. The firm's top holdings include iShares Core S&P 500 ETF(IVV), S&P 500 ETF TRUST ETF(SPY), Amazon.com Inc(NASDAQ:AMZN), Microsoft Corp(NASDAQ:MSFT), and NVIDIA Corp(NASDAQ:NVDA). The firm's equity stands at $201.48 billion, with Technology and Healthcare being its top sectors.

Information about the Traded Stock: Dycom Industries Inc

Dycom Industries Inc, with a market capitalization of $2.78 billion, is a provider of specialty contracting services to the telecommunications infrastructure and utility industries. The company's services include program management, planning, engineering and design, aerial, underground, and wireless construction, maintenance, and fulfillment services. The company's stock is currently priced at $94.84, with a PE percentage of 16.30. According to GuruFocus, the stock is modestly undervalued with a GF Value of 110.03 and a price to GF Value of 0.86.

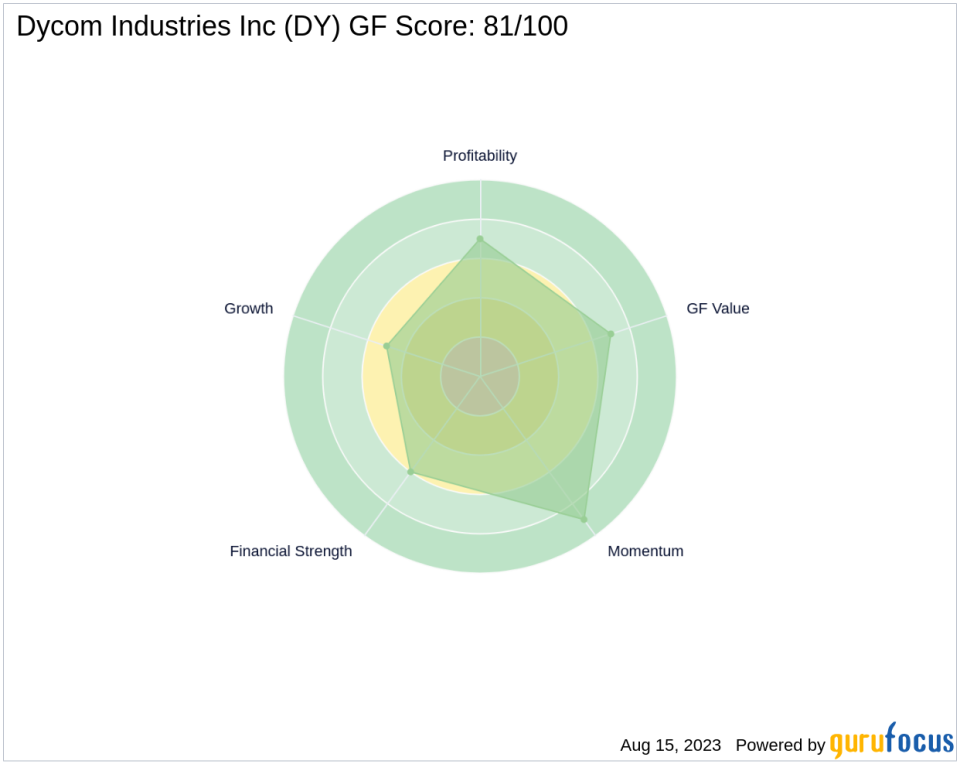

Performance and Ranking of the Traded Stock

Since its Initial Public Offering (IPO) in 1984, Dycom Industries Inc has seen a 7738.02% increase in its stock price. The stock has gained 0.73% since the transaction and 2.07% year-to-date. The stock has a GF Score of 81/100, indicating good outperformance potential. It has a Financial Strength rank of 6/10, a Profitability Rank of 7/10, a Growth Rank of 5/10, a GF Value Rank of 7/10, and a Momentum Rank of 9/10. The stock has a Piotroski F-Score of 7 and an Altman Z score of 4.37, indicating financial stability.

Other Relevant Information about the Traded Stock

Dycom Industries Inc operates in the Construction industry and has an interest coverage of 6.03. The company has a ROE of 20.84 and a ROA of 7.73. The company's gross margin growth is -4.30, and its operating margin growth is -9.30. Over the past three years, the company has seen a revenue growth of 6.60, EBITDA growth of 6.90, and earning growth of 38.10.

Other Gurus' Involvement in the Traded Stock

GAMCO Investors is the largest guru holder of Dycom Industries Inc, while Jefferies Group (Trades, Portfolio) also holds shares in the company.

Conclusion

In conclusion, MILLENNIUM MANAGEMENT LLC's recent acquisition of shares in Dycom Industries Inc is a significant addition to its portfolio. The transaction not only increases the guru's stake in the company but also potentially enhances the value of its portfolio. Given Dycom Industries Inc's performance and ranking, this transaction could offer substantial returns for the guru in the future.

This article first appeared on GuruFocus.